M1 Form 2020

What is the M1 Form

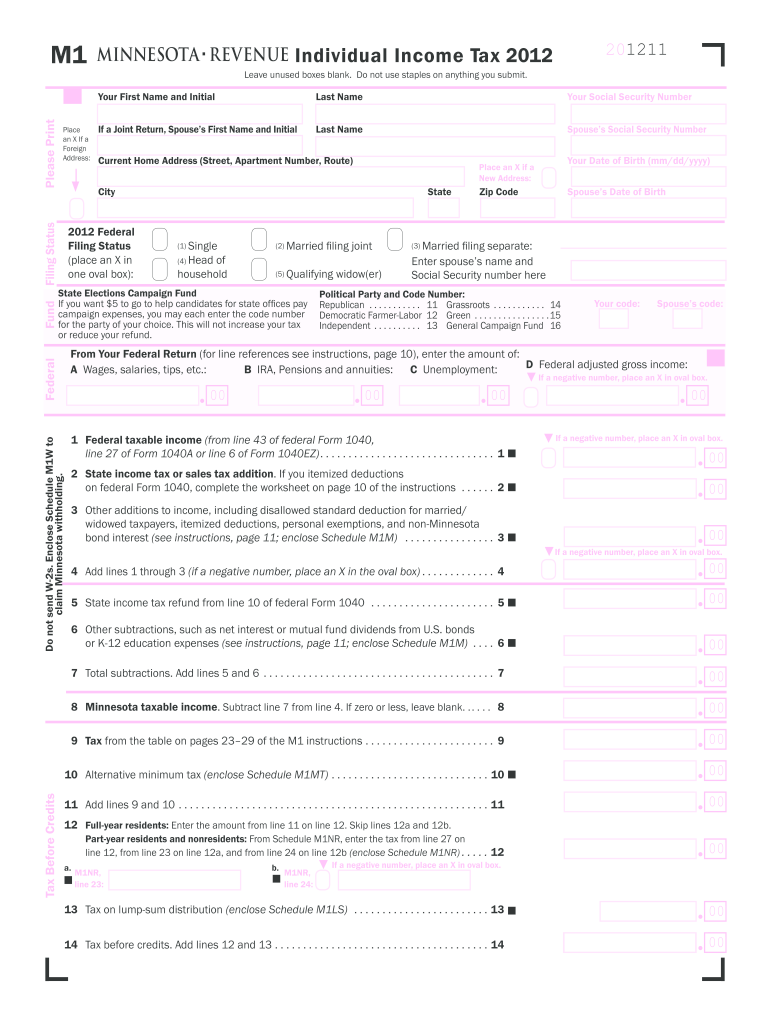

The M1 Form is a state income tax return used by residents of Minnesota to report their income and calculate their tax liability. This form is essential for individuals and couples who earn income in Minnesota, allowing them to claim deductions, credits, and report various types of income. The M1 Form is designed to ensure compliance with Minnesota tax laws and is a critical component of the state's tax system.

How to use the M1 Form

Using the M1 Form involves several steps to accurately report your income and determine your tax obligations. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. After completing the form, review it for accuracy before submitting it to the Minnesota Department of Revenue, either electronically or by mail.

Steps to complete the M1 Form

Completing the M1 Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income from all sources.

- Claim any deductions and credits you are eligible for.

- Calculate your total tax liability.

- Sign and date the form before submission.

Legal use of the M1 Form

The M1 Form must be used in accordance with Minnesota tax laws to ensure its legal validity. It is important to provide accurate information and comply with all requirements outlined by the Minnesota Department of Revenue. Failure to do so may result in penalties or legal repercussions. The form is recognized as a legitimate document for tax reporting purposes, provided that it is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the M1 Form are crucial for taxpayers to avoid penalties. Typically, the deadline for submitting the M1 Form is April 15 of each year, coinciding with the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes in tax laws or deadlines that may affect your filing.

Required Documents

To complete the M1 Form, certain documents are necessary. These include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits claimed.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The M1 Form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the Minnesota Department of Revenue's e-filing system, which is often the fastest option. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions are also accepted at designated tax offices, although this option may be less common.

Quick guide on how to complete 2012 m1 form

Effortlessly Prepare M1 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly substitute for conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without unnecessary delays. Manage M1 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign M1 Form with Ease

- Find M1 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and select the Done button to save your modifications.

- Decide how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign M1 Form while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 m1 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 m1 form

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the M1 Form and why is it important?

The M1 Form is a crucial document used for reporting income and deductions to the state. It helps businesses and individuals accurately assess their tax obligations, making compliance easier. By using the M1 Form, you ensure that you are submitting the correct information required by tax authorities.

-

How can airSlate SignNow help with the M1 Form?

airSlate SignNow provides a streamlined process for creating, signing, and managing your M1 Form electronically. This eliminates the need for paper documents and speeds up the submission process. With our platform, you can have your M1 Form ready for eSignature in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for the M1 Form?

Yes, while airSlate SignNow offers a free trial, there is a subscription cost for continued access to all features, including managing your M1 Form. Our pricing is designed to be competitive and provides excellent value for the tools available. Consider the time and cost savings when using our platform for document management.

-

What features make airSlate SignNow suitable for the M1 Form?

Key features of airSlate SignNow include customizable templates, eSignature capabilities, and seamless document tracking. These tools streamline the preparation and submission of your M1 Form. Additionally, our user-friendly interface ensures you can complete the process efficiently.

-

Can I integrate airSlate SignNow with other software for my M1 Form needs?

Absolutely! airSlate SignNow can be integrated with various business applications and software, making it easy to manage your M1 Form alongside other processes. This integration capability enhances your workflow, allowing you to sync data and share documents between platforms seamlessly.

-

What benefits can I expect from using airSlate SignNow for my M1 Form?

Using airSlate SignNow for your M1 Form offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our platform allows for quick eSigning and document sharing, which saves time and minimizes errors. These advantages can lead to faster processing of your tax documents.

-

Is the M1 Form secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication methods to ensure your M1 Form and other documents are safe from unauthorized access. This commitment to security allows you to focus on your business with peace of mind.

Get more for M1 Form

- Pompano beach contractor registration form

- M1pr form 31556747

- Livingston cover sheet form

- 500px model release form

- Job offer letters my classroom economy form

- Percy julian forgotten genius worksheet answer key form

- Residential tenancy application form sunstar realty ltd residential tenancy application form sunstar realty ltd

- Residential tenancy application form

Find out other M1 Form

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now