Form TP 592 2 July , Claim for Refund, TP5922 FormSend 2019-2026

What is the Form TP 592 2 July, Claim For Refund, TP5922 FormSend

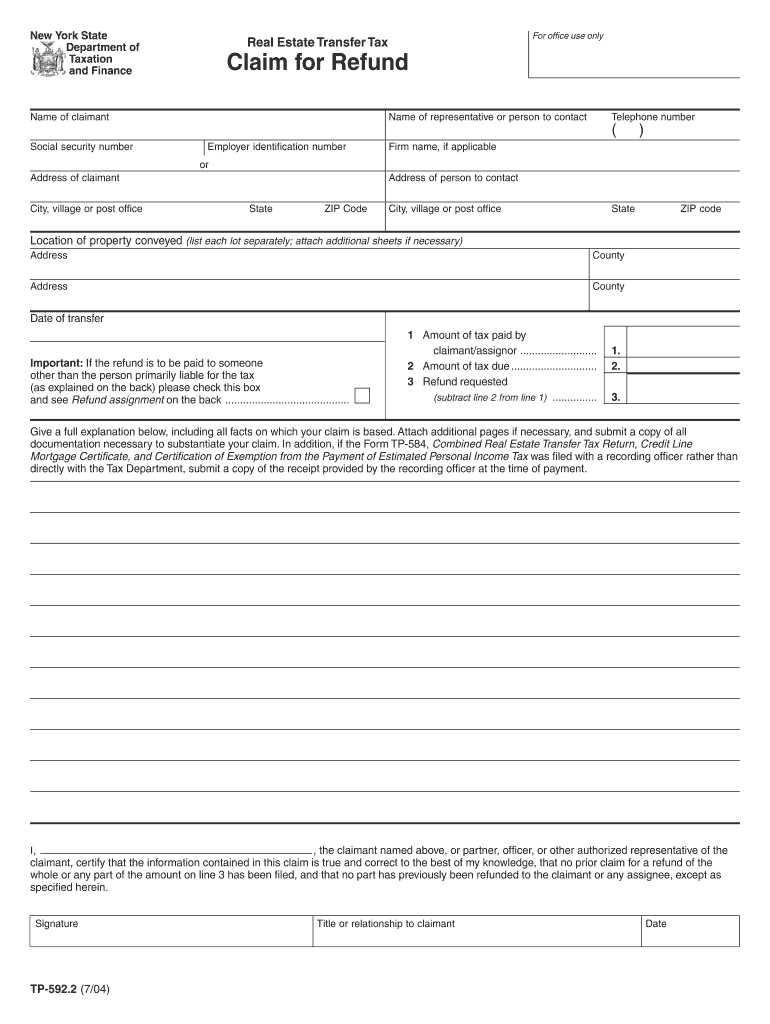

The Form TP 592 2 July, also known as the Claim For Refund TP5922 FormSend, is a document used by taxpayers in the United States to request a refund for overpaid taxes. This form is particularly relevant for individuals and businesses that have made excess payments or have been subject to withholding that exceeds their actual tax liability. By submitting this form, taxpayers can initiate the process of reclaiming funds that are rightfully theirs.

How to use the Form TP 592 2 July, Claim For Refund, TP5922 FormSend

Using the Form TP 592 2 July involves a straightforward process. Taxpayers need to accurately fill out the form with relevant personal and financial information. This includes details such as the taxpayer's identification number, the amount of refund being claimed, and the tax year associated with the claim. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of submission.

Steps to complete the Form TP 592 2 July, Claim For Refund, TP5922 FormSend

Completing the Form TP 592 2 July requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including tax returns and payment receipts.

- Fill in personal information, such as name, address, and Social Security number.

- Specify the tax year for which the refund is being claimed.

- Indicate the amount of overpayment or excess withholding.

- Review the form for accuracy before submission.

Legal use of the Form TP 592 2 July, Claim For Refund, TP5922 FormSend

The legal use of the Form TP 592 2 July is governed by tax laws and regulations. To ensure that the claim is valid, it must be completed accurately and submitted within the designated time frame. Compliance with IRS guidelines is crucial, as improper submissions can lead to delays or rejections of the refund request. Utilizing a reliable electronic signature solution can also enhance the legal standing of the submitted form.

Required Documents

When filing the Form TP 592 2 July, taxpayers must provide supporting documentation to substantiate their claim for a refund. Required documents may include:

- Copy of the original tax return.

- Proof of payment, such as bank statements or payment receipts.

- Any correspondence from the IRS related to the overpayment.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form TP 592 2 July. The form can be sent electronically through approved e-filing systems, which is often the fastest method. Alternatively, taxpayers may choose to print the form and mail it to the appropriate IRS address. In-person submissions may also be possible at designated IRS offices, although this option may vary by location and availability.

Quick guide on how to complete form tp 5922 july 2004 claim for refund tp5922 formsend

Easily prepare Form TP 592 2 July , Claim For Refund, TP5922 FormSend on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to access the right forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form TP 592 2 July , Claim For Refund, TP5922 FormSend on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form TP 592 2 July , Claim For Refund, TP5922 FormSend effortlessly

- Locate Form TP 592 2 July , Claim For Refund, TP5922 FormSend and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as an ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form TP 592 2 July , Claim For Refund, TP5922 FormSend, ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tp 5922 july 2004 claim for refund tp5922 formsend

Create this form in 5 minutes!

How to create an eSignature for the form tp 5922 july 2004 claim for refund tp5922 formsend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is Form TP 592 2 July , Claim For Refund, TP5922 FormSend?

Form TP 592 2 July, Claim For Refund, TP5922 FormSend is a document designed for individuals and businesses to request a refund of specific payments from the government. This form streamlines the refund process, ensuring you're able to submit your claim efficiently.

-

How can I use airSlate SignNow for Form TP 592 2 July , Claim For Refund, TP5922 FormSend?

With airSlate SignNow, you can easily upload and eSign your Form TP 592 2 July, Claim For Refund, TP5922 FormSend. The platform offers a user-friendly interface that allows you to manage your documents effortlessly and ensure they are sent securely for processing.

-

What are the pricing options for using airSlate SignNow with Form TP 592 2 July , Claim For Refund, TP5922 FormSend?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when using Form TP 592 2 July, Claim For Refund, TP5922 FormSend. You can choose from monthly or annual subscriptions, which provide access to all features needed for efficient document management.

-

What features does airSlate SignNow offer for Form TP 592 2 July , Claim For Refund, TP5922 FormSend?

airSlate SignNow offers essential features like eSigning, document tracking, and templates for Form TP 592 2 July, Claim For Refund, TP5922 FormSend. These tools enhance document workflows by making it easier to collect signatures and manage submissions.

-

Is airSlate SignNow secure for handling Form TP 592 2 July , Claim For Refund, TP5922 FormSend?

Yes, airSlate SignNow employs top-tier encryption protocols to ensure the security of your documents, including Form TP 592 2 July, Claim For Refund, TP5922 FormSend. Users can feel confident that their sensitive information is protected throughout the signing process.

-

Can airSlate SignNow integrate with other applications for Form TP 592 2 July , Claim For Refund, TP5922 FormSend?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easy to manage and send Form TP 592 2 July, Claim For Refund, TP5922 FormSend. This functionality helps businesses maintain an efficient workflow by connecting to existing systems.

-

How does airSlate SignNow simplify the submission of Form TP 592 2 July , Claim For Refund, TP5922 FormSend?

airSlate SignNow simplifies the submission process by allowing you to prepare, sign, and send Form TP 592 2 July, Claim For Refund, TP5922 FormSend all in one platform. This reduces the time spent on manual tasks and speeds up the entire refund claim process.

Get more for Form TP 592 2 July , Claim For Refund, TP5922 FormSend

Find out other Form TP 592 2 July , Claim For Refund, TP5922 FormSend

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now