Nc D407 K1 Form 2019

What is the Nc D407 K1 Form

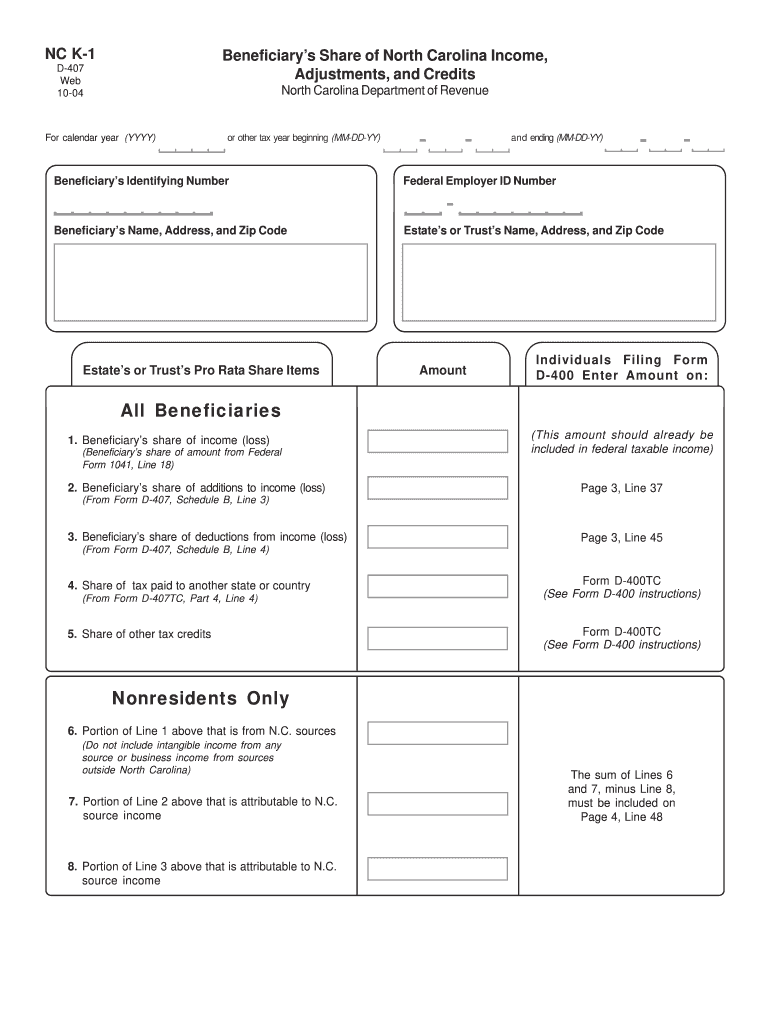

The Nc D407 K1 Form is a tax document used in North Carolina to report income, deductions, and credits for partnerships, S corporations, and limited liability companies (LLCs). This form is essential for ensuring that the state tax obligations of these business entities are accurately reported and fulfilled. It provides a detailed account of each member's share of income and expenses, allowing for proper tax calculation and compliance with state regulations.

How to use the Nc D407 K1 Form

To effectively use the Nc D407 K1 Form, individuals and businesses must first gather all necessary financial information related to their partnership or S corporation. This includes income, expenses, and any applicable deductions. Once the information is compiled, the form can be filled out, detailing each member's share of the income and expenses. It is crucial to ensure that all entries are accurate to avoid issues with the North Carolina Department of Revenue. After completing the form, it should be provided to each member for their personal tax filings.

Steps to complete the Nc D407 K1 Form

Completing the Nc D407 K1 Form involves several key steps:

- Gather financial documents, including income statements and expense reports.

- Identify each member's share of income, deductions, and credits.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions.

- Distribute copies of the completed form to all members for their records.

Legal use of the Nc D407 K1 Form

The Nc D407 K1 Form serves a legal purpose by providing necessary documentation for state tax compliance. It is used to report income to the North Carolina Department of Revenue, ensuring that all business entities adhere to state tax laws. Proper completion and distribution of this form are crucial for maintaining transparency and legality in financial reporting. Failure to accurately report income can result in penalties or audits from the state.

Key elements of the Nc D407 K1 Form

Key elements of the Nc D407 K1 Form include:

- Identification of the entity and its members.

- Details of each member's share of income, deductions, and credits.

- Signature lines for verification and acknowledgment.

- Instructions for completing the form accurately.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Nc D407 K1 Form. Typically, the form must be distributed to members by the due date of the partnership or S corporation tax return. This deadline usually aligns with the federal tax filing date, which is March fifteenth for most entities. Adhering to these deadlines is crucial to avoid penalties and ensure compliance with state regulations.

Quick guide on how to complete nc d407 k1 form

Effortlessly Prepare Nc D407 K1 Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Nc D407 K1 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Modify and eSign Nc D407 K1 Form with Ease

- Find Nc D407 K1 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow manages all your document management needs with just a few clicks from any device of your preference. Modify and eSign Nc D407 K1 Form to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc d407 k1 form

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Nc D407 K1 Form?

The Nc D407 K1 Form is a specific document used for tax purposes in North Carolina. It is essential for reporting income received by partnerships or S corporations. Understanding how to properly fill out this form can help businesses remain compliant with state tax regulations.

-

How can airSlate SignNow assist with the Nc D407 K1 Form?

airSlate SignNow provides a user-friendly platform for eSigning and sending the Nc D407 K1 Form. This allows users to easily gather signatures and submit documents electronically, streamlining the tax filing process. You can save time by completing forms and obtaining necessary approvals without the hassle of printing or faxing.

-

Is airSlate SignNow cost-effective for handling the Nc D407 K1 Form?

Yes, airSlate SignNow offers cost-effective solutions for managing the Nc D407 K1 Form. With flexible pricing plans, businesses can choose the best option that suits their needs without breaking the budget. This ensures that companies of all sizes can digitally manage their documentation efficiently.

-

What features does airSlate SignNow provide for the Nc D407 K1 Form?

airSlate SignNow offers features like customizable templates, secure cloud storage, and audit trails specifically tailored for the Nc D407 K1 Form. These features enhance user experience and ensure that all documents are processed securely. Additionally, users can collaborate on different versions of the form efficiently.

-

Are there integrations available for the Nc D407 K1 Form?

Indeed, airSlate SignNow integrates seamlessly with various applications, which can simplify the process of managing the Nc D407 K1 Form. Whether it’s syncing with accounting software or CRMs, these integrations help automate workflows and improve overall efficiency. You can effortlessly connect your preferred tools to enhance the document management experience.

-

Can I access the Nc D407 K1 Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow allows you to access the Nc D407 K1 Form on mobile devices. The mobile-friendly interface ensures that you can manage, sign, and send documents anytime, anywhere. This flexibility allows users to be productive on the go, making it easy to handle important tax forms.

-

What security measures are in place for the Nc D407 K1 Form with airSlate SignNow?

airSlate SignNow employs robust security measures to protect the Nc D407 K1 Form and all your sensitive documents. Features like encryption, secure access, and detailed audit trails ensure that your information remains confidential and compliant with relevant regulations. Users can trust that their data is safeguarded throughout the document management process.

Get more for Nc D407 K1 Form

Find out other Nc D407 K1 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors