Form 541 2019

What is the Form 541

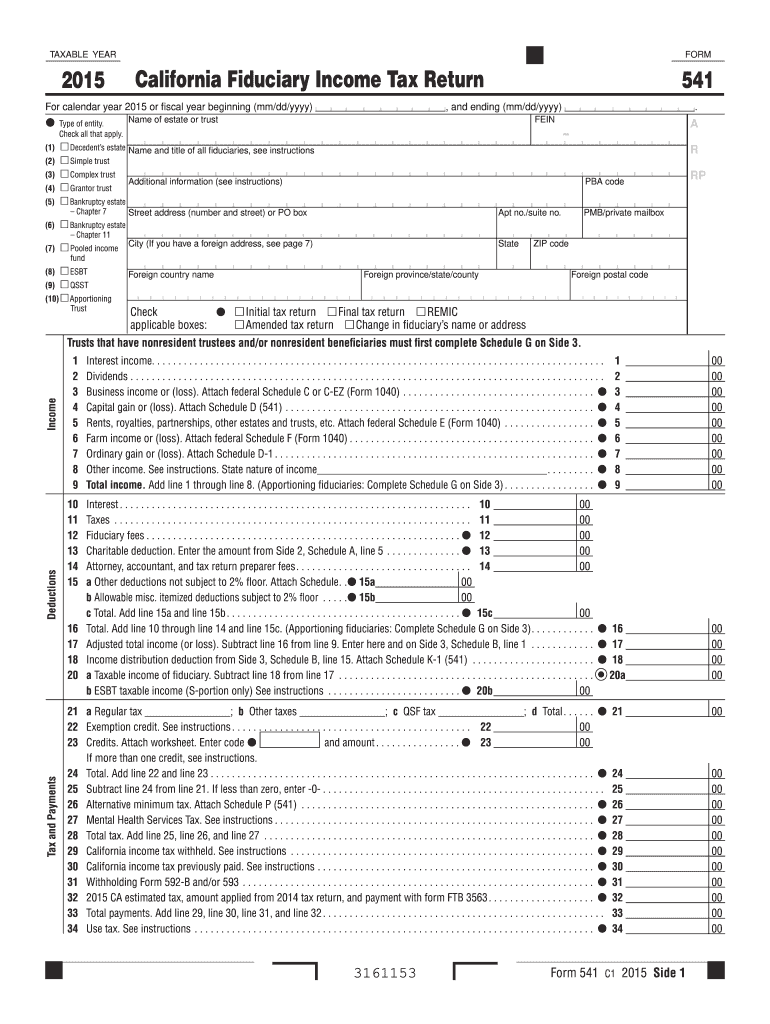

The Form 541 is a tax return specifically designed for fiduciaries in the United States. It is used to report income, deductions, and credits for estates and trusts. This form is crucial for ensuring that the tax obligations of the estate or trust are met, and it helps in the accurate distribution of income to beneficiaries. Understanding the purpose and requirements of Form 541 is essential for fiduciaries managing these entities.

How to use the Form 541

Using Form 541 involves several steps to ensure compliance with IRS regulations. First, gather all necessary financial information related to the estate or trust, including income, expenses, and distributions to beneficiaries. Next, fill out the form accurately, ensuring that all sections are completed as required. Once the form is filled, it must be submitted to the IRS along with any necessary supporting documents. It is important to keep copies of the submitted form for your records.

Steps to complete the Form 541

Completing Form 541 requires careful attention to detail. Follow these steps for successful completion:

- Gather financial records, including income statements and expense receipts.

- Fill in the fiduciary information, including the name and address of the estate or trust.

- Report all income received during the tax year, including dividends, interest, and rental income.

- Deduct allowable expenses, such as administrative costs and taxes paid.

- Calculate the taxable income and determine the tax liability.

- Complete the signature section, ensuring the fiduciary signs and dates the form.

Legal use of the Form 541

The legal use of Form 541 is governed by IRS regulations. It must be filed by the fiduciary responsible for managing the estate or trust. The form must be completed accurately to reflect the financial activities of the estate or trust during the tax year. Failure to file or inaccuracies can lead to penalties, making it essential for fiduciaries to understand their legal obligations regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for Form 541 are critical for compliance. Generally, the form is due on the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to file early to avoid any last-minute issues.

Form Submission Methods (Online / Mail / In-Person)

Form 541 can be submitted through various methods, providing flexibility for fiduciaries. The form can be filed electronically using IRS-approved e-filing software, which is a convenient option that allows for quicker processing. Alternatively, the form can be mailed to the appropriate IRS address based on the fiduciary's location. In-person submission is generally not available for this form, as the IRS primarily processes returns through mail or electronic means.

Quick guide on how to complete form 541 2015

Effortlessly Prepare Form 541 on Any Device

Online document management has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Form 541 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign Form 541 with Ease

- Locate Form 541 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 541 while ensuring seamless communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 541 2015

Create this form in 5 minutes!

How to create an eSignature for the form 541 2015

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 541 and how can airSlate SignNow help with it?

Form 541 is the California Trust's tax return, and airSlate SignNow streamlines the process of signing and sending this crucial document. With our platform, you can easily eSign Form 541, ensuring a secure and efficient submission. Additionally, our user-friendly interface simplifies the workflow, making it accessible for businesses of all sizes.

-

Is airSlate SignNow a cost-effective solution for managing Form 541?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 541 and other documents. Our pricing plans are designed to fit different business needs, ensuring you get the best value without compromising on features. This allows organizations to save both time and money when handling important legal forms.

-

What features does airSlate SignNow offer for signing Form 541?

airSlate SignNow includes features like eSignature collection, document templates, and secure cloud storage, which are essential for managing Form 541. Our platform also supports bulk sending, allowing you to quickly distribute the form to multiple signers. Additionally, real-time tracking ensures you never lose sight of your document's status.

-

Can I integrate airSlate SignNow with other tools for Form 541 management?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications to enhance your workflow for Form 541. Whether you use CRM systems, cloud storage, or project management tools, our platform can help you streamline the signing process and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for Form 541?

Using airSlate SignNow for Form 541 offers numerous benefits, including faster turnaround times and improved compliance. Our secure eSigning capabilities ensure that your important documents are legally binding and stored safely. Furthermore, you can revisit and manage past Form 541 submissions effortlessly through our intuitive interface.

-

Is there customer support available for queries regarding Form 541?

Yes, airSlate SignNow provides dedicated customer support for any queries related to Form 541. Our team is available to assist you with any challenges you might face while eSigning or sending your documents. We also offer a comprehensive knowledge base with FAQs and guides for additional self-help resources.

-

How secure is airSlate SignNow when handling Form 541?

airSlate SignNow prioritizes the security of your documents, including Form 541, using industry-leading encryption protocols. Our platform complies with various security standards to ensure that your sensitive information remains safe. With features like two-factor authentication, you can trust that your eSigned documents are well-protected.

Get more for Form 541

Find out other Form 541

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo