Massachusetts Resident Income Tax Return Form 1 Mass Gov 2019

What is the Massachusetts Resident Income Tax Return Form 1 Mass Gov

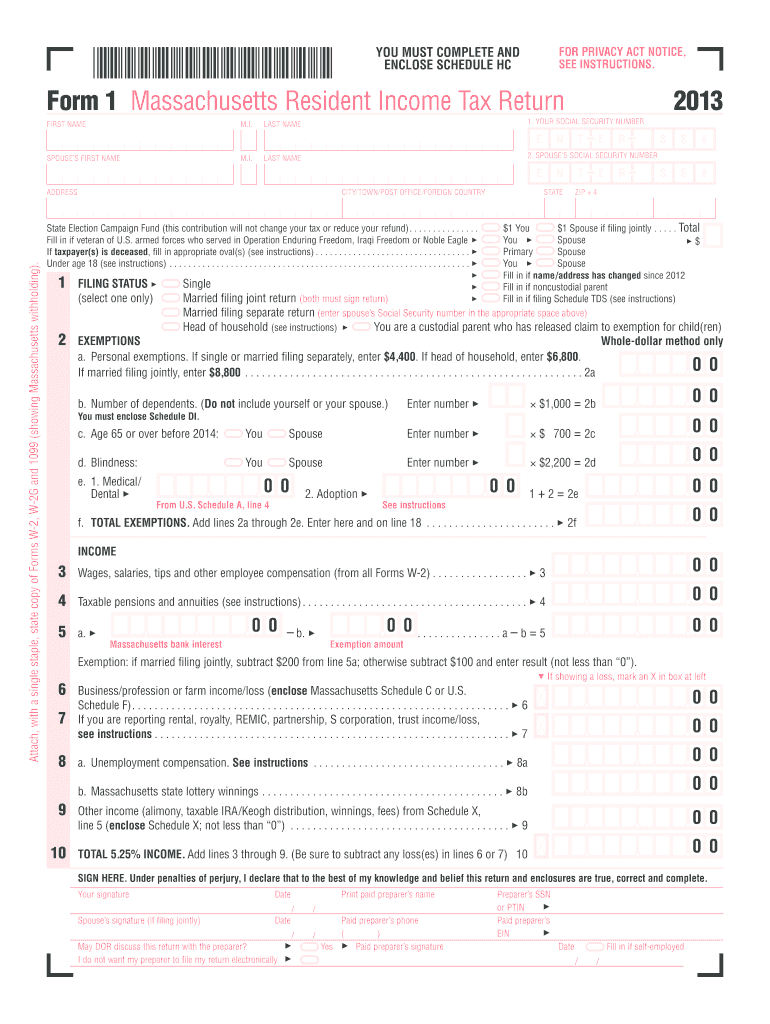

The Massachusetts Resident Income Tax Return Form 1 is the official document used by residents of Massachusetts to report their income and calculate their state tax obligations. This form is essential for individuals who earn income within the state, as it allows them to detail their earnings, deductions, and credits. The information provided on Form 1 is used by the Massachusetts Department of Revenue to assess the amount of tax owed or any refund due. Understanding this form is crucial for compliance with state tax laws and for ensuring that residents take advantage of available tax benefits.

Steps to complete the Massachusetts Resident Income Tax Return Form 1 Mass Gov

Completing the Massachusetts Resident Income Tax Return Form 1 involves several important steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2 forms, 1099 forms, and any documentation for deductions or credits.

- Fill out the form: Input your personal information, including your name, address, and Social Security number. Report your total income and any applicable deductions.

- Calculate your tax: Use the tax tables provided by the Massachusetts Department of Revenue to determine your tax liability based on your reported income.

- Review your form: Double-check all entries for accuracy to avoid errors that could lead to delays or penalties.

- Sign and date the form: Ensure that you sign the form, as an unsigned return is considered invalid.

How to obtain the Massachusetts Resident Income Tax Return Form 1 Mass Gov

Residents can obtain the Massachusetts Resident Income Tax Return Form 1 through several convenient methods. The form is available for download directly from the Massachusetts Department of Revenue's official website. Additionally, physical copies can often be found at local libraries, post offices, and tax assistance centers. For those who prefer to file electronically, many tax preparation software programs include the form and guide users through the filing process, making it easier to complete the return accurately.

