Form 706me 2020

What is the Form 706me

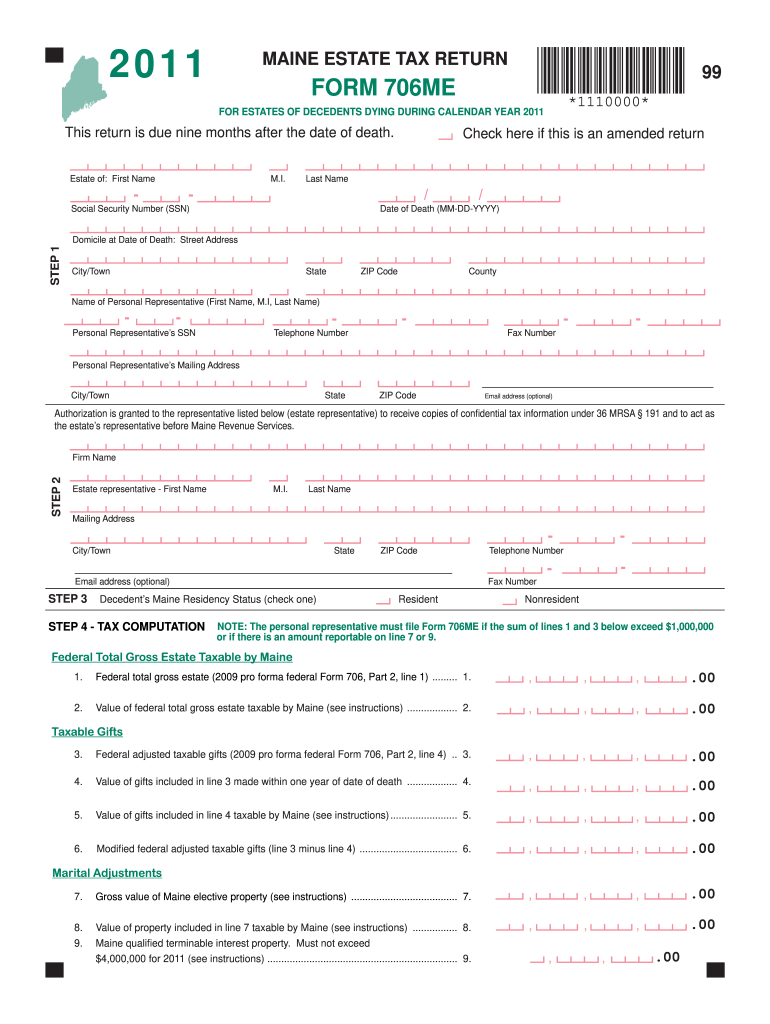

The Form 706me is a specific tax form used in the United States for estate tax purposes. This form is essential for reporting the estate of a deceased individual, particularly when the gross estate exceeds a certain threshold. The 706me form allows executors to calculate the estate tax owed and ensure compliance with federal tax laws. Understanding the purpose of this form is crucial for anyone managing an estate, as it helps in determining the tax liabilities that may arise from the transfer of assets after death.

How to use the Form 706me

Using the Form 706me involves several steps to ensure accurate reporting of the estate's value and tax obligations. Executors must gather all necessary financial information about the deceased's assets, liabilities, and any applicable deductions. After compiling this information, they can fill out the form, detailing the value of the estate and calculating the tax due. It is important to follow the instructions carefully and ensure that all required sections are completed to avoid delays or issues with the IRS.

Steps to complete the Form 706me

Completing the Form 706me involves a systematic approach:

- Gather all relevant financial documents, including bank statements, property deeds, and investment records.

- Determine the gross value of the estate by adding up all assets.

- Identify any debts or liabilities that can be deducted from the gross estate.

- Calculate the taxable estate by subtracting allowable deductions from the gross estate.

- Fill out the Form 706me accurately, ensuring all information is correct and complete.

- Review the form for accuracy and compliance with IRS guidelines before submission.

Legal use of the Form 706me

The Form 706me must be used in accordance with federal regulations to ensure its legal validity. This includes adhering to the guidelines set forth by the IRS regarding filing deadlines, signature requirements, and the inclusion of supporting documentation. Executors should be aware that improper use or failure to file the form can result in penalties or legal repercussions. Therefore, understanding the legal framework surrounding this form is essential for proper estate management.

Filing Deadlines / Important Dates

Filing deadlines for the Form 706me are critical for compliance with tax regulations. Generally, the form must be filed within nine months of the date of death of the individual whose estate is being reported. However, an extension may be requested, allowing for an additional six months to file. It is important for executors to keep track of these dates to avoid late fees or penalties associated with non-compliance.

Required Documents

To complete the Form 706me, several documents are required to substantiate the information reported. These documents typically include:

- Death certificate of the deceased.

- Financial statements detailing all assets and liabilities.

- Appraisals for real estate and valuable personal property.

- Documents related to any debts owed by the deceased.

- Records of any previous gift tax returns filed.

Form Submission Methods (Online / Mail / In-Person)

The Form 706me can be submitted through various methods, depending on the preference of the executor and the requirements of the IRS. The form can be mailed directly to the appropriate IRS address, ensuring that it is sent within the established deadlines. Additionally, executors may have the option to file electronically, which can streamline the process and provide immediate confirmation of receipt. It is advisable to check the IRS guidelines for the most current submission methods available.

Quick guide on how to complete form 706me 2011

Effortlessly Prepare Form 706me on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 706me on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Alter and eSign Form 706me Without Effort

- Locate Form 706me and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal significance as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 706me and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 706me 2011

Create this form in 5 minutes!

How to create an eSignature for the form 706me 2011

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is Form 706me and why is it important?

Form 706me is a crucial document used for estate tax purposes. It provides a detailed account of a deceased individual's assets to determine if estate taxes are owed. Understanding how to properly complete Form 706me can save your estate from potential legal issues and ensure compliance with tax laws.

-

How does airSlate SignNow simplify the process of completing Form 706me?

airSlate SignNow simplifies completing Form 706me by providing an intuitive interface for electronic signatures and document management. This cloud-based solution allows you to easily create, edit, and securely send the form, ensuring that all parties can collaborate efficiently without the need for physical paperwork.

-

What are the pricing options for using airSlate SignNow for Form 706me?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Whether you're a solo estate planner or part of a large firm, you can choose a plan that fits your budget while efficiently managing Form 706me completions and electronic signatures.

-

Can I integrate airSlate SignNow with other tools while working on Form 706me?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications, allowing you to work on Form 706me without disrupting your workflow. Whether you're using CRM systems or cloud storage services, you can streamline your processes and enhance productivity.

-

What are the key features of airSlate SignNow for managing Form 706me?

Key features of airSlate SignNow for managing Form 706me include advanced document editing tools, customizable templates, and robust security measures. These features ensure that your information is protected while making it easy to modify and send the necessary documents to eSign.

-

Is airSlate SignNow secure for submitting Form 706me?

Absolutely! airSlate SignNow employs top-notch security protocols to safeguard your data when submitting Form 706me. With encryption, secure server infrastructure, and compliance with data protection laws, you can feel confident that your sensitive information is safe.

-

How do I get started with airSlate SignNow for Form 706me?

Getting started with airSlate SignNow for Form 706me is quick and easy. Simply sign up for an account, explore the templates available, and start drafting your form. The user-friendly platform makes it easy to eSign and send the document directly where it needs to go.

Get more for Form 706me

Find out other Form 706me

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document