Form W 4MN, Minnesota Employee Withholding Allowance 2020

What is the Form W-4MN, Minnesota Employee Withholding Allowance

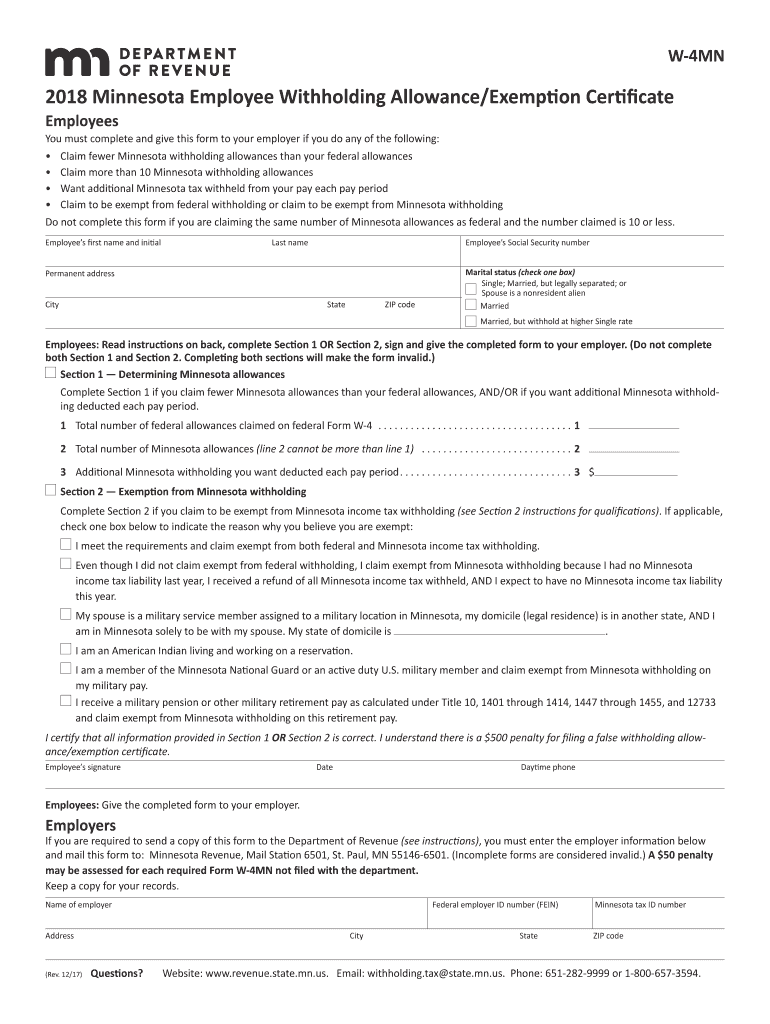

The Form W-4MN, Minnesota Employee Withholding Allowance, is a state-specific tax form used by employees in Minnesota to determine the amount of state income tax withheld from their paychecks. This form allows employees to claim allowances based on their personal and financial situations, which can directly affect their tax liability. By accurately completing the W-4MN, employees can ensure that the correct amount of tax is withheld, helping to avoid underpayment or overpayment of taxes throughout the year.

Steps to complete the Form W-4MN, Minnesota Employee Withholding Allowance

Completing the Form W-4MN involves several key steps:

- Provide personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Claim allowances based on your personal circumstances, such as dependents and other deductions.

- Sign and date the form to validate your information.

After completing the form, it should be submitted to your employer, who will use it to adjust your state tax withholding accordingly.

How to obtain the Form W-4MN, Minnesota Employee Withholding Allowance

The Form W-4MN can be obtained through various sources. It is available for download from the Minnesota Department of Revenue's website. Additionally, employers may provide copies of the form to their employees upon request. It is essential to ensure that you are using the most current version of the form to comply with state tax regulations.

Legal use of the Form W-4MN, Minnesota Employee Withholding Allowance

The Form W-4MN is legally binding when completed and submitted correctly. It must be filled out accurately to reflect your financial situation, as incorrect information may lead to incorrect tax withholding. Employers are required to honor the allowances claimed on the form unless they have reason to believe the information is inaccurate. Compliance with state tax laws is crucial to avoid penalties.

Key elements of the Form W-4MN, Minnesota Employee Withholding Allowance

Key elements of the Form W-4MN include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances you can claim based on your situation.

- Signature: Required to validate the form.

These elements are essential for determining the appropriate withholding amount from your paycheck.

State-specific rules for the Form W-4MN, Minnesota Employee Withholding Allowance

In Minnesota, specific rules apply to the completion and submission of the Form W-4MN. Employees must be aware of state tax laws that influence their withholding allowances. For example, the number of allowances claimed can affect the overall tax burden and potential refund. Additionally, Minnesota residents may need to update their W-4MN if their personal circumstances change, such as marriage or the birth of a child.

Quick guide on how to complete form w 4mn minnesota employee withholding allowance

Complete Form W 4MN, Minnesota Employee Withholding Allowance effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form W 4MN, Minnesota Employee Withholding Allowance on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form W 4MN, Minnesota Employee Withholding Allowance with ease

- Locate Form W 4MN, Minnesota Employee Withholding Allowance and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or black out sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Select your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your preference. Alter and eSign Form W 4MN, Minnesota Employee Withholding Allowance to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 4mn minnesota employee withholding allowance

Create this form in 5 minutes!

How to create an eSignature for the form w 4mn minnesota employee withholding allowance

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Form W 4MN, Minnesota Employee Withholding Allowance?

The Form W 4MN, Minnesota Employee Withholding Allowance, is a document that employees in Minnesota use to declare their withholding allowances for state income tax purposes. By completing this form, you help ensure the correct amount is withheld from your paycheck. It's essential for accurate payroll processing and tax responsibilities at the state level.

-

How can I complete the Form W 4MN using airSlate SignNow?

You can easily complete the Form W 4MN, Minnesota Employee Withholding Allowance, using airSlate SignNow's intuitive digital platform. Simply upload the form, fill in the necessary fields, and eSign where required. Our platform makes it seamless to manage your forms efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for the Form W 4MN?

airSlate SignNow offers various pricing plans suitable for different business needs, including plans that allow you to manage the Form W 4MN, Minnesota Employee Withholding Allowance. We provide a cost-effective solution that gives you access to all the essential features needed for creating, signing, and storing documents without sacrificing quality.

-

What features does airSlate SignNow provide for managing the Form W 4MN?

Our platform provides advanced features for managing the Form W 4MN, Minnesota Employee Withholding Allowance, such as document templates, electronic signature capability, and secure storage. You can also track document status and send reminders to employees, ensuring a smooth process for your team.

-

Can airSlate SignNow integrate with other tools for form management?

Yes, airSlate SignNow supports integrations with popular business tools that enhance your workflow while managing documents like the Form W 4MN, Minnesota Employee Withholding Allowance. This enables you to synchronize your data and streamline processes for accounting, HR, and employee management systems.

-

What are the benefits of using airSlate SignNow for the Form W 4MN?

Using airSlate SignNow for the Form W 4MN, Minnesota Employee Withholding Allowance, offers numerous benefits, including increased efficiency and reduced paperwork. The electronic signature capability ensures quick approvals, while our secure platform protects sensitive information associated with withholding allowances.

-

Is airSlate SignNow secure for handling sensitive documents like the Form W 4MN?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Form W 4MN, Minnesota Employee Withholding Allowance. Our platform is equipped with industry-standard encryption and compliance measures to protect your sensitive personal information at all times.

Get more for Form W 4MN, Minnesota Employee Withholding Allowance

Find out other Form W 4MN, Minnesota Employee Withholding Allowance

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word