Legal use of the Massachusetts Resident Income Tax Return Form 1 Mass Gov

The Massachusetts Resident Income Tax Return Form 1 is legally binding when filled out and submitted in compliance with state tax laws. To ensure its legal validity, it must be signed by the taxpayer. Electronic signatures are accepted, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Properly completed and filed, this form serves as a formal declaration of income and tax liability, and it can be used in legal contexts if disputes arise regarding tax obligations.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Massachusetts Resident Income Tax Return Form 1. Typically, the due date for filing is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may be available, as well as deadlines for estimated tax payments if applicable. Staying informed about these dates helps avoid penalties and ensures timely compliance with state tax regulations.

Required Documents

When preparing to complete the Massachusetts Resident Income Tax Return Form 1, several documents are necessary to ensure accurate reporting. Key documents include:

- W-2 forms: These forms report wages and tax withheld from employers.

- 1099 forms: For reporting various types of income, including freelance earnings and interest income.

- Documentation for deductions: Receipts or statements for eligible deductions such as mortgage interest, property taxes, and charitable contributions.

- Previous year’s tax return: This can provide a useful reference for completing the current year's return.

Quick guide on how to complete massachusetts resident income tax return form 1 massgov

Complete Massachusetts Resident Income Tax Return Form 1 Mass Gov effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Massachusetts Resident Income Tax Return Form 1 Mass Gov on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centered task today.

The easiest way to modify and eSign Massachusetts Resident Income Tax Return Form 1 Mass Gov without hassle

- Obtain Massachusetts Resident Income Tax Return Form 1 Mass Gov and then click Get Form to start.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document administration needs in just a few clicks from any device you prefer. Edit and eSign Massachusetts Resident Income Tax Return Form 1 Mass Gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts resident income tax return form 1 massgov

Create this form in 5 minutes!

How to create an eSignature for the massachusetts resident income tax return form 1 massgov

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Massachusetts Resident Income Tax Return Form 1 Mass Gov?

The Massachusetts Resident Income Tax Return Form 1 Mass Gov is a crucial document for residents filing their state taxes. It allows individuals to report their income, claim deductions, and calculate their tax liabilities. Completing this form accurately is essential to ensure compliance with state tax laws.

-

How can airSlate SignNow help me with my Massachusetts Resident Income Tax Return Form 1 Mass Gov?

airSlate SignNow provides a user-friendly platform to eSign, send, and manage your Massachusetts Resident Income Tax Return Form 1 Mass Gov. Our solution streamlines the process, allowing you to avoid paperwork hassles and keeping everything securely organized. This can save you signNow time and reduce stress during tax season.

-

Is there a cost associated with using airSlate SignNow for my tax return forms?

Yes, airSlate SignNow offers various pricing plans that cater to individual users and businesses. The cost is competitive and tailored to provide value for your needs, especially when handling essential documents like the Massachusetts Resident Income Tax Return Form 1 Mass Gov. You can easily choose a plan that fits your budget.

-

What features does airSlate SignNow offer for tax return processing?

airSlate SignNow offers a variety of features, including document templates, eSignature capabilities, and cloud storage. These features can enhance your experience when managing documents like the Massachusetts Resident Income Tax Return Form 1 Mass Gov. The platform also allows for real-time collaboration, making tax preparation more efficient.

-

Can I integrate airSlate SignNow with other software for filing my taxes?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, making it easy to manage your tax documents, including the Massachusetts Resident Income Tax Return Form 1 Mass Gov. Whether you use accounting software or CRMs, our integrations help keep your workflow smooth and organized.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents provides numerous benefits including enhanced security, efficiency, and ease of use. You can quickly eSign and send your Massachusetts Resident Income Tax Return Form 1 Mass Gov, knowing that your data is protected. This service ultimately reduces the time spent on paperwork, giving you more freedom during tax season.

-

How user-friendly is airSlate SignNow for first-time users?

airSlate SignNow is designed with user experience in mind, making it simple for first-time users to navigate. The intuitive interface allows you to easily manage your Massachusetts Resident Income Tax Return Form 1 Mass Gov without any prior technical knowledge. Our support resources are also available to help you get started.

Get more for Massachusetts Resident Income Tax Return Form 1 Mass Gov

Find out other Massachusetts Resident Income Tax Return Form 1 Mass Gov

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement