Form ATT 001 1 Comptroller of Maryland 2017

What is the Form ATT 001 1 Comptroller Of Maryland

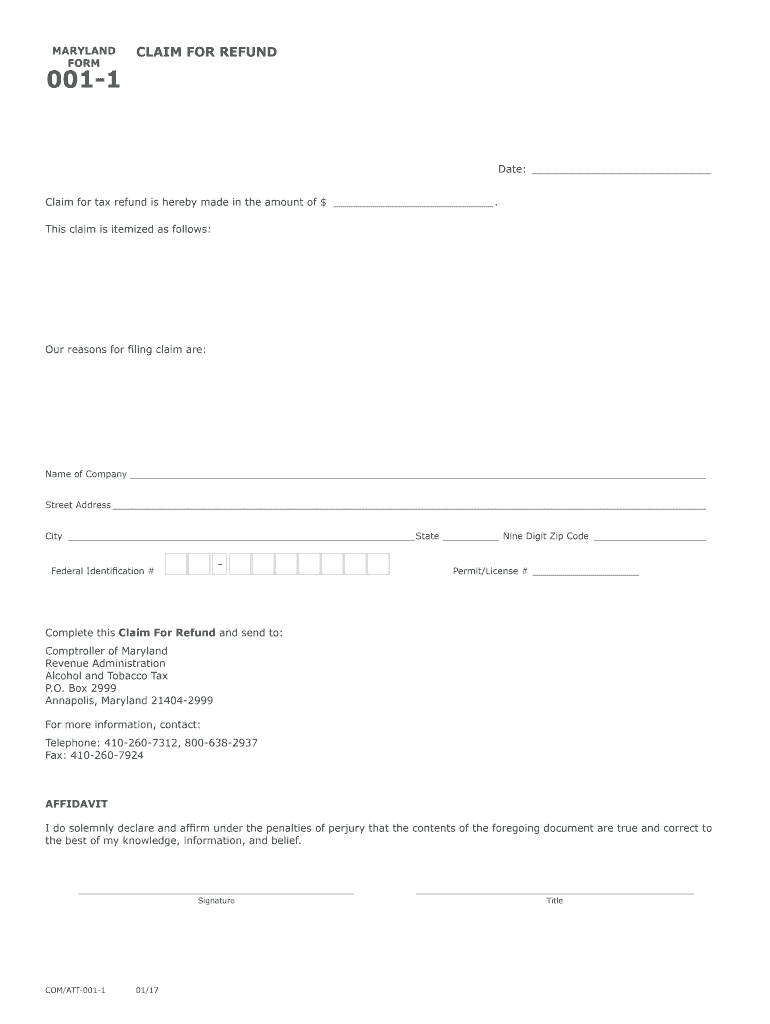

The Form ATT 001 1 is a document issued by the Comptroller of Maryland, primarily used for claiming a refund related to the Maryland comatt program. This form is essential for individuals and businesses seeking to recover overpayments or incorrect charges associated with various state taxes. Understanding the purpose and structure of this form is crucial for ensuring accurate submissions and compliance with state regulations.

Steps to complete the Form ATT 001 1 Comptroller Of Maryland

Completing the Form ATT 001 1 involves several key steps to ensure accurate processing. First, gather all necessary documentation, including proof of payment and any relevant tax records. Next, fill out the form with accurate personal and financial information, ensuring that all sections are completed. After filling out the form, review it for accuracy, and then submit it according to the specified submission methods. Keeping copies of submitted forms and supporting documents is advisable for your records.

Legal use of the Form ATT 001 1 Comptroller Of Maryland

The legal use of the Form ATT 001 1 is governed by Maryland state tax laws. This form must be completed and submitted in accordance with the regulations set forth by the Comptroller's office. Proper use of this form ensures that claims for refunds are processed legally and efficiently. It is essential to adhere to the guidelines provided by the state to avoid potential legal issues or delays in processing your refund claim.

Required Documents

When submitting the Form ATT 001 1, certain documents are required to support your claim. These typically include proof of payment, such as receipts or bank statements, and any relevant tax documents that pertain to the refund being claimed. Ensuring that all necessary documents are included with your submission can help expedite the review process and increase the likelihood of a successful claim.

Form Submission Methods (Online / Mail / In-Person)

The Form ATT 001 1 can be submitted through various methods, depending on your preference and the requirements set by the Comptroller's office. Options typically include online submission through the state’s tax portal, mailing the completed form to the appropriate address, or delivering it in person at designated state offices. Each method may have different processing times, so it is beneficial to choose the one that best fits your needs.

Eligibility Criteria

Eligibility for filing the Form ATT 001 1 is based on specific criteria set by the Comptroller of Maryland. Generally, individuals or businesses that have overpaid taxes or have been incorrectly charged are eligible to submit this form. It is important to review the eligibility requirements to ensure that your claim is valid before proceeding with the submission.

Quick guide on how to complete form att 001 1 comptroller of maryland

Effortlessly prepare Form ATT 001 1 Comptroller Of Maryland on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources required to design, edit, and electronically sign your documents quickly and without interruptions. Handle Form ATT 001 1 Comptroller Of Maryland on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to edit and electronically sign Form ATT 001 1 Comptroller Of Maryland with ease

- Find Form ATT 001 1 Comptroller Of Maryland and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your modifications.

- Select how you want to send your document, via email, SMS, or an invite link, or download it to your computer.

Put an end to lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form ATT 001 1 Comptroller Of Maryland and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form att 001 1 comptroller of maryland

Create this form in 5 minutes!

How to create an eSignature for the form att 001 1 comptroller of maryland

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Maryland Comatt refund process?

The Maryland Comatt refund process involves submitting a request to the state for a refund of certain taxes paid. To initiate this process, ensure that all required documentation is correctly filled out and submitted within the stipulated time frame. Understanding the specifics of the Maryland Comatt refund is crucial for a smooth reimbursement experience.

-

How can airSlate SignNow assist with the Maryland Comatt refund documentation?

airSlate SignNow provides a streamlined way to prepare, sign, and send all necessary documents for your Maryland Comatt refund. Our platform allows you to quickly create templates, ensuring you don’t miss any critical information needed for your submission. This efficiency makes the Maryland Comatt refund process much easier for businesses.

-

Is there a fee associated with requesting a Maryland Comatt refund?

Generally, there are no direct fees for requesting a Maryland Comatt refund from the state. However, using services like airSlate SignNow may involve a subscription cost, which provides you with easy document management tools. This can ultimately save time and reduce hassle during your Maryland Comatt refund process.

-

What features does airSlate SignNow offer for handling refunds?

airSlate SignNow offers features such as templates, eSigning, and document sharing, which can be particularly useful when managing your Maryland Comatt refund. These features allow you to prepare all necessary paperwork digitally and expedite the signature process. With these tools, you can focus on getting your refund quickly and efficiently.

-

Can I track my Maryland Comatt refund request through airSlate SignNow?

While airSlate SignNow does not track the status of your Maryland Comatt refund directly, it enables you to manage your documents seamlessly. You can save copies of your submissions and track their progress through your email confirmations. This organization helps you stay informed on the status of your Maryland Comatt refund.

-

Are there any eligibility requirements for the Maryland Comatt refund?

Yes, specific eligibility requirements must be met to qualify for a Maryland Comatt refund. These vary based on the type of tax and other individual factors. It is beneficial to review these criteria carefully and prepare the required documentation with the help of airSlate SignNow to ensure a successful claim.

-

What is the turnaround time for a Maryland Comatt refund?

The turnaround time for a Maryland Comatt refund can vary, but generally, it takes several weeks for processing. Using airSlate SignNow can expedite your documentation process, potentially shortening your wait time. Be sure to keep track of your submission dates to follow up if necessary.

Get more for Form ATT 001 1 Comptroller Of Maryland

Find out other Form ATT 001 1 Comptroller Of Maryland

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template