M1 Mn State Tax Form 2020

What is the M1 Mn State Tax Form

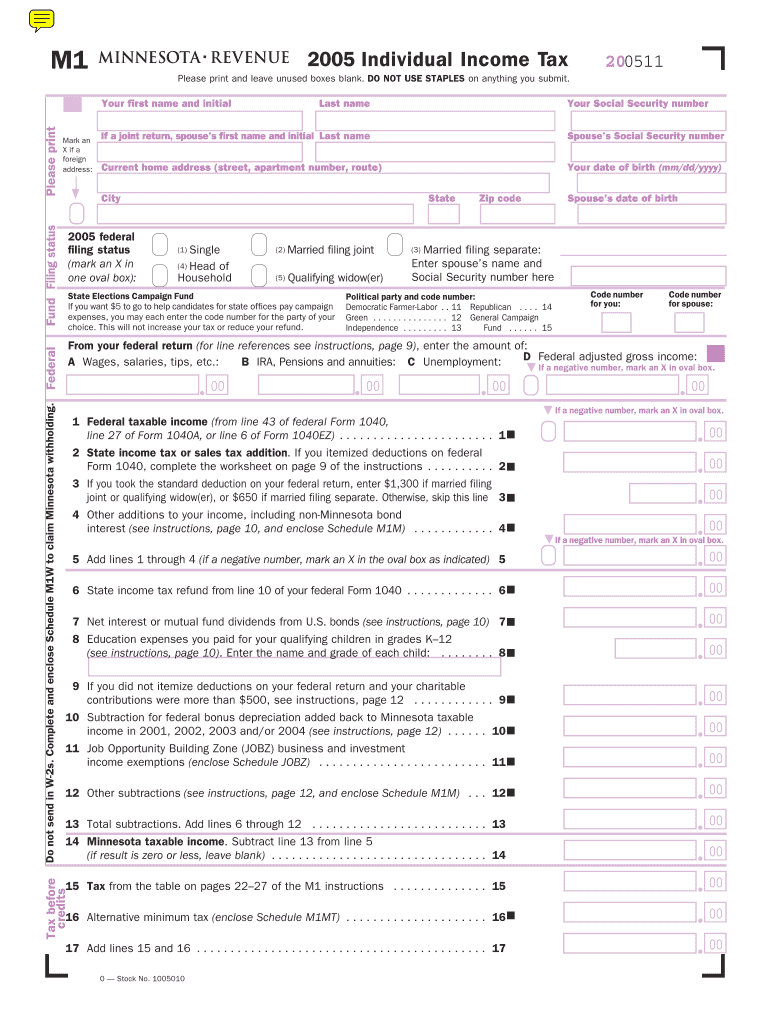

The M1 Mn State Tax Form is the Minnesota Individual Income Tax Return form used by residents to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Minnesota and need to comply with state tax regulations. It includes various sections to report different types of income, deductions, and credits available to taxpayers.

How to use the M1 Mn State Tax Form

Using the M1 Mn State Tax Form involves several steps. First, gather all necessary documents, including W-2s, 1099s, and any supporting documentation for deductions or credits. Next, accurately fill out the form, ensuring that all income sources are reported and deductions are claimed where applicable. It is important to review the completed form for accuracy before submission to avoid delays or penalties.

Steps to complete the M1 Mn State Tax Form

To complete the M1 Mn State Tax Form, follow these steps:

- Gather all income documentation, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim any eligible deductions and credits, ensuring you have supporting documents.

- Calculate your total tax liability or refund due.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Key elements of the M1 Mn State Tax Form

Key elements of the M1 Mn State Tax Form include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Sections for various income types, including wages, interest, and dividends.

- Deductions and Credits: Areas to claim standard or itemized deductions and applicable tax credits.

- Signature Section: Required signature and date for the form to be considered valid.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the M1 Mn State Tax Form. Typically, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and the importance of timely submission to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The M1 Mn State Tax Form can be submitted through various methods. Taxpayers can file online using approved e-filing services, which often provide a faster processing time. Alternatively, the form can be mailed to the appropriate Minnesota Department of Revenue address. In-person submission options may also be available at designated state offices for those who prefer direct assistance.

Quick guide on how to complete m1 mn state tax form 2001

Complete M1 Mn State Tax Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle M1 Mn State Tax Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign M1 Mn State Tax Form effortlessly

- Obtain M1 Mn State Tax Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Edit and eSign M1 Mn State Tax Form and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m1 mn state tax form 2001

Create this form in 5 minutes!

How to create an eSignature for the m1 mn state tax form 2001

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the M1 Mn State Tax Form?

The M1 Mn State Tax Form is the individual income tax return form used by Minnesota residents to report their income, deductions, and tax liability. Completing this form accurately is crucial for compliance with Minnesota tax laws and can affect your refund or amount due.

-

How can airSlate SignNow help me with the M1 Mn State Tax Form?

airSlate SignNow offers a seamless solution for sending and electronically signing the M1 Mn State Tax Form. Our platform simplifies the signing process, ensuring that all necessary details are filled out correctly and promptly submitted, saving you time and reducing errors.

-

Is airSlate SignNow a cost-effective solution for handling the M1 Mn State Tax Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing documents like the M1 Mn State Tax Form. With various pricing plans tailored to different needs, you can choose one that fits your budget while ensuring efficient tax form processing.

-

What features does airSlate SignNow offer for the M1 Mn State Tax Form?

airSlate SignNow provides features such as document templates, reminders, and secure cloud storage that enhance the completion of the M1 Mn State Tax Form. These tools streamline the process, making it easier for you to manage your tax documentation.

-

Can I integrate airSlate SignNow with other applications for my M1 Mn State Tax Form needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications that can aid in preparing and managing your M1 Mn State Tax Form. This includes popular accounting software and tax resources, consolidating your workflow in one place.

-

What are the benefits of using airSlate SignNow for tax forms like the M1 Mn State Tax Form?

Using airSlate SignNow for your M1 Mn State Tax Form brings numerous benefits, including quicker turnaround times, enhanced accuracy through digital signatures, and the ability to store documents securely. This ensures that your tax filing is both efficient and compliant.

-

Is airSlate SignNow user-friendly for someone unfamiliar with the M1 Mn State Tax Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, even for those who may not be familiar with the M1 Mn State Tax Form. Our intuitive interface guides users through the process, making it easy to navigate and complete tax forms without hassle.

Get more for M1 Mn State Tax Form

Find out other M1 Mn State Tax Form

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed