Sc 1120 Form 2020

What is the Sc 1120 Form

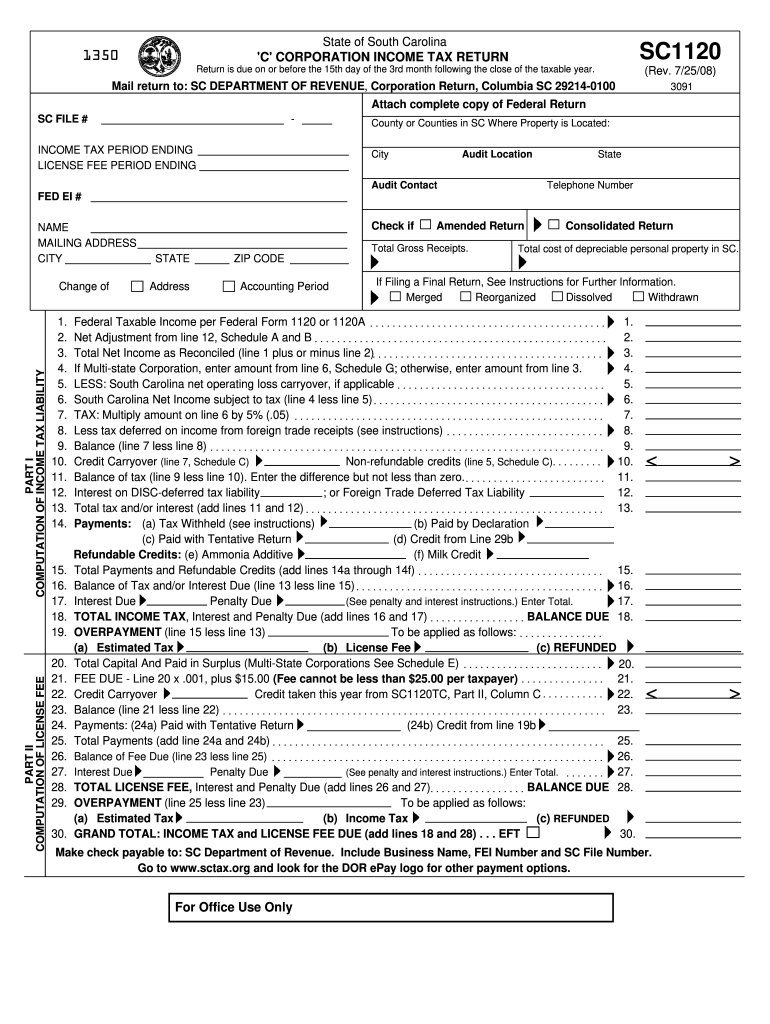

The Sc 1120 Form is a tax document used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for corporations filing their annual tax returns with the Internal Revenue Service (IRS). It provides a comprehensive overview of the corporation's financial activities for the tax year, allowing the IRS to assess the corporation's tax liability accurately. Understanding the Sc 1120 Form is crucial for businesses to ensure compliance with federal tax regulations.

How to use the Sc 1120 Form

Using the Sc 1120 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including income statements, balance sheets, and any relevant documentation of deductions and credits. Next, carefully fill out the form, providing detailed information about the corporation's revenue, expenses, and tax obligations. After completing the form, review it for accuracy, ensuring all figures are correct and all required sections are filled out. Finally, submit the form to the IRS by the specified deadline, either electronically or by mail.

Steps to complete the Sc 1120 Form

Completing the Sc 1120 Form can be done efficiently by following these steps:

- Gather all financial documents, including income statements and expense reports.

- Fill in the corporation's basic information, including name, address, and Employer Identification Number (EIN).

- Report total income, including sales and other sources of revenue.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Review the form for completeness and accuracy before submission.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the Sc 1120 Form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important for corporations to mark these dates to avoid penalties for late filing.

Legal use of the Sc 1120 Form

The Sc 1120 Form is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, corporations must adhere to specific guidelines regarding the accuracy of the information provided. E-signatures can be used for electronic submissions, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. Maintaining accurate records and adhering to filing deadlines helps ensure compliance and protects against potential audits or penalties.

Required Documents

To accurately complete the Sc 1120 Form, corporations need to gather several key documents, including:

- Income statements detailing revenue and sales.

- Expense reports outlining all deductible business expenses.

- Balance sheets showing the corporation's assets, liabilities, and equity.

- Documentation for any tax credits or deductions claimed.

- Prior year tax returns for reference and consistency.

Examples of using the Sc 1120 Form

Corporations of various sizes and structures utilize the Sc 1120 Form to report their financial activities. For instance, a small business corporation may use it to report annual earnings and claim deductions for employee salaries and operational costs. Larger corporations might report complex financial transactions, including investments and mergers. Understanding how different businesses apply the Sc 1120 Form can provide valuable insights into effective tax reporting and compliance strategies.

Quick guide on how to complete sc 1120 2008 form

Complete Sc 1120 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Sc 1120 Form on any platform with airSlate SignNow's Android or iOS applications, and enhance any document-centric process today.

The easiest way to modify and eSign Sc 1120 Form without any hassle

- Locate Sc 1120 Form and click on Get Form to initiate.

- Employ the tools we offer to finish your form.

- Highlight important sections of your documents or redact sensitive content using tools specifically provided by airSlate SignNow for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Sc 1120 Form and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 1120 2008 form

Create this form in 5 minutes!

How to create an eSignature for the sc 1120 2008 form

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the SC 1120 Form?

The SC 1120 Form is a tax return form used by corporations in South Carolina to report income, deductions, and taxes owed. It is essential for maintaining compliance with state tax regulations. Completing the SC 1120 Form correctly is crucial for ensuring your business's tax obligations are met.

-

How can airSlate SignNow help with the SC 1120 Form?

airSlate SignNow provides a seamless way to create, send, and eSign the SC 1120 Form digitally. With our platform, you can ensure that all necessary signatures are gathered quickly and securely, saving you valuable time. Using airSlate SignNow makes the filing process easier and enhances accuracy.

-

Is there a cost associated with using airSlate SignNow for the SC 1120 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including features for processing the SC 1120 Form. Our cost-effective solutions ensure you get the best value while streamlining your document management. Explore our pricing plans to find one that fits your requirements.

-

What features does airSlate SignNow offer for the SC 1120 Form?

airSlate SignNow offers features such as templates, automated reminders, and secure eSigning for the SC 1120 Form. These tools help simplify the process and ensure that all stakeholders can easily complete their parts. Additionally, our platform supports document tracking to monitor the status of your submissions.

-

Can I integrate airSlate SignNow with other tools for handling the SC 1120 Form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, including CRMs and accounting software, to facilitate the handling of the SC 1120 Form. This ensures that all necessary data is easily accessible and can be utilized across different systems, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for the SC 1120 Form?

The primary benefits of using airSlate SignNow for the SC 1120 Form include increased efficiency, reduced paper use, and enhanced security. Our platform allows for quick document turnaround and ensures that sensitive information is protected. This means you can focus on your business while we handle the paperwork.

-

Is airSlate SignNow secure for handling the SC 1120 Form?

Yes, airSlate SignNow employs industry-leading security measures to protect your documents, including the SC 1120 Form. We utilize encryption protocols and comply with privacy regulations to ensure that your information remains confidential. You can trust airSlate SignNow to keep your business's data safe.

Get more for Sc 1120 Form

Find out other Sc 1120 Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT