Oklahoma Form Franchise Tax 2020

What is the Oklahoma Form Franchise Tax

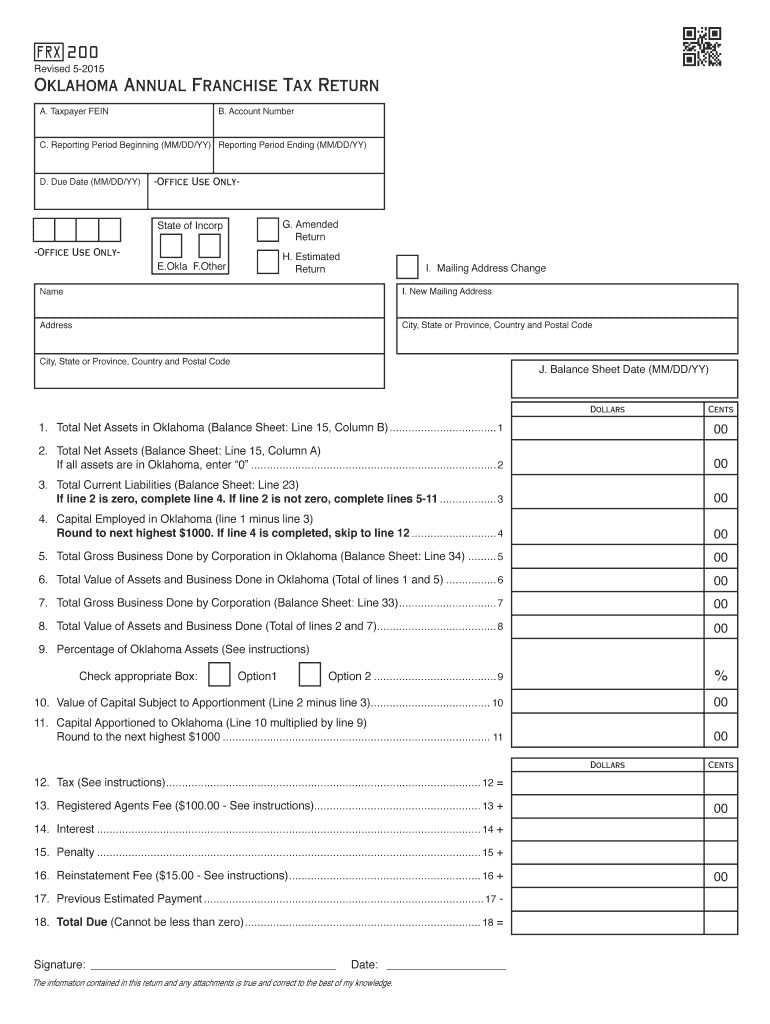

The Oklahoma Form Franchise Tax is a tax form used by businesses operating in the state of Oklahoma. This form is required for various types of business entities, including corporations and limited liability companies (LLCs). The franchise tax is based on the total assets of the business, and it is essential for maintaining good standing with the state. Filing this form ensures compliance with state tax regulations and helps businesses avoid penalties.

How to use the Oklahoma Form Franchise Tax

To effectively use the Oklahoma Form Franchise Tax, businesses must first determine their eligibility based on their entity type. The form requires specific financial information, including total assets and any applicable deductions. Once the necessary information is gathered, the form can be filled out either digitally or on paper. After completing the form, businesses must ensure it is signed and submitted to the appropriate state authority by the designated deadline.

Steps to complete the Oklahoma Form Franchise Tax

Completing the Oklahoma Form Franchise Tax involves several key steps:

- Gather financial records, including balance sheets and asset valuations.

- Determine the appropriate form version based on your business entity type.

- Fill out the form accurately, providing all required information.

- Review the completed form for any errors or omissions.

- Sign the form, ensuring that all necessary signatures are included.

- Submit the form by mail or electronically, depending on your preference.

Legal use of the Oklahoma Form Franchise Tax

The legal use of the Oklahoma Form Franchise Tax is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted within the specified time frame. Using digital tools for e-signatures can enhance the legal standing of the form, provided that they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Ensuring compliance with these regulations can help businesses avoid legal disputes regarding the form's validity.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Form Franchise Tax vary depending on the business entity type. Generally, the form must be submitted annually, with specific due dates established by the Oklahoma Tax Commission. It is crucial for businesses to keep track of these deadlines to avoid late fees and penalties. Important dates may include the initial filing date, extension deadlines, and any changes in tax laws that could affect filing requirements.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit the Oklahoma Form Franchise Tax through various methods, including:

- Online: Many businesses opt to file electronically through the Oklahoma Tax Commission's online portal, which streamlines the process and provides immediate confirmation of receipt.

- Mail: The form can be printed and mailed to the appropriate address provided by the Oklahoma Tax Commission. Businesses should ensure they send it well before the deadline to allow for postal delays.

- In-Person: Some businesses may choose to deliver the form in person at designated state offices, ensuring direct submission and immediate feedback.

Quick guide on how to complete oklahoma form franchise tax 2015

Effortlessly Prepare Oklahoma Form Franchise Tax on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, as you can easily access the necessary form and securely save it on the internet. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Oklahoma Form Franchise Tax on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and eSign Oklahoma Form Franchise Tax with Ease

- Locate Oklahoma Form Franchise Tax and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether it be via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign Oklahoma Form Franchise Tax while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma form franchise tax 2015

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form franchise tax 2015

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Oklahoma Form Franchise Tax?

The Oklahoma Form Franchise Tax is a tax imposed on corporations operating in Oklahoma. It is based on the corporation's assets and is required to be filed annually. Understanding this tax is essential for compliance and maintaining good standing in Oklahoma.

-

How can airSlate SignNow help with the Oklahoma Form Franchise Tax?

airSlate SignNow streamlines the process of preparing and signing documents related to the Oklahoma Form Franchise Tax. With our user-friendly platform, users can electronically sign and send documents securely, ensuring timely filing and compliance with state requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Depending on your needs, you can choose from various subscription levels that provide features tailored for efficient management of documents, including those for the Oklahoma Form Franchise Tax.

-

Are there any specific features useful for filing the Oklahoma Form Franchise Tax?

Yes, airSlate SignNow includes features like eSignature, document templates, and automated workflows that are particularly beneficial when preparing the Oklahoma Form Franchise Tax. These tools simplify the document preparation process, helping businesses stay organized and compliant.

-

Is airSlate SignNow compliant with Oklahoma state regulations?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations, including those regarding the Oklahoma Form Franchise Tax. Users can confidently use our platform knowing their documents meet state compliance standards.

-

Can airSlate SignNow integrate with my existing accounting software for the Oklahoma Form Franchise Tax?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software that can help streamline the process of managing the Oklahoma Form Franchise Tax. This means you can easily sync data and ensure accurate filings with minimal effort.

-

What benefits does airSlate SignNow provide for businesses filing the Oklahoma Form Franchise Tax?

Using airSlate SignNow for your Oklahoma Form Franchise Tax filings benefits businesses by saving time and reducing errors. Our platform enables faster document turnaround and enhances collaboration among team members, allowing you to focus on running your business effectively.

Get more for Oklahoma Form Franchise Tax

- Pepboys commercial account form

- Affidavit template south africa 163140 form

- Toe 250 form

- Printable iep agenda template form

- Pool chemical log sheet form

- Libreview patient consent form

- Outreach certification form

- Sample bylaws the following is an example of bylaws for a typical neighborhood association tucsonaz form

Find out other Oklahoma Form Franchise Tax

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy