Nebraska Individual Income Tax Return, Form 1040N 2020

What is the Nebraska Individual Income Tax Return, Form 1040N

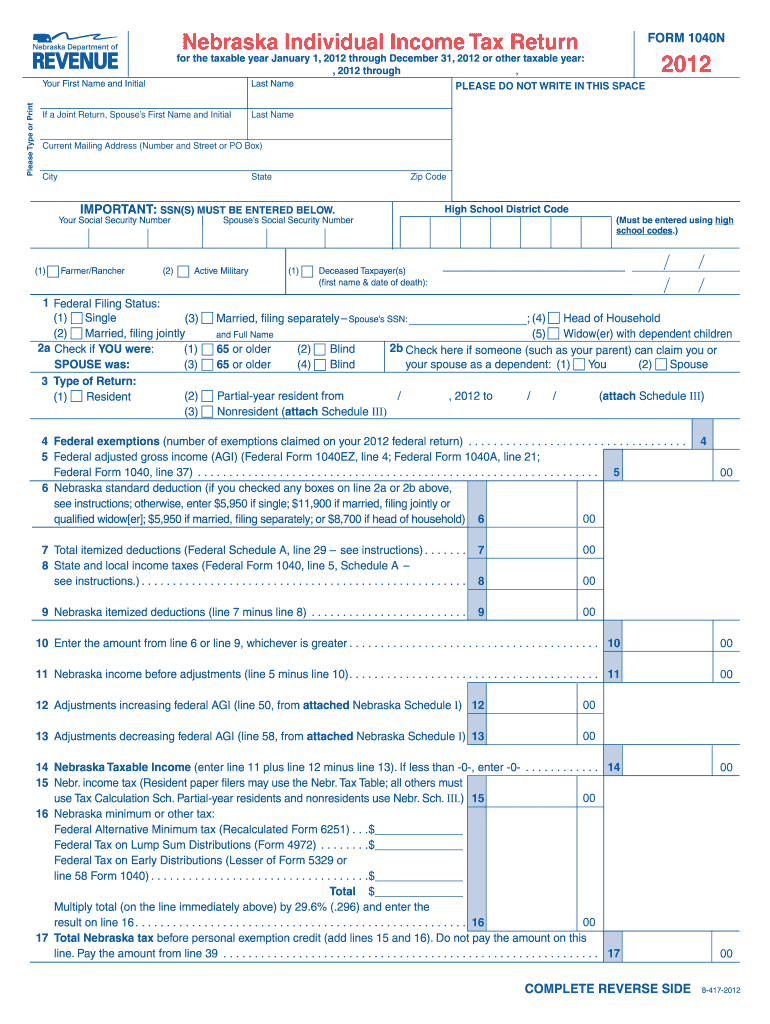

The Nebraska Individual Income Tax Return, Form 1040N, is a state-specific tax form used by residents of Nebraska to report their annual income and calculate the amount of state tax owed. This form is essential for individuals who earn income within the state, allowing them to fulfill their tax obligations. It includes various sections where taxpayers can detail their income sources, deductions, and credits applicable under Nebraska tax law. Understanding this form is crucial for accurate tax filing and compliance with state regulations.

Steps to complete the Nebraska Individual Income Tax Return, Form 1040N

Completing the Nebraska Individual Income Tax Return involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any records of deductions.

- Obtain the latest version of Form 1040N from the Nebraska Department of Revenue website or a trusted source.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and other earnings.

- Claim any deductions or credits you qualify for, which can reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Review all entries for accuracy before submitting the form.

How to obtain the Nebraska Individual Income Tax Return, Form 1040N

To obtain the Nebraska Individual Income Tax Return, Form 1040N, taxpayers can visit the Nebraska Department of Revenue's official website, where the form is available for download. Additionally, physical copies may be available at local tax offices or libraries. It's important to ensure that you are using the most current version of the form to comply with any recent tax law changes.

Legal use of the Nebraska Individual Income Tax Return, Form 1040N

The Nebraska Individual Income Tax Return, Form 1040N, is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must provide accurate information and sign the form. Electronic submissions are accepted, provided they meet the legal requirements for eSignatures under applicable laws, such as the ESIGN Act and UETA. This legal framework ensures that electronic filings are recognized as valid and enforceable.

Filing Deadlines / Important Dates

Taxpayers in Nebraska must be aware of key filing deadlines to avoid penalties. The typical deadline for submitting the Nebraska Individual Income Tax Return, Form 1040N, is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, taxpayers should be mindful of any extensions available, which may provide additional time for filing but not for payment of taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The Nebraska Individual Income Tax Return can be submitted through various methods:

- Online: Taxpayers can file electronically through the Nebraska Department of Revenue's e-filing system, which offers a secure and efficient way to submit the form.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Nebraska Department of Revenue.

- In-Person: Taxpayers may also choose to deliver their forms in person at local tax offices for assistance and immediate confirmation of receipt.

Key elements of the Nebraska Individual Income Tax Return, Form 1040N

Key elements of the Nebraska Individual Income Tax Return include:

- Personal Information: Name, address, and Social Security number are required for identification.

- Income Reporting: Taxpayers must report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: Sections for claiming eligible deductions and tax credits that can reduce tax liability.

- Signature: A signature is required to validate the form, whether filed electronically or by mail.

Quick guide on how to complete nebraska individual income tax return form 1040n

Complete Nebraska Individual Income Tax Return, Form 1040N effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to conventional printed and signed papers, as you can obtain the correct form and securely archive it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Nebraska Individual Income Tax Return, Form 1040N on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Nebraska Individual Income Tax Return, Form 1040N without any hassle

- Locate Nebraska Individual Income Tax Return, Form 1040N and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential parts of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would prefer to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nebraska Individual Income Tax Return, Form 1040N and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska individual income tax return form 1040n

Create this form in 5 minutes!

How to create an eSignature for the nebraska individual income tax return form 1040n

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Nebraska Individual Income Tax Return, Form 1040N?

The Nebraska Individual Income Tax Return, Form 1040N, is a tax form used by residents of Nebraska to report their income and calculate their state taxes. This form is essential for ensuring compliance with state tax laws and optimizing tax liability. It's important to complete the Form 1040N accurately to avoid penalties and ensure proper tax processing.

-

How can airSlate SignNow help with filing the Nebraska Individual Income Tax Return, Form 1040N?

airSlate SignNow streamlines the process of collecting signatures and approvals for documents related to the Nebraska Individual Income Tax Return, Form 1040N. Its user-friendly platform allows you to easily share and eSign necessary documents securely. This enhances efficiency and reduces the time spent on tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for my Nebraska Individual Income Tax Return, Form 1040N?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including individuals and businesses needing to file the Nebraska Individual Income Tax Return, Form 1040N. These plans are designed to be cost-effective, ensuring that users receive value through enhanced document management and signing capabilities. You can choose a plan that best fits your volume of signing needs.

-

What features does airSlate SignNow offer for Nebraska Individual Income Tax Return, Form 1040N?

airSlate SignNow features include easy document sharing, electronic signatures, customizable templates, and workflow management for your Nebraska Individual Income Tax Return, Form 1040N. These features enable seamless collaboration and ensure that you meet deadlines effectively. The platform also allows for tracking and storing signed documents securely.

-

Can airSlate SignNow integrate with other tools to assist with the Nebraska Individual Income Tax Return, Form 1040N?

Absolutely! airSlate SignNow offers integrations with popular tools such as CRM systems and accounting software, which can assist in simplifying the management of your Nebraska Individual Income Tax Return, Form 1040N. These integrations enable a more streamlined workflow and timely data sharing, allowing you to manage your documentation more efficiently.

-

What benefits can I expect from using airSlate SignNow for my tax documents?

Using airSlate SignNow for your Nebraska Individual Income Tax Return, Form 1040N offers numerous benefits, including faster turnaround times, enhanced security for your data, and reduced paper waste. The platform is designed to simplify the signing process, giving you more time to focus on other important aspects of your finances. Additionally, users benefit from a reliable support system for any assistance needed.

-

Is airSlate SignNow user-friendly for filing the Nebraska Individual Income Tax Return, Form 1040N?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, even those who may not be tech-savvy. The platform provides a straightforward interface that simplifies the process of preparing and signing your Nebraska Individual Income Tax Return, Form 1040N. Easy-to-follow instructions and tutorials are also available to assist users.

Get more for Nebraska Individual Income Tax Return, Form 1040N

Find out other Nebraska Individual Income Tax Return, Form 1040N

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy