Maryland Tax Form 2019

What is the Maryland Tax Form

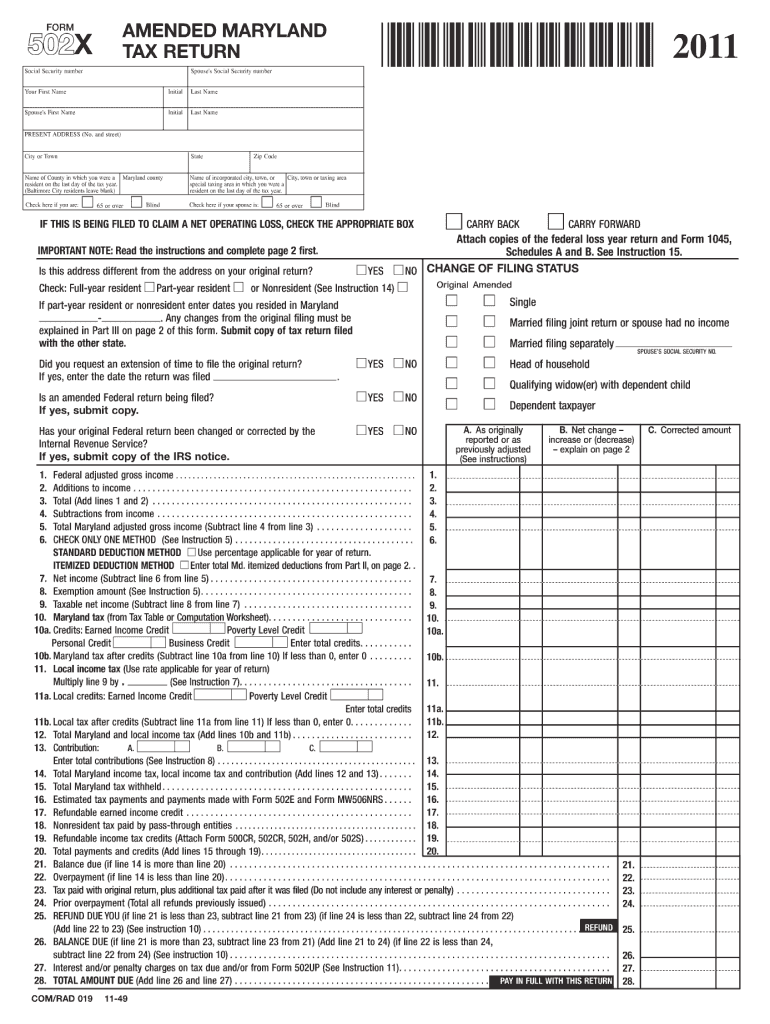

The Maryland Tax Form is an essential document used by residents and businesses in Maryland to report income, calculate tax liabilities, and claim deductions or credits. This form is crucial for ensuring compliance with state tax laws and regulations. Depending on the taxpayer's situation, various versions of the Maryland Tax Form may be applicable, including those for individual income tax, corporate tax, and sales tax. Each form serves a specific purpose and must be completed accurately to avoid penalties.

How to use the Maryland Tax Form

Using the Maryland Tax Form involves several steps to ensure accurate completion and submission. Taxpayers should first identify the correct version of the form that applies to their situation. After obtaining the form, individuals should gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Once the form is filled out, it must be reviewed for accuracy before submission. Taxpayers can file the form electronically or via mail, depending on their preference and the specific requirements of the form.

Steps to complete the Maryland Tax Form

Completing the Maryland Tax Form requires careful attention to detail. Here are the general steps to follow:

- Identify the appropriate form based on your tax situation.

- Gather all necessary documentation, including income statements and deduction records.

- Fill out the form accurately, ensuring all sections are completed as required.

- Double-check calculations to avoid errors that could lead to penalties.

- Sign and date the form, as required.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the Maryland Tax Form

The Maryland Tax Form is legally binding once completed and submitted according to state regulations. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Maryland Comptroller's Office. This includes using the correct form for the tax year, providing accurate information, and signing the form where required. Failure to comply with these legal requirements can result in penalties, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Tax Form vary based on the type of tax being reported. Typically, individual income tax returns are due by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to stay informed of any changes to deadlines and to plan accordingly to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Maryland have several options for submitting their tax forms. The Maryland Tax Form can be filed online through the Maryland Comptroller's website, which provides a secure and efficient way to submit documents. Alternatively, taxpayers may choose to mail their forms to the appropriate address listed on the form instructions. In-person submissions are also accepted at designated locations, allowing for direct interaction with tax officials if needed.

Key elements of the Maryland Tax Form

The Maryland Tax Form includes several key elements that must be accurately completed. These elements typically consist of:

- Taxpayer identification information, including name, address, and Social Security number.

- Income details, including wages, interest, and other sources of income.

- Deductions and credits that the taxpayer is eligible to claim.

- Calculations of total tax liability and any payments made.

- Signature and date fields to validate the submission.

Quick guide on how to complete 2011 maryland tax form

Easily Prepare Maryland Tax Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Maryland Tax Form across any platform using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

Edit and eSign Maryland Tax Form Effortlessly

- Access Maryland Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your edits.

- Choose your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Maryland Tax Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 maryland tax form

Create this form in 5 minutes!

How to create an eSignature for the 2011 maryland tax form

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is a Maryland Tax Form and why is it important?

A Maryland Tax Form is a document required by the state for various tax purposes, including income tax returns. It's crucial for ensuring compliance with state tax regulations. Submitting the correct Maryland Tax Form helps avoid penalties and ensures accurate processing of your tax liabilities.

-

How can airSlate SignNow help with Maryland Tax Form documents?

airSlate SignNow streamlines the process of preparing and signing your Maryland Tax Form. With our eSignature solution, you can easily send documents for signature, reducing the time spent on paperwork. Our platform is designed to make tax form management quick, secure, and efficient.

-

What features does airSlate SignNow offer for handling Maryland Tax Forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for your Maryland Tax Form. You can also store your forms in a centralized location, making it easy to access and manage essential documents. These features enhance efficiency and organization during tax season.

-

Are there any costs associated with using airSlate SignNow for Maryland Tax Forms?

Yes, airSlate SignNow offers various pricing plans to suit your needs. Costs may vary depending on the number of users and features you require for managing your Maryland Tax Form. Each plan is designed to provide value, making it a cost-effective solution for businesses.

-

Can I integrate airSlate SignNow with other tools for my Maryland Tax Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as cloud storage services and accounting software. This allows for easy management and automatic updates to your Maryland Tax Form, ensuring you have all your documents in one place.

-

What are the benefits of using airSlate SignNow for my Maryland Tax Form?

Using airSlate SignNow for your Maryland Tax Form offers numerous benefits, including faster processing times and improved security. You can ensure your documents are signed quickly and stored safely in the cloud. Additionally, our user-friendly interface makes it easy for anyone to navigate and complete the signing process.

-

Is airSlate SignNow compliant with Maryland state regulations for tax forms?

Yes, airSlate SignNow is compliant with all relevant legal requirements for e-signatures, including those applicable to Maryland Tax Forms. Our platform adheres to industry standards to ensure that your signed documents are legally binding and enforceable. This compliance gives you peace of mind when sending and signing tax-related documents.

Get more for Maryland Tax Form

- Meezan remittance form

- Virginia residential property disclosure form

- Court transcript template form

- Blue badge renewal northamptonshire form

- Mileage reimbursement form

- Keller williams independent contractor agreement form

- Primary school leave absence form

- Carolina spine amp neurosurgery center carolina spine and form

Find out other Maryland Tax Form

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online