Ct 3911 2016

What is the CT 3911?

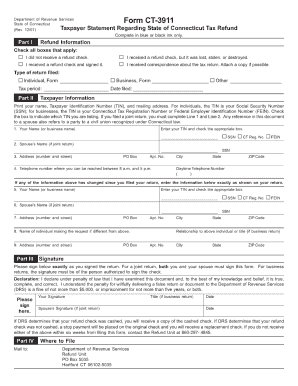

The CT 3911 is a request form used in Connecticut for individuals seeking to obtain a refund for overpaid taxes. This form is particularly relevant for taxpayers who believe they have paid more than their fair share of taxes or who are eligible for a refund due to various circumstances, such as changes in income or tax credits. Understanding the purpose of the CT 3911 is essential for ensuring that you can accurately and effectively request your tax refund.

How to Obtain the CT 3911

To obtain the CT 3911 form, you can visit the Connecticut Department of Revenue Services (DRS) website, where the form is available for download. It is also possible to request a physical copy by contacting the DRS directly. Ensure that you have the latest version of the form to comply with current regulations and requirements.

Steps to Complete the CT 3911

Completing the CT 3911 involves several key steps:

- Gather all necessary documentation, including previous tax returns and any relevant financial information.

- Fill out the form accurately, providing your personal details, including your Social Security number and contact information.

- Detail the reasons for your refund request, ensuring that you provide any supporting documentation as needed.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the CT 3911

The CT 3911 must be used in accordance with state laws governing tax refunds. It is important to ensure that all information provided is truthful and supported by documentation. Misrepresentation or fraudulent claims can lead to penalties or legal repercussions. Familiarizing yourself with the legal guidelines surrounding the use of this form can help protect you from potential issues.

Form Submission Methods

You can submit the CT 3911 through various methods. The form can be sent via mail to the appropriate address provided by the Connecticut DRS. Additionally, some taxpayers may have the option to submit the form electronically, depending on the current regulations and available services. Always check the DRS website for the most up-to-date submission methods and guidelines.

Required Documents

When completing the CT 3911, certain documents may be required to support your request. These can include:

- Copies of previous tax returns.

- Documentation of any tax payments made.

- Records of any tax credits or deductions claimed.

Having these documents ready can streamline the process and help ensure that your refund request is processed efficiently.

Quick guide on how to complete ct 3911

Prepare Ct 3911 seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Ct 3911 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Ct 3911 without hassle

- Obtain Ct 3911 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Ct 3911 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3911

Create this form in 5 minutes!

How to create an eSignature for the ct 3911

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is a CT 3911 request and why is it important?

A CT 3911 request is a form used to request a copy of a tax return or other tax information from the IRS. Understanding how to submit this request is important for individuals and businesses needing their tax records. Knowing how can I can a CT 3911 request can simplify the process and ensure you have access to your financial history.

-

How can I initiate a CT 3911 request using airSlate SignNow?

To initiate a CT 3911 request using airSlate SignNow, you simply need to create the document within our platform and fill out the required information. Our user-friendly interface allows you to customize your request easily. By understanding how can I can a CT 3911 request with our tools, you'll save time and streamline the process.

-

What features of airSlate SignNow support the CT 3911 request process?

AirSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking that enhance the CT 3911 request process. These tools ensure your request is filled out accurately and signed securely. Understanding how can I can a CT 3911 request using these features can greatly increase your efficiency.

-

Are there any costs associated with submitting a CT 3911 request through airSlate SignNow?

Submitting a CT 3911 request through airSlate SignNow involves a subscription cost, but there are no additional fees for eSigning or sending documents. Our pricing plans are designed to be cost-effective for businesses of all sizes. To know how can I can a CT 3911 request affordably, consider our transparent pricing options.

-

What benefits does airSlate SignNow provide for managing CT 3911 requests?

AirSlate SignNow simplifies the management of CT 3911 requests by providing a platform that is easy to navigate and highly efficient. Benefits include quick access to document history, secure storage, and the ability to share requests with multiple recipients. Learning how can I can a CT 3911 request through our system will enhance your overall document management.

-

Can I integrate airSlate SignNow with other tools to handle my CT 3911 requests?

Yes, airSlate SignNow can integrate seamlessly with various tools and platforms to help manage your CT 3911 requests. This integration allows for better workflow automation and data sharing across applications. By exploring how can I can a CT 3911 request through our integrations, you'll improve efficiency in document handling.

-

Is support available for users submitting a CT 3911 request with airSlate SignNow?

Absolutely, airSlate SignNow offers dedicated support for users who have questions about submitting a CT 3911 request. Our support team is available via chat, email, and phone to assist with any issues you might encounter. Understanding how can I can a CT 3911 request with our support will ensure a smooth experience.

Get more for Ct 3911

Find out other Ct 3911

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed