Form it 201 2019

What is the Form It 201

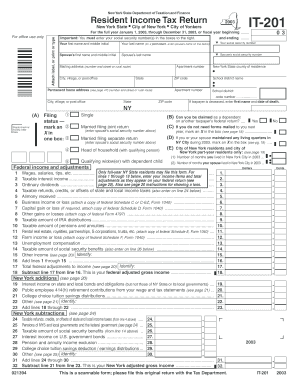

The Form It 201 is a specific income tax return form used by residents of New York State. This form is essential for reporting income and calculating the state tax liability. It is designed for individuals and businesses to ensure compliance with state tax regulations. The form gathers information about income sources, deductions, and credits, allowing taxpayers to accurately determine their tax obligations.

How to use the Form It 201

Using the Form It 201 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions. Next, carefully fill out the form, ensuring all income and deductions are reported accurately. Once completed, review the form for errors before submitting it to the appropriate tax authority. Utilizing a digital solution can streamline this process, making it easier to fill out and sign the form securely.

Steps to complete the Form It 201

Completing the Form It 201 requires a systematic approach:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any applicable deductions and credits to lower your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, following the guidelines for your state.

Legal use of the Form It 201

The legal use of the Form It 201 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Electronic signatures are permissible, provided they meet the requirements set forth by the state. Using a compliant digital platform can enhance the legal standing of the submitted form, ensuring that it adheres to all necessary regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form It 201 are crucial for compliance. Typically, the form must be submitted by April fifteenth of each year, aligning with the federal tax deadline. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to state-specific regulations or extensions that may be granted in certain circumstances.

Required Documents

To complete the Form It 201, several documents are necessary:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Documentation for deductions, such as mortgage interest statements and charitable contributions.

- Records of any other income sources, including rental income or investment earnings.

Digital vs. Paper Version

When deciding between the digital and paper versions of the Form It 201, consider the benefits of each. The digital version allows for easier completion and submission, often with built-in checks for errors. It also provides a secure way to store and access your tax documents. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the choice, ensuring accuracy and compliance is essential.

Quick guide on how to complete form it 201

Prepare Form It 201 seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage Form It 201 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form It 201 effortlessly

- Obtain Form It 201 and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Form It 201 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 201

Create this form in 5 minutes!

How to create an eSignature for the form it 201

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the process for filing an income tax return it 201 with airSlate SignNow?

Filing your income tax return it 201 with airSlate SignNow is straightforward. Simply upload your completed tax document, add relevant signatures, and send it securely for e-signature. Our platform ensures compliance and provides an easy way to manage all your tax documents.

-

How does airSlate SignNow benefit users when filing an income tax return it 201?

Using airSlate SignNow to file your income tax return it 201 offers a streamlined and efficient way to manage your tax documents. The easy-to-use interface allows for quick document preparation and e-signing, saving you time and reducing stress during tax season.

-

What are the pricing options for using airSlate SignNow for income tax return it 201?

airSlate SignNow offers several pricing plans designed to meet the needs of individuals and businesses filing their income tax return it 201. Each plan provides access to essential features, including unlimited templates and e-signatures, ensuring you find the right fit for your budget.

-

Does airSlate SignNow integrate with other financial software for income tax return it 201?

Yes, airSlate SignNow integrates seamlessly with various financial applications, making it easier to manage your income tax return it 201. This integration allows you to import data directly and streamline your entire tax preparation process, enhancing overall efficiency.

-

Is my data secure when I use airSlate SignNow for income tax return it 201?

Absolutely, airSlate SignNow prioritizes your security. When you file your income tax return it 201 through our platform, your data is protected with industry-standard encryption, ensuring that sensitive information remains confidential and secure throughout the entire process.

-

Can I track the status of my income tax return it 201 documents with airSlate SignNow?

Yes, airSlate SignNow allows you to easily track the status of your income tax return it 201 documents. You’ll receive real-time notifications regarding the signing process, so you can stay informed and ensure your tax documents are processed promptly.

-

What features does airSlate SignNow offer for managing income tax return it 201?

airSlate SignNow provides a variety of features specifically designed for managing your income tax return it 201, including customizable templates, automated reminders, and secure storage. These tools help simplify the process and ensure that you can easily access your documents whenever needed.

Get more for Form It 201

Find out other Form It 201

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors