Newark Quarter Payroll Tax Statement Form 2020

What is the Newark Quarter Payroll Tax Statement Form

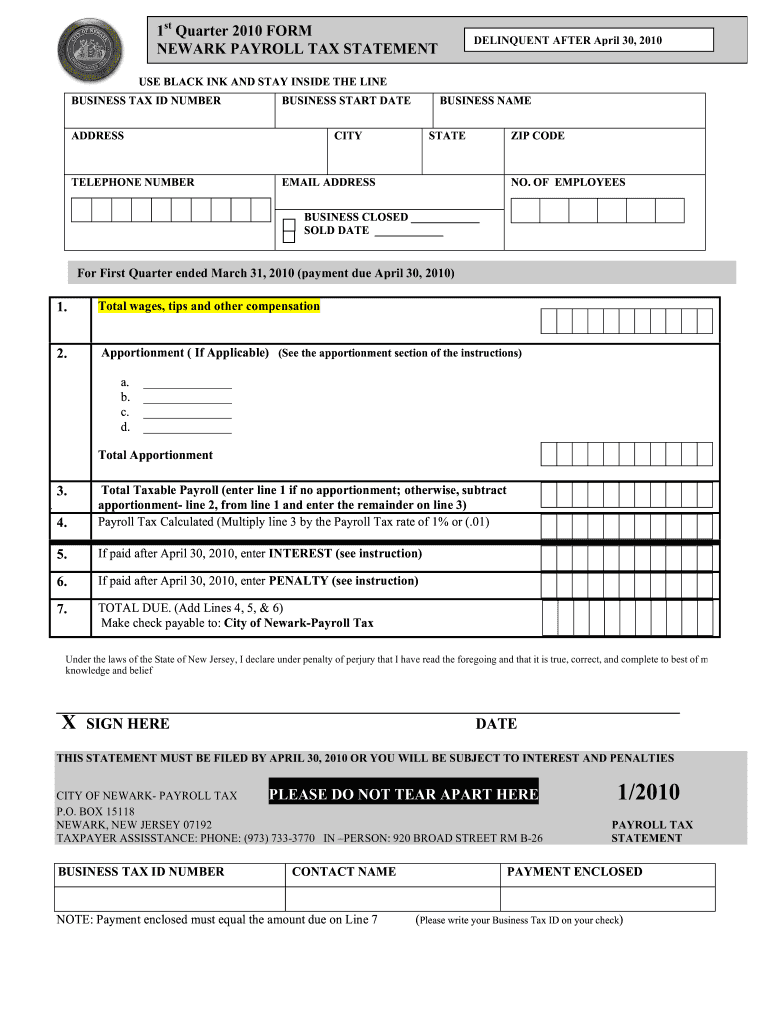

The Newark Quarter Payroll Tax Statement Form is a crucial document used by employers in Newark, New Jersey, to report payroll taxes for employees. This form provides detailed information about wages paid, taxes withheld, and contributions to various local and state tax programs. It is essential for ensuring compliance with local tax regulations and for the accurate reporting of employee earnings to the appropriate tax authorities.

How to use the Newark Quarter Payroll Tax Statement Form

To effectively use the Newark Quarter Payroll Tax Statement Form, employers should first gather all necessary payroll data, including employee names, Social Security numbers, and total wages paid during the quarter. Once the data is compiled, it should be accurately entered into the form. After completing the form, employers must sign it electronically or physically, depending on their submission method. This form can be submitted online, by mail, or in person to the relevant tax authority.

Steps to complete the Newark Quarter Payroll Tax Statement Form

Completing the Newark Quarter Payroll Tax Statement Form involves several key steps:

- Gather all relevant payroll records for the quarter.

- Accurately fill in employee information, including names and Social Security numbers.

- Enter total wages paid and taxes withheld for each employee.

- Review the form for accuracy to ensure compliance with tax regulations.

- Sign the form electronically or physically.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal use of the Newark Quarter Payroll Tax Statement Form

The Newark Quarter Payroll Tax Statement Form is legally binding when completed correctly and submitted within the required timeframe. Employers must ensure that the information provided is accurate and truthful, as any discrepancies may result in penalties or audits by tax authorities. Utilizing a reliable electronic signature solution, such as signNow, can enhance the legal standing of the form by ensuring compliance with relevant eSignature laws.

Key elements of the Newark Quarter Payroll Tax Statement Form

Key elements of the Newark Quarter Payroll Tax Statement Form include:

- Employer identification information, such as name and address.

- Employee details, including names and Social Security numbers.

- Total wages paid to each employee during the quarter.

- Amounts of payroll taxes withheld for local and state tax programs.

- Signature of the employer or authorized representative.

Form Submission Methods

The Newark Quarter Payroll Tax Statement Form can be submitted through various methods to accommodate different employer preferences. Common submission methods include:

- Online submission via the state tax authority's website.

- Mailing a printed copy of the form to the designated tax office.

- In-person delivery to the local tax authority office.

Quick guide on how to complete 2010 newark quarter payroll tax statement form

Handle Newark Quarter Payroll Tax Statement Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly option to conventional printed and signed documents, allowing users to access the necessary forms and securely keep them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Newark Quarter Payroll Tax Statement Form on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

Steps to modify and eSign Newark Quarter Payroll Tax Statement Form without hassle

- Obtain Newark Quarter Payroll Tax Statement Form and click Get Form to begin.

- Leverage the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal authority as an ink signature.

- Verify the information and then click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate issues like lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Newark Quarter Payroll Tax Statement Form to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 newark quarter payroll tax statement form

Create this form in 5 minutes!

How to create an eSignature for the 2010 newark quarter payroll tax statement form

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the Newark Quarter Payroll Tax Statement Form?

The Newark Quarter Payroll Tax Statement Form is a document required by employers to report payroll taxes on a quarterly basis. This form provides essential information regarding employee wages, withholdings, and other payroll-related data. Utilizing the Newark Quarter Payroll Tax Statement Form ensures compliance with local tax regulations and helps maintain accurate employee records.

-

How can I complete the Newark Quarter Payroll Tax Statement Form using airSlate SignNow?

To complete the Newark Quarter Payroll Tax Statement Form with airSlate SignNow, simply upload the form to our platform. You can then fill in all necessary fields, save your progress, and eSign it easily. Our user-friendly interface makes the entire process efficient and straightforward, ensuring your form is completed accurately.

-

Is there a cost associated with using the Newark Quarter Payroll Tax Statement Form on airSlate SignNow?

Yes, there is a subscription fee for using airSlate SignNow to process the Newark Quarter Payroll Tax Statement Form. However, our pricing plans are designed to be budget-friendly and provide excellent value for businesses of all sizes. You can choose a plan that aligns with your needs while enjoying access to our full suite of features.

-

What features does airSlate SignNow offer for handling the Newark Quarter Payroll Tax Statement Form?

airSlate SignNow offers various features tailored for the Newark Quarter Payroll Tax Statement Form, such as electronic signatures, document tracking, and cloud storage. These features streamline the process of completing your form and ensure that all parties can sign and access the document efficiently. Additionally, you can automate reminders for signatures, enhancing productivity.

-

Can I integrate airSlate SignNow with other software for payroll management?

Yes, airSlate SignNow offers integrations with numerous payroll and HR management software solutions. This allows you to seamlessly manage your Newark Quarter Payroll Tax Statement Form and other related documents in one place. Integrating with your existing systems ensures that your payroll processes are efficient and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the Newark Quarter Payroll Tax Statement Form?

Using airSlate SignNow for the Newark Quarter Payroll Tax Statement Form offers numerous benefits, including time savings and enhanced accuracy. Our platform simplifies document management, reduces paperwork, and ensures compliance with tax regulations. Additionally, eSigning speeds up the process, enabling you to meet deadlines without hassle.

-

Are there any tips for filling out the Newark Quarter Payroll Tax Statement Form accurately?

To fill out the Newark Quarter Payroll Tax Statement Form accurately, double-check all employee information and payroll figures before submission. It’s also advisable to keep all payroll records handy, as they will help ensure that the information is complete and correct. airSlate SignNow can facilitate this by allowing you to save and retrieve previous submissions easily.

Get more for Newark Quarter Payroll Tax Statement Form

- Taa lease contract form

- Healthplex dental claim form

- B1 form download

- Ps form 1723

- Application for licensure massage therapy georgia secretary of state sos ga form

- Prohibited waste removal record form eqp state of michigan michigan

- Ldss 3370 fill out and sign printable pdf template form

- Animal bite report tennessee state government tn gov form

Find out other Newark Quarter Payroll Tax Statement Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors