St 14 Sc Claim for Refund Form 2020

What is the St 14 Sc Claim For Refund Form

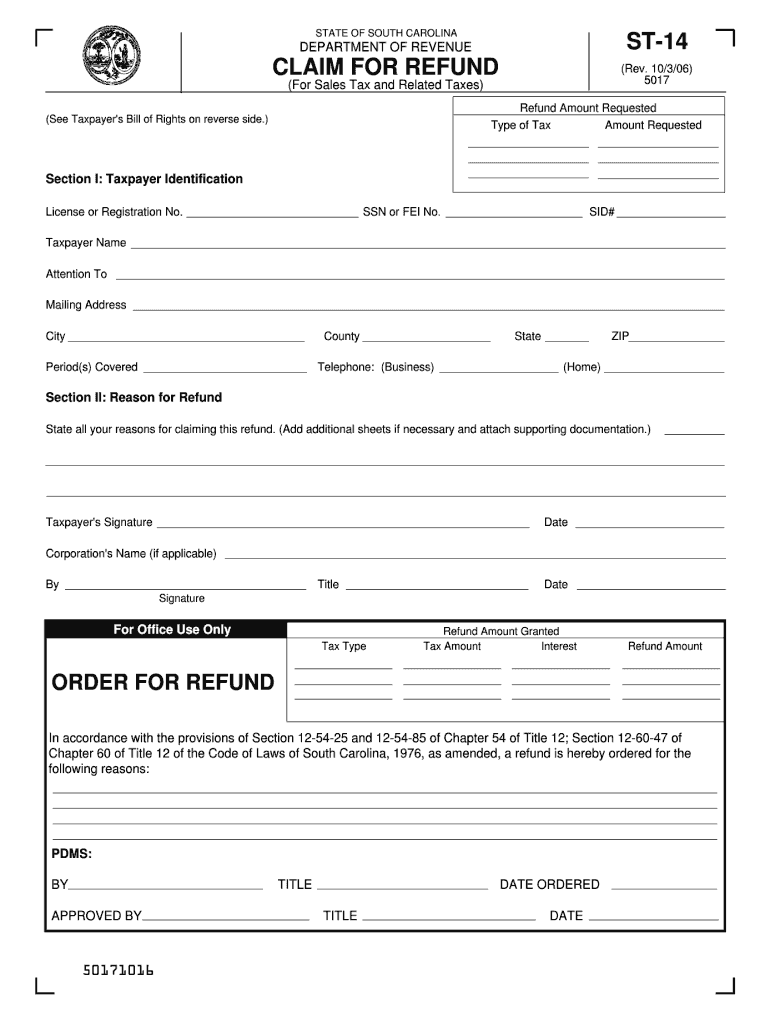

The St 14 Sc Claim For Refund Form is a document used by taxpayers in the United States to request a refund for overpaid taxes. This form is particularly relevant for individuals and businesses seeking to recover funds that were mistakenly paid to the state or federal government. The form serves as an official request and must be completed accurately to ensure a smooth refund process.

How to use the St 14 Sc Claim For Refund Form

Using the St 14 Sc Claim For Refund Form involves several steps to ensure that your request is processed efficiently. First, gather all necessary documentation, including proof of payment and any relevant tax records. Next, fill out the form with accurate information, including your personal details and the amount you believe you are owed. Once completed, submit the form according to the provided instructions, which may include online submission or mailing it to the appropriate agency.

Steps to complete the St 14 Sc Claim For Refund Form

Completing the St 14 Sc Claim For Refund Form requires careful attention to detail. Follow these steps:

- Begin by downloading the form from a reliable source or accessing it through the appropriate state agency website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the tax year in question and the specific reasons for your refund request.

- Attach any supporting documents that validate your claim, such as payment receipts or tax returns.

- Review the form for accuracy before submitting it to avoid delays.

Legal use of the St 14 Sc Claim For Refund Form

The St 14 Sc Claim For Refund Form is legally binding when completed correctly and submitted in accordance with applicable laws. It is essential to ensure that all information provided is truthful and accurate, as submitting false information can lead to penalties. The form must comply with relevant state and federal regulations to be considered valid, and it should be submitted within the designated time frames to avoid forfeiting your right to a refund.

Filing Deadlines / Important Dates

Filing deadlines for the St 14 Sc Claim For Refund Form can vary based on the type of tax and the specific circumstances of the refund request. Generally, it is advisable to submit the form as soon as you identify an overpayment. Many states have a statute of limitations that requires claims to be filed within three years from the date the tax was paid. It is crucial to check the specific deadlines applicable to your situation to ensure compliance.

Required Documents

To successfully complete the St 14 Sc Claim For Refund Form, certain documents are typically required. These may include:

- Proof of payment, such as bank statements or payment receipts.

- Copies of previous tax returns for the relevant tax year.

- Any correspondence with tax authorities regarding the overpayment.

Having these documents ready can facilitate a smoother process and help substantiate your claim.

Quick guide on how to complete st 14 sc claim for refund 2006 form

Effortlessly prepare St 14 Sc Claim For Refund Form on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle St 14 Sc Claim For Refund Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign St 14 Sc Claim For Refund Form with ease

- Obtain St 14 Sc Claim For Refund Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight necessary parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign St 14 Sc Claim For Refund Form and facilitate excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 14 sc claim for refund 2006 form

Create this form in 5 minutes!

How to create an eSignature for the st 14 sc claim for refund 2006 form

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the St 14 Sc Claim For Refund Form?

The St 14 Sc Claim For Refund Form is a document designed for individuals or businesses in South Carolina to request a refund for overpaid taxes. This form facilitates the process by providing a structured format for submitting your claim.

-

How can airSlate SignNow help with the St 14 Sc Claim For Refund Form?

airSlate SignNow offers a simple and efficient way to electronically sign and send your St 14 Sc Claim For Refund Form. With our user-friendly platform, you can ensure that your form is completed accurately and submitted promptly.

-

What are the pricing options for using airSlate SignNow to handle the St 14 Sc Claim For Refund Form?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including options for individuals and businesses. Our competitive pricing provides extensive features for managing documents like the St 14 Sc Claim For Refund Form while ensuring affordability.

-

Can I track the status of my St 14 Sc Claim For Refund Form submission with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your St 14 Sc Claim For Refund Form submission in real time. This feature provides peace of mind, ensuring that you are aware of when your form is received and processed.

-

Is it secure to use airSlate SignNow for my St 14 Sc Claim For Refund Form?

Absolutely! airSlate SignNow prioritizes security by implementing advanced encryption and authentication measures. You can confidently use our platform to complete and send your St 14 Sc Claim For Refund Form knowing your data is protected.

-

Does airSlate SignNow integrate with other applications for processing the St 14 Sc Claim For Refund Form?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, making it easy to manage your St 14 Sc Claim For Refund Form alongside your existing systems. This flexibility enhances productivity and streamlines your document workflow.

-

What are the benefits of using airSlate SignNow for the St 14 Sc Claim For Refund Form?

Using airSlate SignNow for the St 14 Sc Claim For Refund Form offers numerous benefits, including quicker processing times and reduced paperwork. Our platform enables easy collaboration among multiple signers, ensuring that your claim is submitted efficiently.

Get more for St 14 Sc Claim For Refund Form

Find out other St 14 Sc Claim For Refund Form

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement