Form 592 2021

What is the Form 592

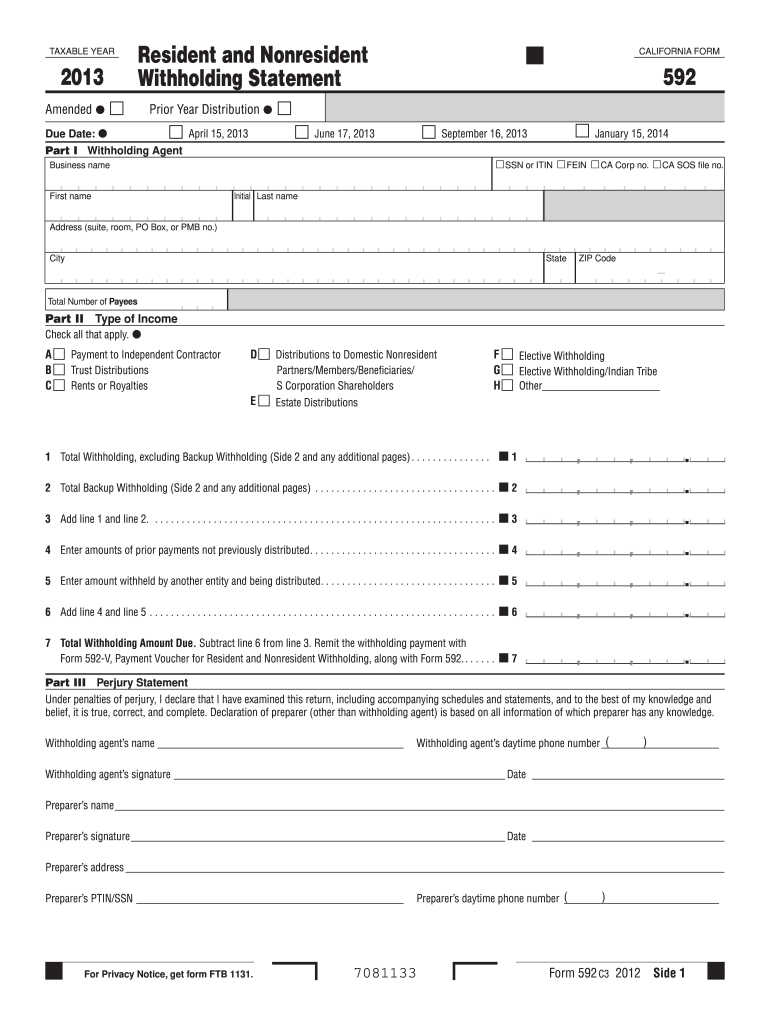

The Form 592 is a California tax form used to report income received by non-residents and to calculate the withholding tax on that income. It is primarily utilized by businesses and individuals who engage in transactions with non-residents, ensuring compliance with state tax regulations. This form serves as a crucial document for tax reporting purposes, helping to determine the correct amount of tax that needs to be withheld from payments made to non-residents.

How to use the Form 592

Using the Form 592 involves several steps to ensure accurate reporting and compliance with tax obligations. First, gather all relevant information regarding payments made to non-residents. This includes details about the recipient, the nature of the payment, and the total amount. Next, complete the form by providing the required information, including the payer's details and the amount subject to withholding. Finally, submit the completed form to the California Franchise Tax Board along with any required payment for withholding tax.

Steps to complete the Form 592

Completing the Form 592 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 592 from the California Franchise Tax Board's website.

- Fill in the payer's information, including name, address, and taxpayer identification number.

- Provide details about the non-resident recipient, including their name, address, and identification number.

- Report the total amount paid to the non-resident and calculate the withholding amount based on the applicable tax rate.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 592

The Form 592 must be used in accordance with California tax laws to ensure its legal validity. It is essential for the payer to accurately report payments and withhold the correct amount of tax to avoid penalties. The form is legally binding when completed correctly and submitted on time. Non-compliance with the requirements may result in fines or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 are crucial for compliance. Typically, the form must be submitted by the due date of the tax return for the year in which the payments were made. It is important to keep track of specific deadlines, as late submissions can incur penalties. Always check the California Franchise Tax Board's official guidelines for the most current deadlines and any changes that may occur.

Required Documents

To complete the Form 592, certain documents are necessary. These may include:

- Records of payments made to non-residents.

- Taxpayer identification numbers for both the payer and the non-resident recipient.

- Any relevant contracts or agreements that outline the nature of the payments.

Having these documents ready will facilitate a smoother completion of the form and help ensure accuracy in reporting.

Quick guide on how to complete 2013 form 592

Complete Form 592 seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 592 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 592 with ease

- Find Form 592 and click Get Form to begin.

- Utilize the tools we supply to complete your document.

- Emphasize important sections of your documents or hide sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and hit the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Leave behind concerns about lost or misplaced documents, sluggish form navigation, or errors that necessitate printing new copies. airSlate SignNow manages your document administration needs with just a few clicks from any device of your choice. Modify and eSign Form 592 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 592

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 592

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is Form 592 and why is it important?

Form 592 is a California tax form used to report income paid to non-residents. It is essential for ensuring compliance with state tax regulations. Filing Form 592 accurately helps avoid penalties and ensures proper withholding of taxes on payments to non-residents.

-

How can airSlate SignNow help with completing Form 592?

airSlate SignNow simplifies the process of completing Form 592 by providing a user-friendly interface for eSigning and document management. You can easily create, fill, and send the form electronically, speeding up your workflow and reducing the possibility of errors. Additionally, the platform ensures that your documents are secure and legally binding.

-

What features does airSlate SignNow offer for managing Form 592?

With airSlate SignNow, you can access features specifically tailored for Form 592 management, including customizable templates, automated reminders, and in-app eSignature capabilities. These features help streamline the entire process from document creation to final signatures, ensuring efficiency in managing your tax forms.

-

Is there a cost associated with using airSlate SignNow for Form 592?

Yes, airSlate SignNow offers various pricing plans, providing users with flexibility based on their needs. The plans include features to manage Form 592 and other documents efficiently. It’s worth exploring the different options to find one that suits your business requirements and budget.

-

Can I integrate airSlate SignNow with other tools for Form 592 processing?

Absolutely! airSlate SignNow supports integration with various third-party applications, enhancing your workflow for processing Form 592. Whether you use CRM systems, cloud storage solutions, or accounting software, these integrations allow for a seamless experience and improved document management.

-

How secure is my data when using airSlate SignNow for Form 592?

Security is a top priority for airSlate SignNow. When you use the platform to manage Form 592, your data is protected by end-to-end encryption and secure cloud storage. The platform also complies with industry-standard regulations, ensuring that your sensitive information remains safe and confidential.

-

Can I track the status of my Form 592 documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents, including Form 592. You can monitor when the document is viewed, signed, or completed, allowing you to stay updated on its progress. This transparency enhances your workflow and helps you stay organized.

Get more for Form 592

Find out other Form 592

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now