SC Revenue Ruling #09 13 South Carolina Department of Revenue 2020

What is the SC Revenue Ruling #09 13 South Carolina Department Of Revenue

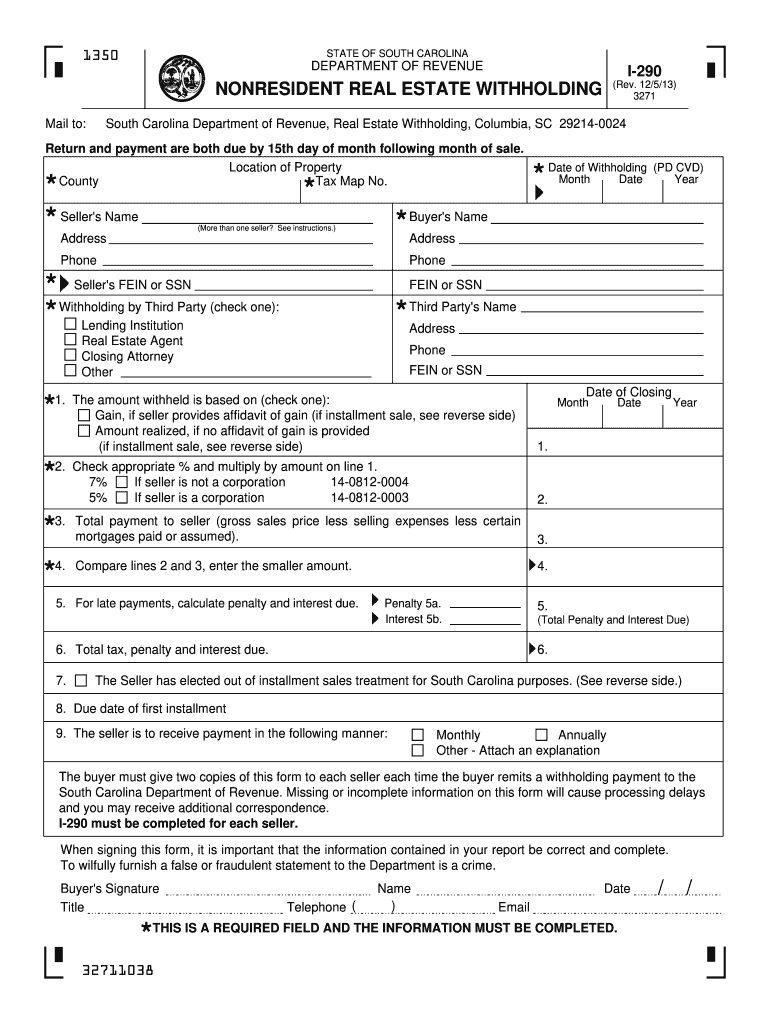

The SC Revenue Ruling #09 13 is an official document issued by the South Carolina Department of Revenue that provides guidance on specific tax-related issues. It clarifies how certain tax laws apply to particular situations, ensuring that taxpayers understand their obligations and rights. This ruling is particularly relevant for businesses and individuals in South Carolina, as it outlines the interpretation of tax regulations that may affect their financial responsibilities.

Steps to complete the SC Revenue Ruling #09 13 South Carolina Department Of Revenue

Completing the SC Revenue Ruling #09 13 involves several clear steps to ensure compliance with state tax laws. First, gather all necessary documentation related to your tax situation, including income statements and any previous tax filings. Next, carefully read the ruling to understand its implications on your tax obligations. Fill out the required forms accurately, ensuring that all information aligns with the guidance provided in the ruling. Finally, review your completed forms for accuracy before submission to avoid any potential issues with the South Carolina Department of Revenue.

Legal use of the SC Revenue Ruling #09 13 South Carolina Department Of Revenue

The legal use of the SC Revenue Ruling #09 13 is essential for ensuring that taxpayers comply with state tax laws. This ruling serves as a legal reference, providing clarity on how specific tax regulations are interpreted by the South Carolina Department of Revenue. By adhering to the guidelines outlined in the ruling, taxpayers can minimize the risk of penalties or disputes with tax authorities. It is advisable to consult with a tax professional if there are uncertainties regarding the application of the ruling to your specific circumstances.

How to obtain the SC Revenue Ruling #09 13 South Carolina Department Of Revenue

To obtain the SC Revenue Ruling #09 13, individuals and businesses can visit the South Carolina Department of Revenue's official website. The ruling is typically available in a downloadable format, allowing users to access the document easily. Additionally, taxpayers may contact the Department directly for any inquiries or clarifications regarding the ruling. Having a copy of this ruling is crucial for understanding its implications on tax filings and compliance.

Key elements of the SC Revenue Ruling #09 13 South Carolina Department Of Revenue

The key elements of the SC Revenue Ruling #09 13 include specific interpretations of tax laws, relevant examples, and guidelines for compliance. The ruling outlines the criteria that must be met for certain tax benefits or obligations, detailing the necessary documentation and procedures. Understanding these elements helps taxpayers navigate their responsibilities and make informed decisions regarding their tax situations.

Examples of using the SC Revenue Ruling #09 13 South Carolina Department Of Revenue

Examples of using the SC Revenue Ruling #09 13 can illustrate how the ruling applies in real-world scenarios. For instance, a business may reference the ruling when determining eligibility for specific tax credits or deductions. Similarly, individuals may use the guidance provided to clarify their tax liabilities. These examples highlight the practical applications of the ruling, reinforcing its importance in tax planning and compliance.

Quick guide on how to complete sc revenue ruling 09 13 south carolina department of revenue

Complete SC Revenue Ruling #09 13 South Carolina Department Of Revenue effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle SC Revenue Ruling #09 13 South Carolina Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign SC Revenue Ruling #09 13 South Carolina Department Of Revenue with ease

- Find SC Revenue Ruling #09 13 South Carolina Department Of Revenue and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Thoroughly review all the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign SC Revenue Ruling #09 13 South Carolina Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc revenue ruling 09 13 south carolina department of revenue

Create this form in 5 minutes!

How to create an eSignature for the sc revenue ruling 09 13 south carolina department of revenue

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the SC Revenue Ruling 09 13 and how does it relate to electronic signatures?

The SC Revenue Ruling 09 13 provides guidance on the acceptability of electronic signatures for certain legal documents in South Carolina. With airSlate SignNow, businesses can comply with this ruling while ensuring that their eSignatures are legally binding and secure. Our platform is designed to help users navigate the complexities of electronic signing under regulations like SC Revenue Ruling 09 13.

-

How does airSlate SignNow ensure compliance with SC Revenue Ruling 09 13?

airSlate SignNow is committed to compliance with all relevant regulations, including SC Revenue Ruling 09 13. We utilize advanced authentication methods and secure audit trails that ensure every signed document maintains its integrity and legal standing in accordance with this ruling. This makes it easy for businesses to adopt electronic signatures with confidence.

-

What features does airSlate SignNow offer to support SC Revenue Ruling 09 13?

Our platform provides a range of features tailored to meet the requirements of SC Revenue Ruling 09 13, including secure document storage, tamper-evident signatures, and detailed audit logs. These features not only enhance security but also provide users with a transparent process for their electronic signature needs. By using airSlate SignNow, you align your document processes with legal standards.

-

Is airSlate SignNow cost-effective for small businesses seeking to adhere to SC Revenue Ruling 09 13?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses that need to comply with SC Revenue Ruling 09 13. Our pricing plans are flexible and affordable, allowing companies to efficiently manage their document signing processes without breaking the bank. Small businesses can enjoy the benefits of legally binding eSignatures while controlling costs.

-

Can airSlate SignNow integrate with other software to comply with SC Revenue Ruling 09 13?

Absolutely! airSlate SignNow offers seamless integrations with various business software applications, ensuring that your document workflows are efficient and compliant with SC Revenue Ruling 09 13. Whether you're using CRM, ERP, or document management systems, our integrations help create a unified experience for document handling and eSigning.

-

What are the benefits of using airSlate SignNow in relation to SC Revenue Ruling 09 13?

Using airSlate SignNow offers numerous benefits regarding SC Revenue Ruling 09 13, such as enhanced security, increased efficiency, and reduced turnaround times on document approvals. Our platform streamlines your eSigning processes while ensuring compliance, allowing your business to focus on core operations without worrying about legal pitfalls. Experience peace of mind knowing your eSignatures meet regulatory standards.

-

How can I get started with airSlate SignNow for SC Revenue Ruling 09 13 compliance?

Getting started with airSlate SignNow for SC Revenue Ruling 09 13 compliance is simple. Sign up for a free trial on our website to explore our features and see how our platform can fit your needs. Our user-friendly dashboard allows you to easily manage documents and eSignatures, ensuring that you comply with all necessary regulations right from the start.

Get more for SC Revenue Ruling #09 13 South Carolina Department Of Revenue

Find out other SC Revenue Ruling #09 13 South Carolina Department Of Revenue

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter