593 V Form 2021

What is the 593 V Form

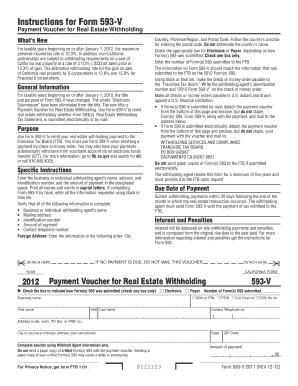

The 593 V Form is a crucial document used in the United States for reporting the sale or transfer of real estate. This form is primarily utilized by individuals and entities to disclose information about the transaction to the Internal Revenue Service (IRS). It ensures that the correct amount of tax is withheld from the proceeds of the sale, particularly for non-resident sellers. Understanding this form is essential for compliance with federal tax regulations.

How to use the 593 V Form

Using the 593 V Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant details about the property sale, including the sale price, the buyer's information, and any applicable exemptions. Next, fill out the form with precise information, ensuring that all sections are completed as required. Once the form is filled, it should be submitted to the appropriate tax authority, typically alongside the seller's tax return. Proper use of this form helps avoid potential penalties associated with incorrect reporting.

Steps to complete the 593 V Form

Completing the 593 V Form requires careful attention to detail. Follow these steps:

- Begin by entering the seller's information, including name, address, and taxpayer identification number.

- Provide details about the property being sold, including its address and the date of sale.

- Indicate the sale price and any adjustments that may apply.

- Complete the section regarding the buyer’s information.

- Sign and date the form to certify the accuracy of the information provided.

After completing these steps, review the form to ensure all information is correct before submission.

Legal use of the 593 V Form

The 593 V Form is legally binding when filled out correctly and submitted in compliance with IRS regulations. It serves as a formal declaration of the sale, ensuring that the appropriate taxes are withheld. This form must be submitted by the seller or their representative at the time of the sale, and failure to do so may result in penalties. It is essential to understand the legal implications of this form to avoid complications during tax filing.

Key elements of the 593 V Form

Several key elements are crucial for the proper completion of the 593 V Form:

- Seller Information: Accurate identification of the seller is essential.

- Property Details: Clear information about the property being sold is necessary.

- Transaction Amount: The sale price must be reported accurately.

- Buyer's Information: Details about the buyer are also required.

- Signature: The seller's signature confirms the validity of the information provided.

Ensuring that these elements are correctly filled out is vital for the form's acceptance by tax authorities.

Form Submission Methods

The 593 V Form can be submitted through various methods, depending on the preferences of the seller and the requirements of the local tax authority. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic filing of this form.

- Mail: The completed form can be mailed to the appropriate tax office.

- In-Person: Some sellers may choose to submit the form in person at their local tax office.

Choosing the right submission method can help ensure timely processing and compliance with tax regulations.

Quick guide on how to complete 593 v form

Effortlessly Complete 593 V Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to craft, modify, and electronically sign your documents swiftly without any hassle. Handle 593 V Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest method to modify and electronically sign 593 V Form with ease

- Obtain 593 V Form and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any preferred device. Modify and electronically sign 593 V Form to ensure clear communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 593 v form

Create this form in 5 minutes!

How to create an eSignature for the 593 v form

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 593 V Form and how does it work?

The 593 V Form is a crucial document for tax purposes, specifically designed for certain transactions in the United States. With airSlate SignNow, you can easily send, eSign, and manage your 593 V Form in a secure environment, ensuring compliance and reducing the risk of errors in your transactions.

-

Are there any fees associated with using the 593 V Form in airSlate SignNow?

Using the 593 V Form with airSlate SignNow comes with flexible pricing options that cater to various business needs. Our plans are designed to be cost-effective, making it easy for businesses of all sizes to manage their document signing and eSigning needs without breaking the bank.

-

What features does airSlate SignNow offer for managing the 593 V Form?

airSlate SignNow provides a range of features tailored for the 593 V Form, including templates, automated workflows, and real-time tracking. These features ensure that your document management process is efficient and streamlined, allowing you to focus on your business growth.

-

Can I integrate airSlate SignNow with other applications for handling the 593 V Form?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, making it easy to manage your 593 V Form alongside other business tools. This integration helps enhance productivity and ensures that all your documents are easily accessible and organized.

-

What are the benefits of using the 593 V Form in airSlate SignNow?

Using the 593 V Form in airSlate SignNow brings numerous benefits, including increased efficiency, enhanced security, and compliance with tax regulations. The platform's user-friendly interface ensures that signing and sending documents is straightforward, saving you time and effort.

-

Is the 593 V Form legally binding when signed electronically?

Absolutely! The 593 V Form will be legally binding when signed electronically via airSlate SignNow, which complies with the eSign Act. This ensures that your electronically signed documents are recognized and enforceable, giving you peace of mind.

-

How does airSlate SignNow ensure the security of my 593 V Form?

AirSlate SignNow prioritizes the security of your documents, including the 593 V Form, with encryption, secure access, and compliance with industry standards. You can trust that your sensitive information will be protected throughout the signing process.

Get more for 593 V Form

- Air standard multi tenant office lease gross form

- Singtel authorisation letter 250148359 form

- 25 literary terms crossword puzzle answer key form

- Supervised driving log form

- Planet earth caves 47 minutes answer key form

- Abb vfd warranty form

- Igneous rocks worksheet answer key form

- Function report adult form ssa 3373 bk

Find out other 593 V Form

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement