North Carolina Personal Services 2018-2026

Understanding the North Carolina Personal Services

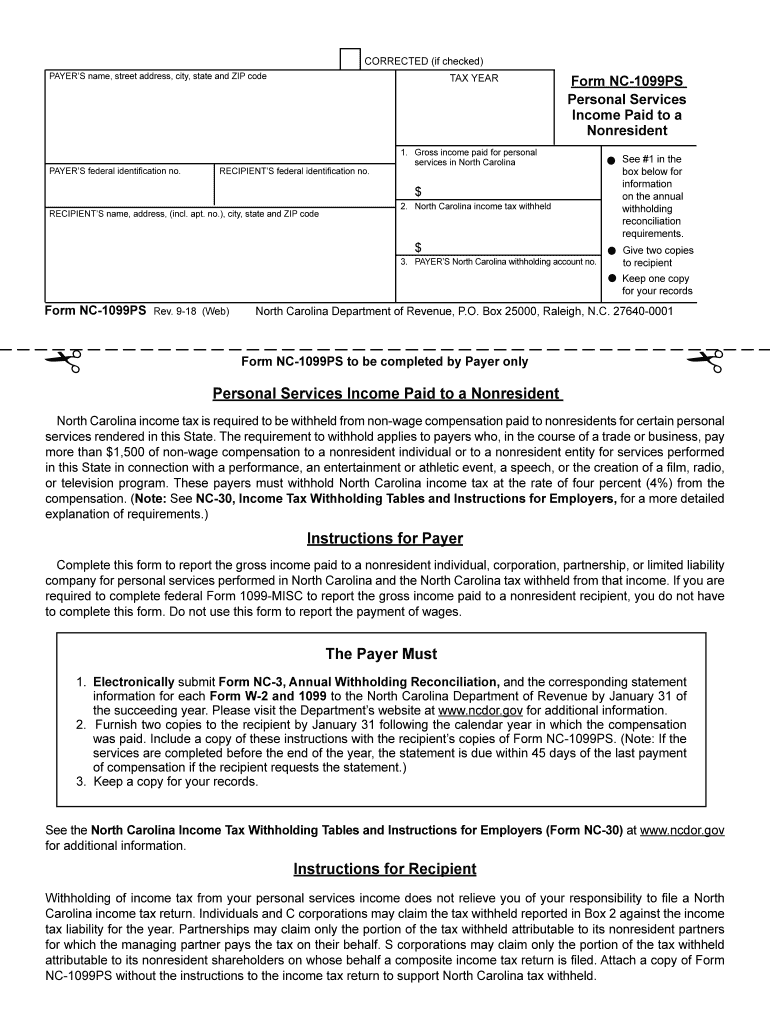

The North Carolina Personal Services form, commonly referred to as the 1099 form NC, is utilized for reporting income paid to non-residents for personal services rendered in the state. This form is essential for ensuring compliance with state tax regulations, as it provides the necessary documentation for individuals and businesses that have paid non-residents for services. It is crucial to accurately fill out this form to avoid potential penalties and ensure proper tax reporting.

Steps to Complete the North Carolina Personal Services Form

Completing the North Carolina Personal Services form involves several key steps:

- Gather Required Information: Collect all necessary details, including the payee's name, address, and Social Security number or Employer Identification Number (EIN).

- Report Income Amount: Clearly state the total amount paid to the non-resident for personal services within North Carolina.

- Fill Out the Form: Accurately complete the 1099 form NC, ensuring all fields are filled out correctly to prevent delays or issues.

- Review for Accuracy: Double-check all entries for accuracy, including numbers and personal information.

- Submit the Form: File the completed form with the North Carolina Department of Revenue by the specified deadline.

Legal Use of the North Carolina Personal Services Form

The legal use of the North Carolina Personal Services form is governed by state tax laws. It is essential that the form is filled out correctly and submitted on time to avoid penalties. This form serves as a formal record of payments made to non-residents and is necessary for both the payer and payee to comply with tax obligations. Failure to use the form properly can result in audits or fines from the North Carolina Department of Revenue.

Filing Deadlines for the North Carolina Personal Services Form

Filing deadlines for the North Carolina Personal Services form are critical for compliance. Typically, the form must be submitted by January thirty-first of the year following the tax year in which the payments were made. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or updates from the state tax authority.

Required Documents for the North Carolina Personal Services Form

When preparing to file the North Carolina Personal Services form, certain documents are essential:

- Payee Information: Social Security number or EIN of the non-resident.

- Payment Records: Documentation of the total payments made for personal services.

- Tax Identification: Any relevant tax identification numbers needed for reporting.

Examples of Using the North Carolina Personal Services Form

Examples of situations where the North Carolina Personal Services form is applicable include:

- Payments made to freelance consultants or contractors who reside outside of North Carolina.

- Compensation for services provided by non-resident entertainers or performers.

- Fees paid to non-resident professionals, such as lawyers or accountants, for services rendered in the state.

Quick guide on how to complete north carolina personal services

Complete North Carolina Personal Services effortlessly on any device

The management of online documents has gained popularity among businesses and individuals alike. It presents an ideal eco-friendly replacement for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your paperwork quickly and without delays. Handle North Carolina Personal Services on any platform using the airSlate SignNow Android or iOS applications and simplify any document-based process today.

The simplest way to modify and eSign North Carolina Personal Services with ease

- Find North Carolina Personal Services and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or mask sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, lengthy form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign North Carolina Personal Services and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north carolina personal services

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is an NC 1099 form and why do I need it?

The NC 1099 form is a state tax document used to report various payments made to non-employees in North Carolina. It is essential for businesses to accurately report these payments to comply with state tax regulations. Using airSlate SignNow can streamline the process of creating and signing your NC 1099 forms, making it easier to manage your reporting needs.

-

How can airSlate SignNow help in preparing NC 1099 forms?

airSlate SignNow offers a user-friendly platform that allows you to easily create, edit, and send NC 1099 forms. With automated templates and secure eSignature capabilities, you can ensure accuracy and save time. This functionality reduces the risk of errors and helps businesses stay compliant with reporting requirements.

-

What features does airSlate SignNow provide for handling NC 1099 forms?

airSlate SignNow provides features such as customizable templates, advanced editing tools, and secure eSignature options specifically for NC 1099 forms. Additionally, you can track the status of your documents and set reminders for follow-ups. These features ensure a smooth workflow for your tax reporting tasks.

-

Is there a cost associated with using airSlate SignNow for NC 1099 forms?

Yes, airSlate SignNow offers various pricing plans tailored to business needs, including options for managing NC 1099 forms efficiently. The pricing is competitive and fair, considering the extensive features provided. Explore our plans to find the best match for your company needs while ensuring a cost-effective solution.

-

Can I integrate airSlate SignNow with other software to manage NC 1099 forms?

Absolutely! airSlate SignNow provides integration capabilities with popular accounting and financial software, enabling you to manage your NC 1099 forms seamlessly. This feature helps consolidate your financial workflow and enhances productivity. Check our integration options to learn how you can simplify your document management process.

-

What are the benefits of using airSlate SignNow for NC 1099 form processing?

Using airSlate SignNow for NC 1099 form processing enhances efficiency, ensures compliance, and improves document security. It allows for faster transactions through electronic signatures and reduces paperwork clutter. These benefits provide businesses with peace of mind while handling important tax documents.

-

How secure is my information when using airSlate SignNow for NC 1099 forms?

airSlate SignNow prioritizes data security, ensuring that your NC 1099 forms and sensitive information are protected with advanced encryption and compliance with industry standards. Our secure platform provides peace of mind while processing your important documents. You can focus on your business without worrying about data bsignNowes or unauthorized access.

Get more for North Carolina Personal Services

Find out other North Carolina Personal Services

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement