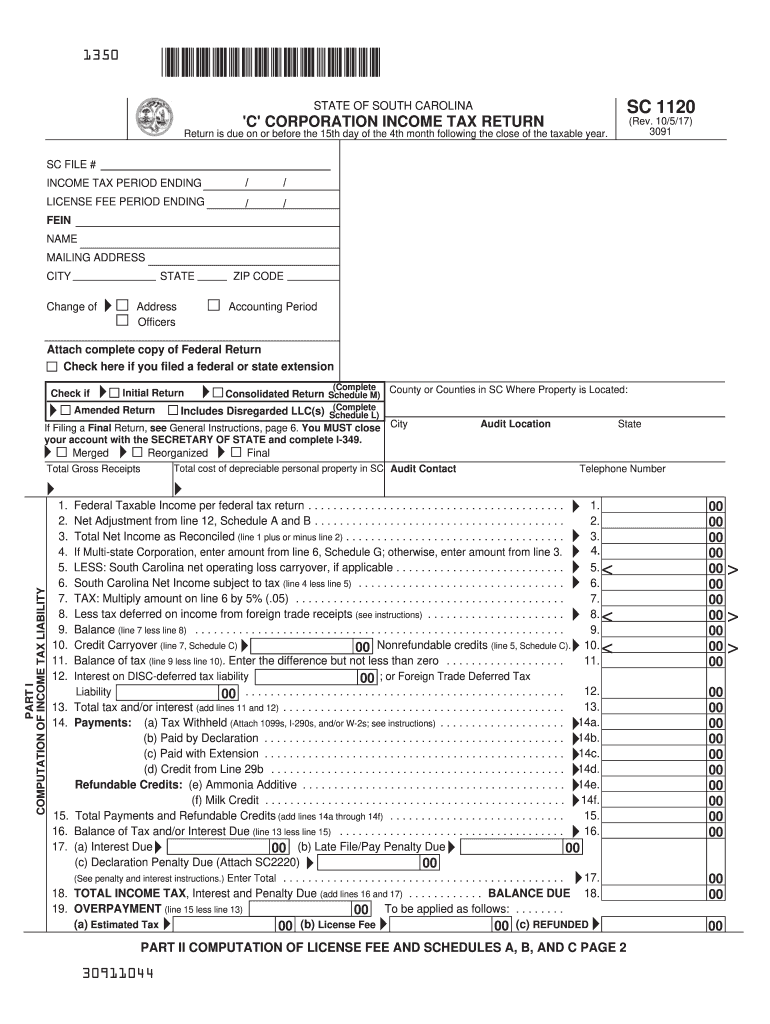

Sc 1120 Form 2020

What is the Sc 1120 Form

The Sc 1120 Form is a tax document specifically designed for S corporations in the United States. This form is used to report the income, deductions, gains, and losses of an S corporation, which is a special type of corporation that meets specific Internal Revenue Service (IRS) requirements. The Sc 1120 Form allows S corporations to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. This means that the income is taxed at the individual level rather than at the corporate level, which can provide tax benefits for shareholders.

How to use the Sc 1120 Form

Using the Sc 1120 Form involves several steps to ensure accurate reporting of your S corporation's financial activities. First, gather all necessary financial records, including income statements, balance sheets, and any relevant deductions. Next, complete the form by entering the required information in the designated sections, such as income, deductions, and credits. It is essential to follow the IRS guidelines closely to avoid errors that could lead to penalties. Once completed, the form must be signed by an authorized officer of the corporation before submission.

Steps to complete the Sc 1120 Form

Completing the Sc 1120 Form requires careful attention to detail. Here are the key steps:

- Gather financial documents, including profit and loss statements and balance sheets.

- Fill in the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income in the appropriate section, including sales and other revenue.

- List all allowable deductions, ensuring to include expenses such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the sections related to tax credits, if applicable.

- Sign and date the form before submission.

Legal use of the Sc 1120 Form

The Sc 1120 Form is legally binding when completed and submitted according to IRS regulations. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies can lead to audits or penalties. The form must be filed annually by S corporations to maintain their tax status and comply with federal tax laws. Failure to file the Sc 1120 Form on time can result in significant penalties, including fines and loss of S corporation status.

Filing Deadlines / Important Dates

Filing the Sc 1120 Form must be done within specific deadlines to avoid penalties. Generally, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. It is advisable to keep track of these important dates to ensure timely filing.

Form Submission Methods

The Sc 1120 Form can be submitted through various methods, providing flexibility for S corporations. The primary methods include:

- Online Submission: Many corporations choose to file electronically through IRS-approved software, which can simplify the process and reduce errors.

- Mail Submission: Corporations can also print the completed form and mail it to the appropriate IRS address. It is important to use certified mail to confirm delivery.

- In-Person Submission: While less common, some corporations may opt to deliver the form directly to an IRS office.

Quick guide on how to complete sc 1120 2015 form 6964516

Complete Sc 1120 Form smoothly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle Sc 1120 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to amend and eSign Sc 1120 Form effortlessly

- Locate Sc 1120 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form: by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Edit and eSign Sc 1120 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 1120 2015 form 6964516

Create this form in 5 minutes!

How to create an eSignature for the sc 1120 2015 form 6964516

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the SC 1120 Form?

The SC 1120 Form is a tax document used by corporations to report income and calculate taxes owed to the state of South Carolina. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations, and airSlate SignNow can help streamline the eSigning process for this document.

-

How can I eSign my SC 1120 Form using airSlate SignNow?

To eSign your SC 1120 Form using airSlate SignNow, simply upload the completed form to our platform, add the necessary signers, and send it for signature. Our intuitive interface makes it easy to manage your documents, ensuring that your SC 1120 Form is signed quickly and securely.

-

What are the pricing options for using airSlate SignNow to manage the SC 1120 Form?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Whether you need a basic plan for individual use or a comprehensive solution for a larger organization processing multiple SC 1120 Forms, we provide cost-effective options that fit your needs.

-

What features does airSlate SignNow offer for handling the SC 1120 Form?

airSlate SignNow provides a variety of features specifically designed to assist with the SC 1120 Form, including document templates, automated reminders for signers, and integration with popular accounting software. These features facilitate efficient completion and management of your documents.

-

Are there any legal benefits to eSigning the SC 1120 Form with airSlate SignNow?

Yes, eSigning your SC 1120 Form with airSlate SignNow offers legal benefits as it complies with electronic signature laws such as ESIGN and UETA. This ensures that your eSigned SC 1120 Form holds up in court and meets all necessary legal standards.

-

Can I integrate airSlate SignNow with other software for SC 1120 Form management?

Absolutely! airSlate SignNow seamlessly integrates with various software, including popular accounting and tax preparation applications, to enhance your SC 1120 Form management process. This integration allows for a more streamlined workflow, reducing the time spent on document handling.

-

What are the benefits of using airSlate SignNow for the SC 1120 Form compared to traditional methods?

Using airSlate SignNow for the SC 1120 Form offers several advantages over traditional paper-based methods, including faster processing times, reduced paperwork, and enhanced security through encryption. Our platform allows for remote signing, which is particularly beneficial in today’s digital-first landscape.

Get more for Sc 1120 Form

- Akc revoke limited registration form

- Acc 5937 authority to act form

- Color code test pdf form

- Business vocabulary in use intermediate pdf form

- Affidavit of parental consent for minor to travel form

- Dodie osteen healing scriptures pdf form

- Ny dtf it 280 fill and sign printable template form

- Publicaciones del irs form

Find out other Sc 1120 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors