Did You Materially Participate in the Operation of This Business during 2020

What is the Did You Materially Participate In The Operation Of This Business During

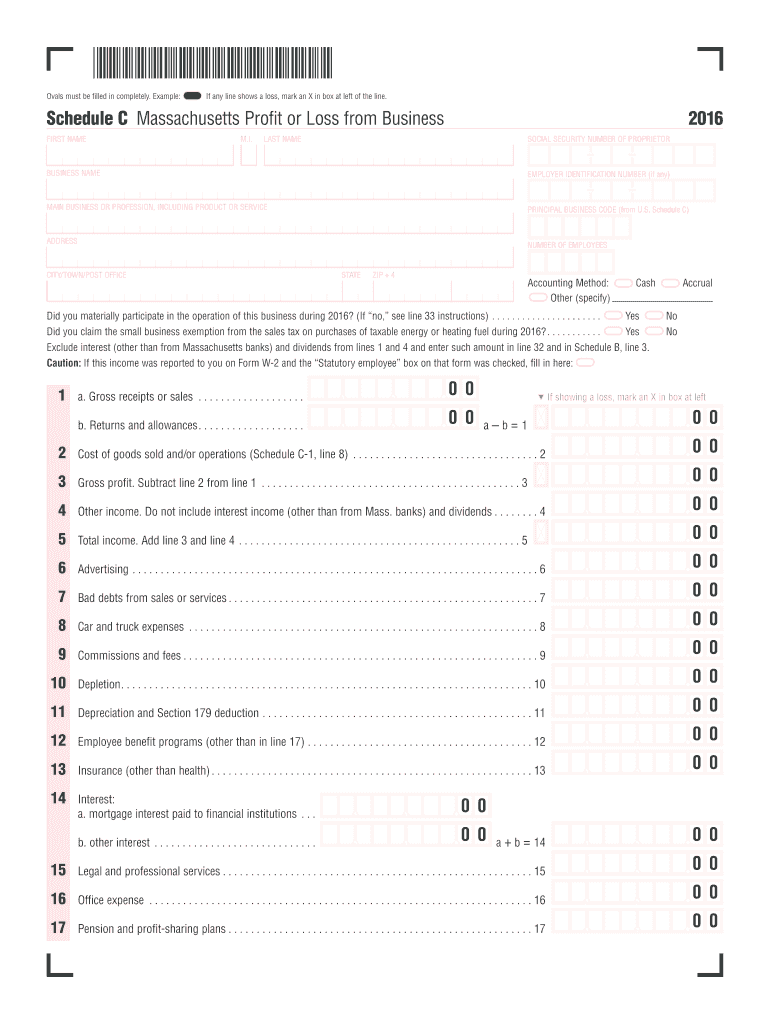

The form titled "Did You Materially Participate In The Operation Of This Business During" is primarily used to determine an individual's level of involvement in a business's operations for tax purposes. This form is essential for taxpayers who need to establish their participation in a business to qualify for specific tax benefits or deductions. Understanding the criteria for material participation is crucial, as it directly impacts how income or losses from the business are reported on tax returns.

Steps to complete the Did You Materially Participate In The Operation Of This Business During

Completing the "Did You Materially Participate In The Operation Of This Business During" form involves several key steps:

- Gather necessary documentation, including business records and financial statements.

- Review the IRS guidelines on material participation to understand the criteria.

- Answer the questions on the form accurately, detailing your involvement in the business operations.

- Ensure that all information is complete and correct before submission.

- Sign the form electronically or physically, depending on your submission method.

Legal use of the Did You Materially Participate In The Operation Of This Business During

For the "Did You Materially Participate In The Operation Of This Business During" form to be legally valid, it must comply with IRS regulations regarding eSignatures and documentation. Electronic signatures are recognized under the ESIGN Act and UETA, provided that the signing process meets specific security and authentication standards. This ensures that the form is legally binding and can be used for tax purposes without issues.

IRS Guidelines

The IRS provides specific guidelines regarding material participation, which are critical for accurately completing the form. According to IRS rules, material participation generally requires that the taxpayer is involved in the business on a regular, continuous, and substantial basis. The IRS outlines several tests to determine if a taxpayer meets these criteria, including the number of hours worked and the nature of the tasks performed. Familiarizing yourself with these guidelines can help ensure compliance and maximize potential tax benefits.

Eligibility Criteria

Eligibility to claim material participation on the "Did You Materially Participate In The Operation Of This Business During" form depends on various factors. Taxpayers must demonstrate that they have been actively engaged in the business's operations. This includes meeting specific hours of involvement, such as working more than five hundred hours during the year or being the sole owner of the business. Understanding these eligibility criteria is essential for proper tax reporting and compliance.

Form Submission Methods

The "Did You Materially Participate In The Operation Of This Business During" form can be submitted through various methods. Taxpayers may choose to file the form electronically, which is often faster and more efficient. Alternatively, the form can be submitted via mail or in person at designated IRS offices. Each submission method has its own requirements and timelines, so it is important to choose the one that best fits your needs.

Quick guide on how to complete did you materially participate in the operation of this business during 2016

Effortlessly Prepare Did You Materially Participate In The Operation Of This Business During on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed materials, as you can easily access the correct version and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without any delays. Handle Did You Materially Participate In The Operation Of This Business During on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign Did You Materially Participate In The Operation Of This Business During with Ease

- Locate Did You Materially Participate In The Operation Of This Business During and click Get Form to begin.

- Utilize the available tools to complete your form.

- Select important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign Did You Materially Participate In The Operation Of This Business During and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct did you materially participate in the operation of this business during 2016

Create this form in 5 minutes!

How to create an eSignature for the did you materially participate in the operation of this business during 2016

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What does it mean to ask, 'Did You Materially Participate In The Operation Of This Business During'?

The question 'Did You Materially Participate In The Operation Of This Business During' refers to your active involvement in business operations. Understanding this is crucial for tax considerations and compliance. For businesses utilizing airSlate SignNow, keeping accurate records of participation can simplify this process considerably.

-

How does airSlate SignNow help in documenting participation?

airSlate SignNow offers seamless document management and eSigning features that enable businesses to accurately document participation. By utilizing electronic signatures, you can easily track who participated in operations and when. This clarity is essential when answering the question, 'Did You Materially Participate In The Operation Of This Business During.'

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides a range of pricing plans to suit various business needs. From individual users to large enterprises, we cater to all sizes with affordable options. Investing in airSlate SignNow not only provides eSigning capabilities but also aids in accurate participation documentation by simplifying processes related to 'Did You Materially Participate In The Operation Of This Business During.'

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates easily with various applications such as Google Drive, Salesforce, and more. This integration allows for a streamlined workflow and ensures all participation documentation is centralized. By managing your operations effectively, you can better answer 'Did You Materially Participate In The Operation Of This Business During.'

-

What features does airSlate SignNow offer to enhance user experience?

airSlate SignNow offers a user-friendly interface, customizable templates, and access control features. These tools help users ensure that all necessary documentation, especially related to 'Did You Materially Participate In The Operation Of This Business During,' is easily accessible and organized. Enhancing user experience translates to better operational management.

-

How secure is my data with airSlate SignNow?

Data security is a top priority at airSlate SignNow. We implement robust security measures, including encryption and secure cloud storage, to protect your documents and sensitive information. Ensuring the safety of your records will make answering 'Did You Materially Participate In The Operation Of This Business During' much easier and reliable.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any questions or issues. Whether you're unsure about utilizing features or need guidance on documentation related to 'Did You Materially Participate In The Operation Of This Business During,' our team is here to help.

Get more for Did You Materially Participate In The Operation Of This Business During

- Subcontractor statement 77791404 form

- Sherwin williams business credit application form

- Security guard timesheet template form

- Ddp1 form

- Tpt form 100094545

- Divorce papers mn pdf form

- Edgecombe county sheriff department gun permit form

- Policies uat ncdhhs govdivisionalsocialdss 5240 permanency planning family services agreement form

Find out other Did You Materially Participate In The Operation Of This Business During

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT