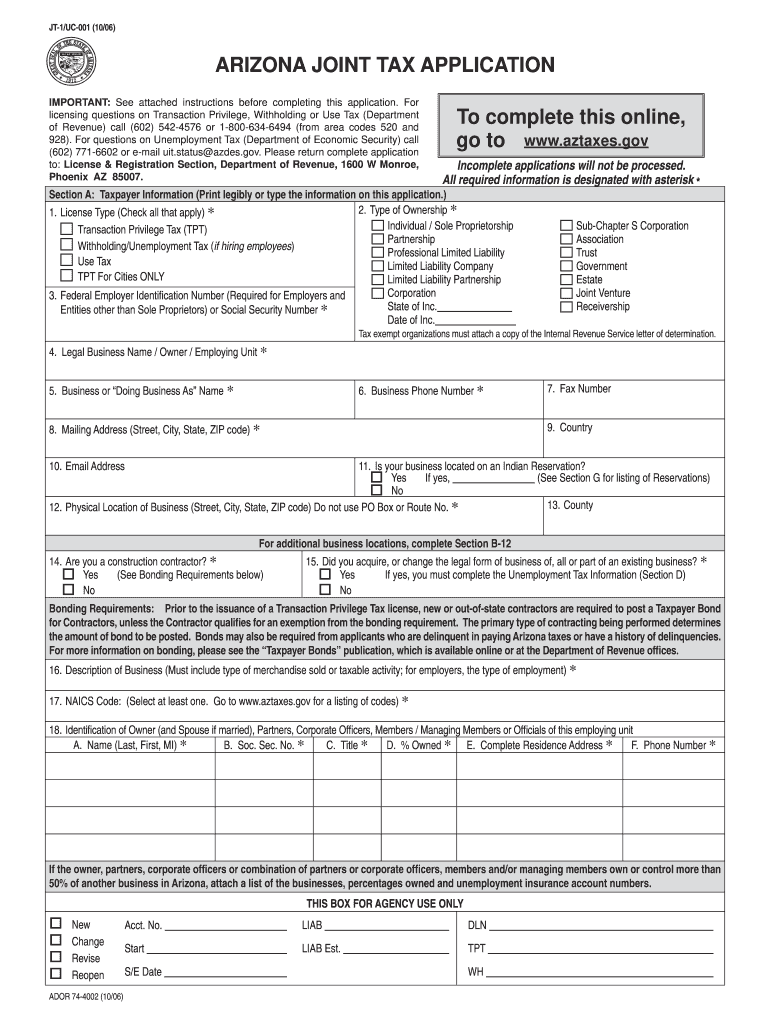

Arizona Joint Tax Application Business Taxes Registration Application Online Tax ID Number 2019

What is the Arizona Joint Tax Application Business Taxes Registration Application Online tax id number

The Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number is a crucial document for businesses operating in Arizona. This application allows entities to register for various state taxes, including transaction privilege tax, use tax, and withholding tax. By obtaining a tax ID number, businesses can ensure compliance with state tax laws and facilitate the collection and remittance of taxes owed to the state. This application serves as a foundational step for any business looking to operate legally within Arizona.

Steps to complete the Arizona Joint Tax Application Business Taxes Registration Application Online tax id number

Completing the Arizona Joint Tax Application involves several key steps:

- Gather necessary information, including business name, address, and ownership details.

- Visit the Arizona Department of Revenue website to access the online application.

- Fill out the application form, ensuring all required fields are completed accurately.

- Review the information for correctness before submission.

- Submit the application electronically and retain any confirmation for your records.

Following these steps will help ensure a smooth registration process.

How to obtain the Arizona Joint Tax Application Business Taxes Registration Application Online tax id number

To obtain the Arizona Joint Tax Application, businesses must apply through the Arizona Department of Revenue’s online portal. The application process is straightforward:

- Access the Arizona Department of Revenue website.

- Locate the Joint Tax Application section.

- Complete the online form with accurate business information.

- Submit the application and wait for confirmation of your tax ID number.

Once processed, businesses will receive their tax ID number, which is essential for tax compliance.

Key elements of the Arizona Joint Tax Application Business Taxes Registration Application Online tax id number

Several key elements must be included in the Arizona Joint Tax Application:

- Business Information: Name, address, and contact details.

- Ownership Structure: Details about the owners or partners involved.

- Tax Types: Specify which taxes the business will be liable for, such as sales tax and withholding tax.

- Signature: An electronic signature may be required to validate the application.

Ensuring these elements are correctly filled out is vital for a successful application.

Legal use of the Arizona Joint Tax Application Business Taxes Registration Application Online tax id number

The Arizona Joint Tax Application is legally binding once submitted and processed by the Arizona Department of Revenue. It establishes the business's obligation to comply with state tax laws. This application is essential for maintaining good standing with the state and avoiding potential penalties for non-compliance. Businesses must ensure that all information provided is accurate and up-to-date to uphold the legal validity of the application.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for businesses to remain compliant. The Arizona Joint Tax Application does not have a specific deadline; however, businesses should register before commencing operations to avoid penalties. Additionally, once registered, businesses must adhere to regular tax filing deadlines based on their tax obligations, such as monthly or quarterly filings. Keeping track of these dates helps ensure timely compliance with state tax laws.

Quick guide on how to complete arizona joint tax application business taxes registration application online tax id number

Effortlessly Prepare Arizona Joint Tax Application Business Taxes Registration Application Online tax id number on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly and without holdups. Handle Arizona Joint Tax Application Business Taxes Registration Application Online tax id number on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

Steps to Edit and eSign Arizona Joint Tax Application Business Taxes Registration Application Online tax id number with Ease

- Locate Arizona Joint Tax Application Business Taxes Registration Application Online tax id number and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Modify and eSign Arizona Joint Tax Application Business Taxes Registration Application Online tax id number and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona joint tax application business taxes registration application online tax id number

Create this form in 5 minutes!

How to create an eSignature for the arizona joint tax application business taxes registration application online tax id number

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number?

The Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number is a unique identifier assigned to businesses operating in Arizona. This application allows businesses to register for various tax obligations and manage their tax liabilities online, streamlining the process and ensuring compliance with state regulations.

-

How can I apply for an Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number?

To apply for the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number, you can complete the application through the official Arizona Department of Revenue website. The process is user-friendly and can be done entirely online, ensuring you receive your tax ID number efficiently.

-

What are the benefits of using the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number?

Using the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number simplifies tax registration and compliance for businesses. This online application helps avoid common errors, reduces processing times, and centralizes multiple tax registrations in one location, ultimately saving businesses time and effort.

-

Is there a fee for applying for the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number?

There is no fee associated with applying for the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number. This makes it an accessible option for businesses to register for their tax obligations without incurring additional costs during the registration process.

-

How long does it take to receive the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number?

Typically, businesses can expect to receive the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number within a few business days after submitting their application. The online process is designed to be efficient, allowing businesses to start operating legally as quickly as possible.

-

Can I update my information for the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number?

Yes, you can update your information for the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number through the Arizona Department of Revenue website. It’s crucial to keep your business information current to ensure compliance and accurate tax reporting.

-

Are there integrations available for managing the Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number?

Yes, businesses can integrate various accounting software solutions with their Arizona Joint Tax Application Business Taxes Registration Application Online tax ID number. This integration facilitates seamless tax reporting and compliance while managing your business's finances effectively.

Get more for Arizona Joint Tax Application Business Taxes Registration Application Online tax id number

Find out other Arizona Joint Tax Application Business Taxes Registration Application Online tax id number

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors