About Form 8453 EMP, Declaration for Employment Tax 2023

Understanding Form 8453 EMP, Declaration For Employment Tax

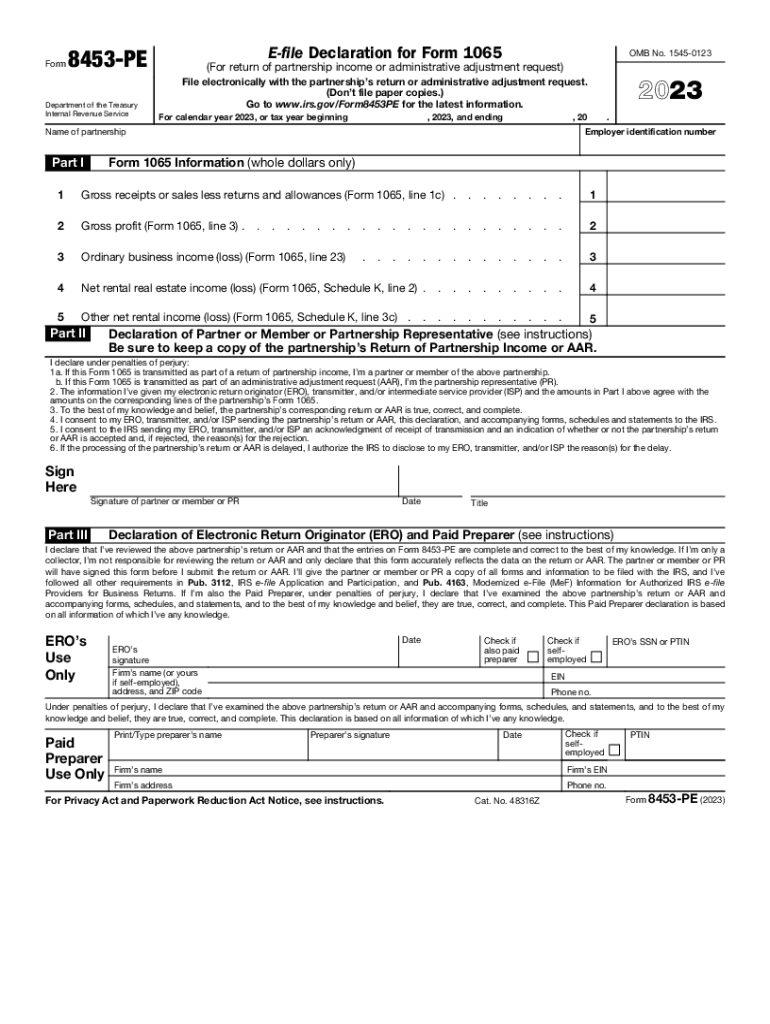

The 2023 Internal Revenue Service Form 8453 EMP serves as a declaration for employment tax. This form is essential for employers who need to file employment tax returns electronically. By signing this form, employers affirm that the information provided in their electronic employment tax returns is accurate and complete. This form is particularly important for ensuring compliance with IRS regulations and for maintaining proper records of employment tax filings.

Steps to Complete Form 8453 EMP

Completing the 2023 Internal Revenue Service Form 8453 EMP involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and details about your employment tax obligations.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for any errors or omissions.

- Sign the form electronically, confirming that the information is true and accurate.

- Submit the form along with your electronic employment tax return.

How to Obtain Form 8453 EMP

The 2023 Internal Revenue Service Form 8453 EMP can be obtained directly from the IRS website or through authorized tax software providers. It is important to ensure that you are using the most current version of the form to comply with IRS requirements. Most tax preparation software will include this form as part of the employment tax filing process, making it easier for employers to complete and submit their returns.

Filing Deadlines and Important Dates

Employers must be aware of the filing deadlines associated with the 2023 Internal Revenue Service Form 8453 EMP. Typically, employment tax returns must be filed quarterly, with specific due dates for each quarter. It is crucial to submit the form and any associated tax returns by these deadlines to avoid penalties and interest charges. For the most accurate dates, refer to the IRS calendar or consult a tax professional.

Legal Use of Form 8453 EMP

The legal use of the 2023 Internal Revenue Service Form 8453 EMP is vital for employers to comply with federal employment tax laws. This form ensures that all electronic filings are properly authorized and that the information submitted is legally binding. Employers must retain copies of this form as part of their tax records, as it may be requested during audits or reviews by the IRS.

Penalties for Non-Compliance

Failure to properly file the 2023 Internal Revenue Service Form 8453 EMP can result in significant penalties. Employers may face fines for late submissions or inaccuracies in their employment tax filings. Additionally, non-compliance can lead to increased scrutiny from the IRS, potentially resulting in audits or further legal action. It is essential for employers to understand these risks and ensure timely and accurate submissions.

Quick guide on how to complete about form 8453 emp declaration for employment tax

Complete About Form 8453 EMP, Declaration For Employment Tax effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the resources needed to generate, alter, and eSign your documents swiftly without delays. Manage About Form 8453 EMP, Declaration For Employment Tax on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The most effective way to edit and eSign About Form 8453 EMP, Declaration For Employment Tax with ease

- Find About Form 8453 EMP, Declaration For Employment Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—by email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign About Form 8453 EMP, Declaration For Employment Tax while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8453 emp declaration for employment tax

Create this form in 5 minutes!

How to create an eSignature for the about form 8453 emp declaration for employment tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 internal revenue service form and how does airSlate SignNow help with it?

The 2023 internal revenue service form is a necessary document for tax submissions this year. AirSlate SignNow makes it easy to prepare, send, and eSign these forms securely, ensuring compliance and accuracy for your tax filings.

-

Is there a cost associated with using airSlate SignNow for 2023 internal revenue service forms?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs. You can choose a plan that allows you to efficiently manage and eSign your 2023 internal revenue service forms at an affordable rate.

-

What features does airSlate SignNow offer for managing 2023 internal revenue service forms?

AirSlate SignNow offers features like customizable templates, bulk sending, and audit trails to manage your 2023 internal revenue service forms efficiently. These features streamline the signing process and enhance document management.

-

How can airSlate SignNow enhance the eSigning process for the 2023 internal revenue service form?

AirSlate SignNow simplifies the eSigning process for the 2023 internal revenue service form by providing a user-friendly interface. This ensures that signatures are captured quickly and securely, reducing delays in your tax submission.

-

Are there integrations available with airSlate SignNow for the 2023 internal revenue service forms?

Absolutely! AirSlate SignNow integrates with various third-party applications, making it seamless to link your financial software and enhance your workflow for managing the 2023 internal revenue service forms.

-

What are the benefits of using airSlate SignNow for 2023 internal revenue service form management?

Using airSlate SignNow for 2023 internal revenue service form management provides increased efficiency, security, and compliance. You can easily track submissions and ensure that all necessary signatures are obtained promptly.

-

Can I customize the 2023 internal revenue service form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your 2023 internal revenue service forms to meet specific requirements. This flexibility helps you tailor documents according to your business's needs.

Get more for About Form 8453 EMP, Declaration For Employment Tax

- Usm tuition remission form morgan

- Cv addendum form mssm

- Muskingum teaching environment class information form

- Transcript request form pdf oakland university oakland

- Printable fillable tax exempt form ohio

- Concurrent enrolment form

- Oklahoma baptist university transcript request form

- Counselling forms online

Find out other About Form 8453 EMP, Declaration For Employment Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors