DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 2007

What is the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107

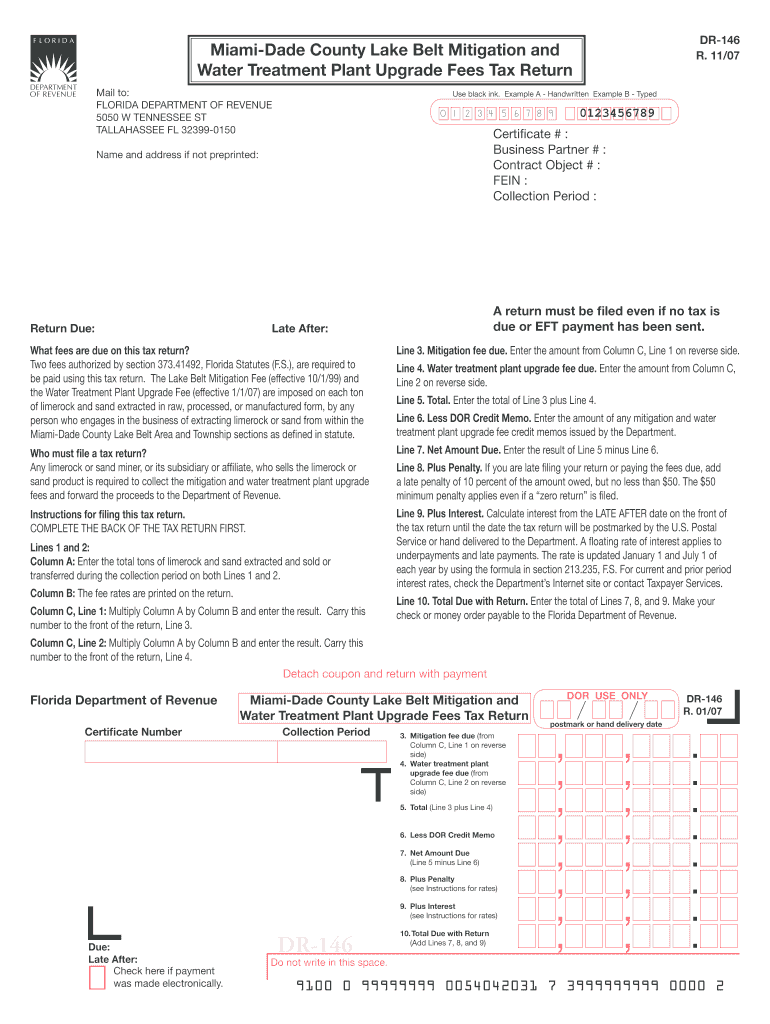

The DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 is a specific form used to report and remit mitigation fees associated with the Lake Belt area in Miami-Dade County. This form is essential for businesses and individuals engaged in activities that impact the environment in this region, particularly those related to mining and land development. The fees collected are used to fund environmental restoration and conservation efforts in the Lake Belt area, ensuring compliance with local regulations and promoting sustainable practices.

Steps to complete the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107

Completing the DR 146 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial records and any prior mitigation fee assessments. Next, fill out the form by providing required information such as the entity name, address, and details of the activities that necessitate the mitigation fee. Be sure to calculate the fee based on the guidelines provided by the Miami-Dade County authorities. After completing the form, review all entries for accuracy before submitting it.

How to obtain the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107

The DR 146 form can be obtained through the Miami-Dade County government website or by visiting the local office responsible for environmental regulation and permitting. It is advisable to check for the most current version of the form to ensure compliance with any updates in regulations or fee structures. Additionally, some local libraries or community centers may have physical copies available for public use.

Legal use of the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107

The DR 146 form is legally binding when completed and submitted in accordance with Miami-Dade County regulations. To ensure its legal validity, it must be signed by the appropriate party, typically a business owner or authorized representative. Compliance with local laws, including accurate fee calculations and timely submissions, is essential to avoid penalties or legal repercussions. Utilizing electronic signatures through a secure platform can enhance the legal standing of the submission.

Form Submission Methods

The DR 146 form can be submitted through multiple methods to accommodate different preferences and needs. Options typically include online submission via the Miami-Dade County portal, mailing a physical copy to the designated office, or delivering it in person. Each method may have specific requirements, such as additional documentation or payment methods, so it is important to review the guidelines carefully before submission.

Filing Deadlines / Important Dates

Filing deadlines for the DR 146 form are crucial for compliance. Typically, the form must be submitted annually, with specific due dates set by Miami-Dade County. It is important to stay informed about these deadlines to avoid late fees or penalties. Checking the official county website or contacting the relevant office can provide the most accurate and updated information regarding important dates.

Quick guide on how to complete dr 146 miami dade county lake belt mitigation fee tax return r1107

Complete DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 with ease

- Obtain DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or a link invitation, or download it to your computer.

Put aside concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 while ensuring excellent communication throughout the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 146 miami dade county lake belt mitigation fee tax return r1107

Create this form in 5 minutes!

How to create an eSignature for the dr 146 miami dade county lake belt mitigation fee tax return r1107

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107?

The DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 is a form used to report and pay the mitigation fees associated with the Lake Belt area in Miami-Dade County. It ensures compliance with local regulations regarding environmental impacts and land use, making it essential for businesses operating in this region.

-

How do I complete the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107?

Completing the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 involves gathering necessary data regarding your activities that impact the Lake Belt area. You can easily fill out the form online using airSlate SignNow, which provides a straightforward interface for inputting your information.

-

What are the costs associated with using airSlate SignNow for the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107?

Using airSlate SignNow for the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 is cost-effective, with a flexible pricing structure that accommodates businesses of all sizes. Subscribing to our service gives you access to eSigning features and document management tools without breaking the bank.

-

What features does airSlate SignNow offer for managing the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107?

airSlate SignNow offers a range of features to streamline the process of managing your DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107. These include easy document uploads, collaborative editing, secure eSigning, and automated reminders to help you meet deadlines.

-

How does airSlate SignNow enhance the filing process for the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107?

airSlate SignNow enhances the filing process for the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 by simplifying documentation and ensuring that all necessary signatures are obtained swiftly. This efficient process reduces delays and keeps your business compliant with local laws.

-

Can airSlate SignNow integrate with other tools for the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107?

Yes, airSlate SignNow can integrate seamlessly with various business tools and software systems to facilitate the management of the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107. This allows for better data management and workflow efficiency, enabling you to link your documents directly with accounting or project management platforms.

-

What benefits does airSlate SignNow provide for businesses filing the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107?

Filing the DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107 using airSlate SignNow comes with several benefits, including time savings, enhanced document security, and increased accuracy. Our platform allows you to keep track of your submissions and receive updates in real time.

Get more for DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107

Find out other DR 146 Miami Dade County Lake Belt Mitigation Fee Tax Return R 1107

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy