941n Form 2020

What is the 941n Form

The 941n Form is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically designed for reporting the wages paid to employees and the taxes withheld from those wages. It is essential for compliance with federal tax regulations and helps the Internal Revenue Service (IRS) track employment tax liabilities.

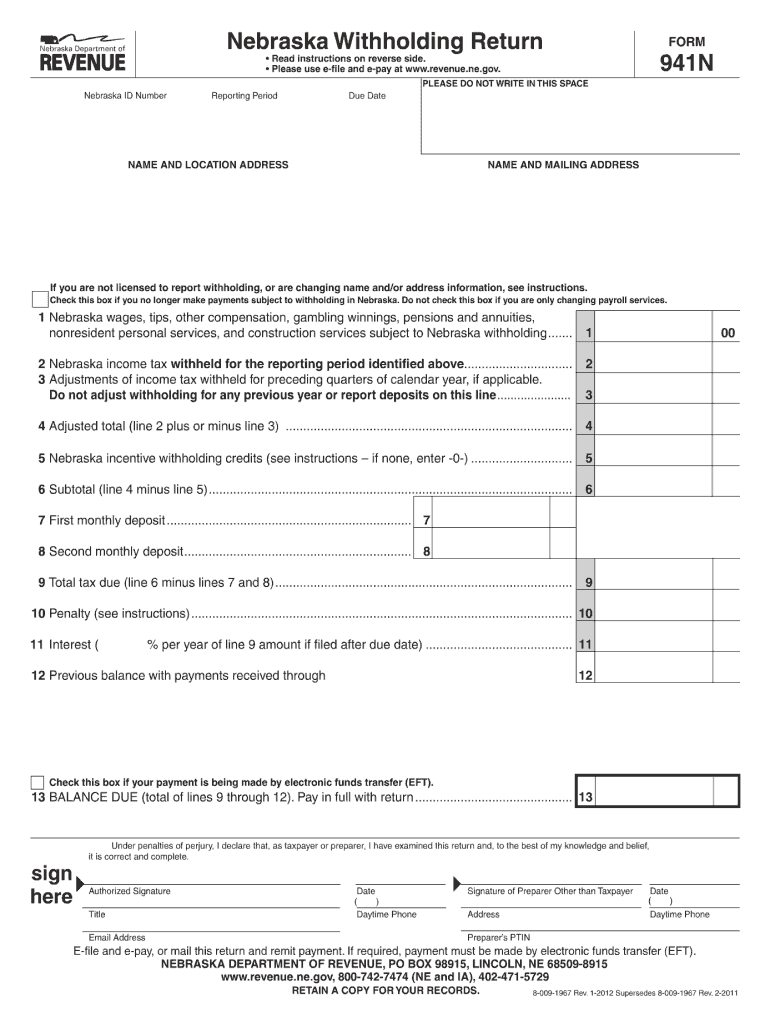

How to use the 941n Form

Using the 941n Form involves several steps to ensure accurate reporting of employment taxes. Employers must fill out the form with information regarding total wages paid, the amount of federal income tax withheld, and the employer's share of Social Security and Medicare taxes. It is crucial to review all entries for accuracy before submission, as errors can lead to penalties or delays in processing.

Steps to complete the 941n Form

Completing the 941n Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including total wages paid and taxes withheld.

- Fill in the employer's identification information, including name, address, and EIN.

- Report total wages and tips paid in the designated sections.

- Calculate the total taxes withheld and the employer's share of Social Security and Medicare taxes.

- Sign and date the form to certify its accuracy.

Legal use of the 941n Form

The 941n Form must be completed and submitted in accordance with IRS regulations to be considered legally valid. Employers are required to file this form quarterly, ensuring that all information is accurate and complete. Failure to comply with the filing requirements can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the 941n Form. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for the 2023 tax year are:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Form Submission Methods

The 941n Form can be submitted to the IRS in several ways. Employers have the option to file electronically through the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submissions are generally not recommended for this form.

Quick guide on how to complete 941n 2011 form

Complete 941n Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the right form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle 941n Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign 941n Form with ease

- Locate 941n Form and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your documentation management needs in just a few clicks from any device you prefer. Modify and eSign 941n Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941n 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 941n 2011 form

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 941n Form and why do I need it?

The 941n Form is a tax form used by businesses to report income, withholding, and employment taxes to the IRS. Understanding the 941n Form is essential for compliance with federal tax requirements, ensuring your business avoids penalties.

-

How can airSlate SignNow help with filling out the 941n Form?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the 941n Form. With features like templates and real-time collaboration, you can ensure accuracy and efficiency, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 941n Form?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs. Each plan provides comprehensive features for managing documents, including the ease of preparing your 941n Form.

-

Can I track the status of my 941n Form submissions using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 941n Form submissions in real-time. You can monitor when documents are sent, viewed, and completed, giving you peace of mind during tax time.

-

Does airSlate SignNow integrate with accounting software for the 941n Form?

Yes, airSlate SignNow integrates seamlessly with various accounting software, helping you manage your financial documents, including the 941n Form. This integration streamlines your workflow by automating data entry and document sharing.

-

What are the key benefits of using airSlate SignNow for the 941n Form?

Using airSlate SignNow for the 941n Form offers numerous benefits, including time savings and greater accuracy. Its easy-to-use interface helps reduce errors and makes document management straightforward, enhancing overall productivity.

-

How secure is airSlate SignNow when handling the 941n Form?

airSlate SignNow takes security seriously, utilizing advanced encryption and compliance measures to protect your data when handling the 941n Form. You can trust that your sensitive information is safe and secure.

Get more for 941n Form

Find out other 941n Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe