Ny Ct 3 Instructions 2020

What is the NY CT-3 Instructions

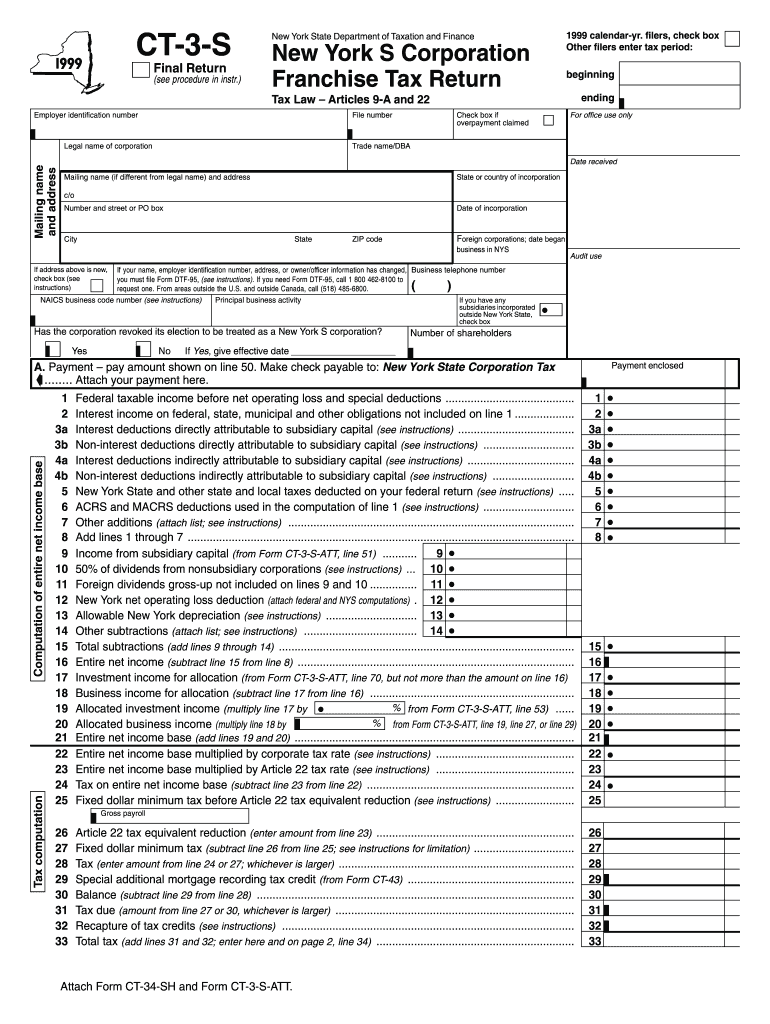

The NY CT-3 Instructions provide guidance for completing the New York State Corporation Franchise Tax Return. This form is essential for corporations operating in New York, as it outlines the necessary steps for reporting income, calculating tax liabilities, and ensuring compliance with state regulations. Understanding these instructions is crucial for businesses to fulfill their tax obligations accurately and on time.

Steps to Complete the NY CT-3 Instructions

Completing the NY CT-3 Instructions involves several key steps:

- Gather all financial documents, including income statements and balance sheets.

- Review the specific sections of the NY CT-3 form to understand what information is required.

- Calculate your corporation's taxable income based on the provided guidelines.

- Complete each section of the form, ensuring that all figures are accurate and reflect your financial records.

- Double-check the calculations and ensure all necessary attachments are included.

Legal Use of the NY CT-3 Instructions

The NY CT-3 Instructions are legally binding documents that must be followed to ensure compliance with New York State tax laws. Properly completing the form according to these instructions helps avoid penalties and legal issues. It is important for corporations to adhere to the guidelines to maintain good standing with state authorities.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines associated with the NY CT-3 Instructions. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For calendar year filers, this typically means March 15. Failure to file on time may result in penalties and interest on unpaid taxes.

Required Documents

When completing the NY CT-3 Instructions, corporations should prepare the following documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income and expenses for the tax year.

- Any relevant supporting documentation, such as prior tax returns or correspondence with tax authorities.

Form Submission Methods

The NY CT-3 Instructions allow for multiple submission methods. Corporations can file the form electronically through the New York State Department of Taxation and Finance website. Alternatively, the form can be printed and mailed to the appropriate address provided in the instructions. In-person submissions may also be accepted at designated tax offices.

Who Issues the Form

The NY CT-3 form and its instructions are issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and administration within the state, ensuring that corporations meet their tax obligations effectively.

Quick guide on how to complete ny ct 3 instructions

Complete Ny Ct 3 Instructions effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Handle Ny Ct 3 Instructions on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

The easiest method to modify and electronically sign Ny Ct 3 Instructions without hassle

- Find Ny Ct 3 Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Ny Ct 3 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny ct 3 instructions

Create this form in 5 minutes!

How to create an eSignature for the ny ct 3 instructions

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What are the ny ct 3 instructions for using airSlate SignNow?

The ny ct 3 instructions outline the steps required to complete and submit your CT-3 return using airSlate SignNow. This process includes filling out the necessary fields, signing the document electronically, and ensuring compliance with state regulations. By following these instructions, you can streamline your filing and avoid potential errors.

-

How much does airSlate SignNow cost for users filing ny ct 3 instructions?

airSlate SignNow offers various pricing plans that cater to different user needs, starting from a free trial to affordable monthly subscriptions. While exact pricing may vary, our plans provide excellent value for businesses looking to simplify the ny ct 3 instructions process. You can choose the best plan that fits your business requirements.

-

What features does airSlate SignNow offer for ny ct 3 instructions?

AirSlate SignNow provides a range of features to assist with ny ct 3 instructions, including customizable templates, real-time collaboration, and secure electronic signatures. These features ensure that your documents are completed accurately and efficiently. Additionally, you can track the status of your documents easily.

-

How can airSlate SignNow help improve the efficiency of ny ct 3 instructions?

By using airSlate SignNow, you can enhance your efficiency in completing ny ct 3 instructions through streamlined workflows and automatic reminders. The platform’s user-friendly interface allows you to complete and sign documents quickly, reducing the time spent on paperwork. This efficiency can also lead to fewer mistakes in your filings.

-

Are there integrations available for airSlate SignNow that support ny ct 3 instructions?

Yes, airSlate SignNow integrates with many popular tools and platforms, providing flexibility when managing your ny ct 3 instructions. Integrations with cloud storage solutions, CRM systems, and productivity software allow for seamless document management. This connectivity ensures that all your files are accessible and organized in one place.

-

Can airSlate SignNow help with multiple users managing ny ct 3 instructions?

Absolutely! AirSlate SignNow supports multiple users, making it easy for teams to collaborate on ny ct 3 instructions. Each user can edit, sign, and track document progress, ensuring everyone is on the same page. This collaboration feature enhances productivity, especially during peak filing seasons.

-

What security measures does airSlate SignNow implement for ny ct 3 instructions?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like those related to ny ct 3 instructions. The platform uses industry-leading encryption and compliance protocols to protect your data. Additionally, user authentication and audit trails enhance security and accountability.

Get more for Ny Ct 3 Instructions

- Form bi 1682 download

- Food production sheet template form

- Application for refund of duty interest in word format

- Gmvn online registration form

- Chase withdrawal slip form

- Gst clearance certificate format

- Authorization to verify funds form

- Montana chemical dependency center application montana chemical dependency center application form

Find out other Ny Ct 3 Instructions

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself