for Assistance, See FormIT2105I, Instructions for FormIT2105, 2021

What is the For Assistance, See FormIT2105I, Instructions For FormIT2105

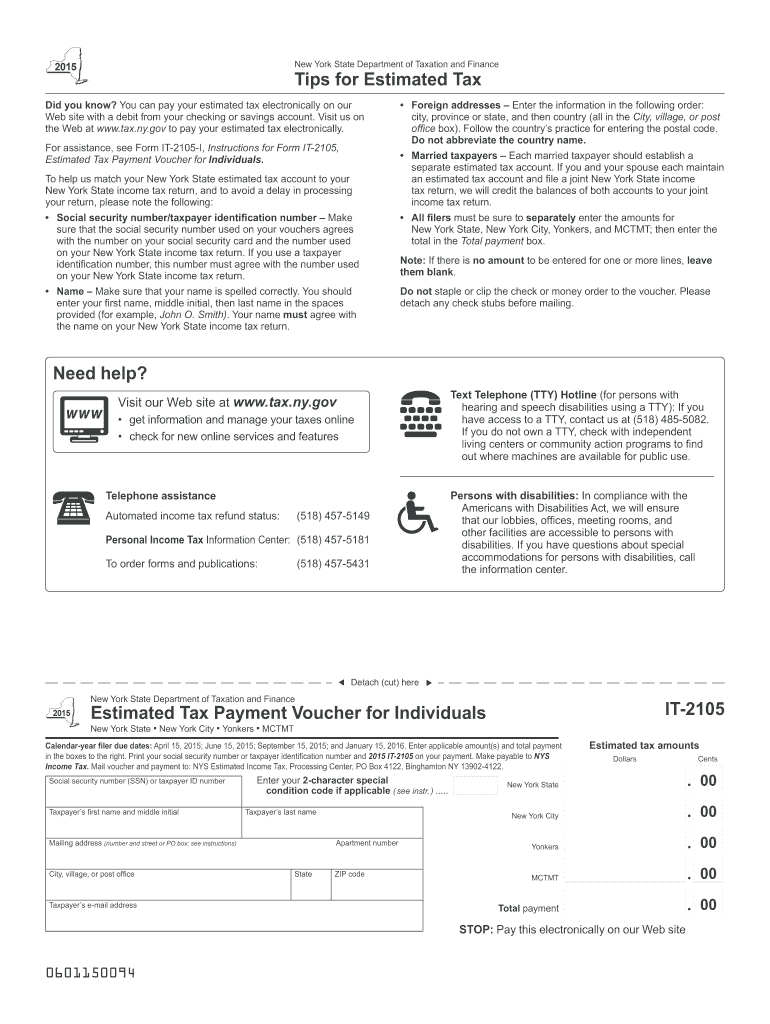

The For Assistance, See FormIT2105I, Instructions For FormIT2105 is a document provided by the IRS that offers guidance on how to properly complete Form IT-2105. This form is primarily used for estimated income tax payments in New York State. The instructions detail the necessary steps, eligibility criteria, and specific requirements taxpayers must follow to ensure compliance with state tax laws. Understanding this document is crucial for individuals and businesses who need to manage their tax obligations effectively.

Steps to complete the For Assistance, See FormIT2105I, Instructions For FormIT2105

Completing the For Assistance, See FormIT2105I, Instructions For FormIT2105 involves several key steps:

- Gather necessary financial information, including income and deductions.

- Determine your estimated tax liability based on your income projections.

- Fill out the form accurately, following the guidelines provided in the instructions.

- Review your completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Each of these steps is essential to ensure that your estimated tax payments are calculated correctly and submitted on time.

Legal use of the For Assistance, See FormIT2105I, Instructions For FormIT2105

The For Assistance, See FormIT2105I, Instructions For FormIT2105 serves a legal purpose in the context of tax compliance. When completed accurately, the form and its instructions ensure that taxpayers fulfill their obligations under New York State tax law. Adhering to the instructions provided helps to avoid potential legal issues, such as fines or audits, that may arise from incorrect or late submissions. It is important to understand that the legal validity of the form relies on proper completion and timely filing.

Filing Deadlines / Important Dates

Timely submission of the For Assistance, See FormIT2105I, Instructions For FormIT2105 is critical. The deadlines for filing estimated tax payments typically align with quarterly due dates throughout the year. Specific dates may vary, so it is important to consult the latest IRS guidelines or state tax authority announcements. Missing these deadlines can result in penalties and interest on unpaid taxes, highlighting the importance of staying informed about these dates.

Required Documents

To complete the For Assistance, See FormIT2105I, Instructions For FormIT2105, you will need several documents, including:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

- Any relevant financial records that support your estimated income.

Having these documents ready will streamline the process of filling out the form and ensure accuracy in your calculations.

Who Issues the Form

The For Assistance, See FormIT2105I, Instructions For FormIT2105 is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and providing resources to help taxpayers understand their obligations. The instructions are designed to assist individuals and businesses in navigating the complexities of state tax requirements, making it easier to comply with the law.

Quick guide on how to complete for assistance see formit2105i instructions for formit2105

Effortlessly Prepare For Assistance, See FormIT2105I, Instructions For FormIT2105, on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle For Assistance, See FormIT2105I, Instructions For FormIT2105, on any device with the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Edit and eSign For Assistance, See FormIT2105I, Instructions For FormIT2105, with Ease

- Locate For Assistance, See FormIT2105I, Instructions For FormIT2105, and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign For Assistance, See FormIT2105I, Instructions For FormIT2105, to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for assistance see formit2105i instructions for formit2105

Create this form in 5 minutes!

How to create an eSignature for the for assistance see formit2105i instructions for formit2105

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how can it help my business?

airSlate SignNow is an intuitive eSignature solution that empowers businesses to effortlessly send and sign documents online. For Assistance, See FormIT2105I, Instructions For FormIT2105, to understand how this tool simplifies document management and enhances productivity.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans tailored to meet different business needs, ensuring a cost-effective solution for eSigning documents. For Assistance, See FormIT2105I, Instructions For FormIT2105, to find the best plan that fits your requirements and budget.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features like templates, bulk sending, and advanced document tracking, all designed to facilitate seamless document workflows. For Assistance, See FormIT2105I, Instructions For FormIT2105, to explore these features and how they can benefit your organization.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with various popular applications, enhancing its functionality and allowing users to streamline their existing processes. For Assistance, See FormIT2105I, Instructions For FormIT2105, for detailed information on compatible integrations.

-

How secure is airSlate SignNow for my documents?

airSlate SignNow prioritizes security and compliance, using advanced encryption and compliance with industry standards to protect your documents. For Assistance, See FormIT2105I, Instructions For FormIT2105, to learn more about our security protocols.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, enabling users to send and sign documents from anywhere. For Assistance, See FormIT2105I, Instructions For FormIT2105, to discover more about our mobile capabilities.

-

What types of documents can I sign with airSlate SignNow?

With airSlate SignNow, you can sign a variety of documents, including contracts, agreements, and forms, ensuring flexibility in your document management. For Assistance, See FormIT2105I, Instructions For FormIT2105, to see examples of document types supported by our platform.

Get more for For Assistance, See FormIT2105I, Instructions For FormIT2105,

Find out other For Assistance, See FormIT2105I, Instructions For FormIT2105,

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT