Form 593 C Real Estate Withholding Certificate Ftb Ca Gov 2019

What is the Form 593 C Real Estate Withholding Certificate?

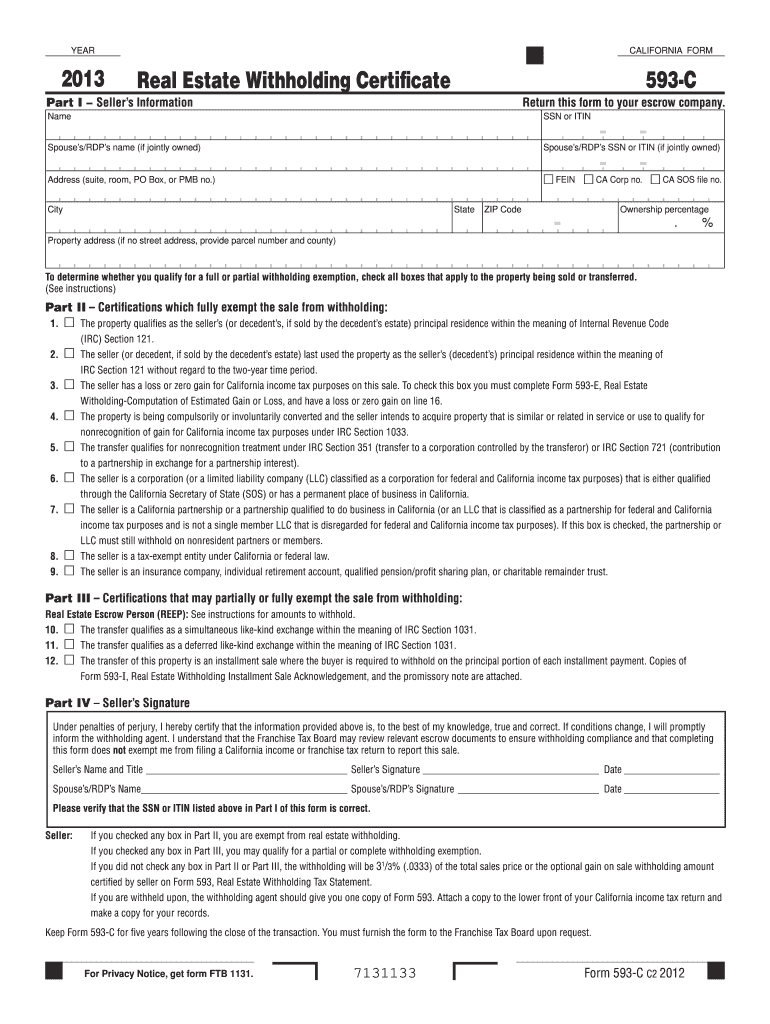

The Form 593 C Real Estate Withholding Certificate is a document required by the California Franchise Tax Board (FTB) for certain real estate transactions. This form is typically used when a property is sold, and it helps ensure that the appropriate tax withholding is applied to the sale proceeds. The form is essential for non-resident sellers, as it allows them to certify their eligibility for withholding exemptions or to indicate the amount to be withheld from the sale proceeds. Understanding this form is crucial for compliance with California tax laws.

Steps to Complete the Form 593 C Real Estate Withholding Certificate

Completing the Form 593 C involves several key steps:

- Gather necessary information, including the seller's details, property address, and transaction specifics.

- Indicate the reason for the withholding exemption, if applicable, by selecting the appropriate box on the form.

- Provide the estimated gain or loss from the sale, as this will affect the withholding amount.

- Sign and date the form to validate it, ensuring that all information is accurate and complete.

Once completed, the form must be submitted to the buyer or the buyer's agent, who will then file it with the FTB.

Legal Use of the Form 593 C Real Estate Withholding Certificate

The Form 593 C is legally binding when completed correctly and submitted in accordance with California tax regulations. It serves as a formal declaration of the seller's tax status and withholding obligations. Failure to submit this form when required can lead to penalties, including fines and interest on unpaid taxes. It is important for sellers, especially non-residents, to understand their legal responsibilities regarding this form to avoid potential legal issues.

Key Elements of the Form 593 C Real Estate Withholding Certificate

Several key elements must be included in the Form 593 C to ensure its validity:

- Seller Information: Full name, address, and taxpayer identification number.

- Property Details: Address and type of property being sold.

- Withholding Exemption Reason: Specific reasons for claiming an exemption from withholding.

- Signature: The seller must sign and date the form to confirm the accuracy of the information provided.

Each of these elements plays a critical role in the processing of the form by the FTB.

How to Obtain the Form 593 C Real Estate Withholding Certificate

The Form 593 C can be obtained directly from the California Franchise Tax Board's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many real estate professionals and tax advisors can provide copies of the form and assist in its completion. Ensuring you have the most current version of the form is essential for compliance.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 593 C. Generally, the form must be submitted at the time of the sale or before the close of escrow. The FTB requires that the withholding amount be remitted along with the form by the specified deadlines to avoid penalties. Keeping track of these dates is crucial for sellers to ensure compliance and avoid unnecessary fees.

Quick guide on how to complete 2013 form 593 c real estate withholding certificate ftbcagov

Complete Form 593 C Real Estate Withholding Certificate Ftb ca gov effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 593 C Real Estate Withholding Certificate Ftb ca gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Form 593 C Real Estate Withholding Certificate Ftb ca gov with ease

- Find Form 593 C Real Estate Withholding Certificate Ftb ca gov and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Select relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 593 C Real Estate Withholding Certificate Ftb ca gov and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 593 c real estate withholding certificate ftbcagov

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 593 c real estate withholding certificate ftbcagov

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Form 593 C Real Estate Withholding Certificate Ftb ca gov?

The Form 593 C Real Estate Withholding Certificate Ftb ca gov is a document used in California real estate transactions to report and withhold state income tax on gains from the sale of real property. It's essential for both buyers and sellers to understand this form to ensure compliance with state tax regulations.

-

How does airSlate SignNow simplify the process of submitting the Form 593 C Real Estate Withholding Certificate Ftb ca gov?

airSlate SignNow streamlines the eSigning process for the Form 593 C Real Estate Withholding Certificate Ftb ca gov, allowing users to complete and submit the document efficiently. Our platform's user-friendly interface ensures that even those unfamiliar with digital documents can easily navigate the process.

-

What are the advantages of using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate Ftb ca gov?

Using airSlate SignNow offers numerous advantages for the Form 593 C Real Estate Withholding Certificate Ftb ca gov, including enhanced security, easy tracking of document status, and the ability to sign from anywhere. This convenience helps save time and resources, making your real estate transactions smoother.

-

Is there a cost associated with using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate Ftb ca gov?

airSlate SignNow provides a cost-effective solution for processing the Form 593 C Real Estate Withholding Certificate Ftb ca gov. Our pricing plans are designed to suit various business needs, ensuring you only pay for the features that benefit you the most.

-

Can I integrate airSlate SignNow with other software for handling the Form 593 C Real Estate Withholding Certificate Ftb ca gov?

Yes, airSlate SignNow offers seamless integrations with various software platforms to enhance your workflow for the Form 593 C Real Estate Withholding Certificate Ftb ca gov. This flexibility allows you to connect with CRM systems, document management tools, and more, ensuring a smooth processing experience.

-

What features does airSlate SignNow offer for electronic signatures on the Form 593 C Real Estate Withholding Certificate Ftb ca gov?

airSlate SignNow provides robust features for electronic signatures on the Form 593 C Real Estate Withholding Certificate Ftb ca gov, including customizable signing workflows, real-time notifications, and secure storage of signed documents. These features ensure that you can manage your documents effectively and securely.

-

How can airSlate SignNow enhance collaboration when working on the Form 593 C Real Estate Withholding Certificate Ftb ca gov?

Collaboration is made easy with airSlate SignNow when working on the Form 593 C Real Estate Withholding Certificate Ftb ca gov. Our platform allows multiple users to review and sign documents concurrently, streamlining the workflow and reducing time delays in completing your transactions.

Get more for Form 593 C Real Estate Withholding Certificate Ftb ca gov

Find out other Form 593 C Real Estate Withholding Certificate Ftb ca gov

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile