Tax Forms H&e 2019

What is the Tax Forms H&e

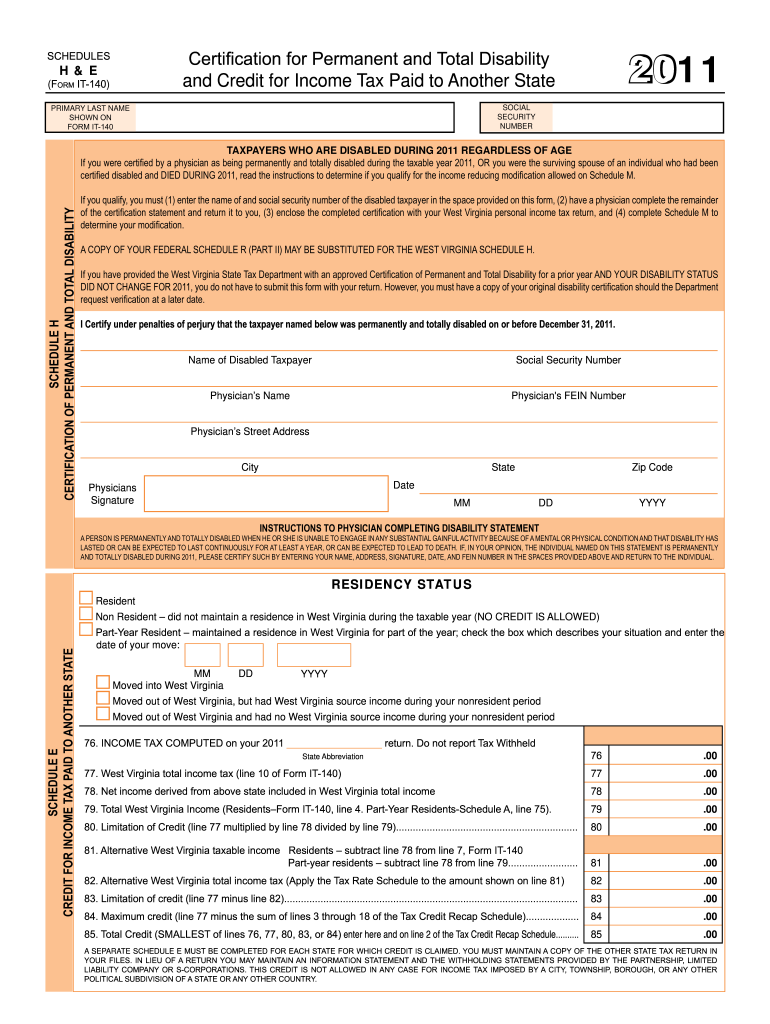

The Tax Forms H&e refers to specific tax documentation required for various financial reporting and compliance purposes within the United States. These forms are essential for individuals and businesses to accurately report income, expenses, and other financial activities to the Internal Revenue Service (IRS). Understanding the purpose and requirements of these forms is crucial for ensuring compliance with federal tax laws.

How to use the Tax Forms H&e

Using the Tax Forms H&e involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements, receipts, and previous tax returns. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is advisable to review the form for any errors before submission. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail, depending on your preference and the specific requirements of the form.

Steps to complete the Tax Forms H&e

Completing the Tax Forms H&e requires a systematic approach:

- Gather all relevant financial documents, including W-2s, 1099s, and other income statements.

- Carefully read the instructions provided with the form to understand the required information.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check your entries for any mistakes or omissions.

- Submit the form by the specified deadline, either electronically through a secure platform or via traditional mail.

Legal use of the Tax Forms H&e

The legal use of the Tax Forms H&e is governed by federal tax laws, which require accurate reporting of income and expenses. When completed correctly, these forms serve as official documentation for tax purposes and can be used in legal proceedings if necessary. It is important to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Forms H&e vary depending on the specific form and the taxpayer's situation. Generally, individual tax returns are due on April fifteenth, while businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to avoid late penalties and ensure timely compliance with tax regulations.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the Tax Forms H&e. These guidelines include detailed instructions on the information required, filing methods, and any additional documentation that may be necessary. Familiarizing yourself with these guidelines can help ensure that your form is completed accurately and in accordance with federal regulations.

Quick guide on how to complete tax forms hampe 2011

Complete Tax Forms H&e effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It serves as an ideal green alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Tax Forms H&e on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Tax Forms H&e effortlessly

- Obtain Tax Forms H&e and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Tax Forms H&e and ensure clear communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax forms hampe 2011

Create this form in 5 minutes!

How to create an eSignature for the tax forms hampe 2011

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What are Tax Forms H&e and how can they benefit my business?

Tax Forms H&e are essential documents that allow businesses to report income and expenses to tax authorities. Using airSlate SignNow, you can easily create, send, and eSign these forms, ensuring compliance and accuracy. This streamlined process not only saves time but also minimizes errors, providing peace of mind during tax season.

-

Is airSlate SignNow compliant with tax regulations for Tax Forms H&e?

Yes, airSlate SignNow ensures compliance with all relevant regulations regarding Tax Forms H&e. Our platform adheres to industry standards and legal requirements, providing a secure environment for eSigning essential tax documents. You can trust that your forms are handled safely and in accordance with tax laws.

-

How does airSlate SignNow simplify the process of managing Tax Forms H&e?

With airSlate SignNow, managing Tax Forms H&e becomes effortless. Our user-friendly interface allows you to easily generate, send, and track these forms electronically. Additionally, the automated workflows help reduce administrative burdens and increase efficiency in your document handling.

-

What pricing plans are available for airSlate SignNow regarding Tax Forms H&e?

airSlate SignNow offers flexible pricing plans designed to meet various business needs when dealing with Tax Forms H&e. Whether you're a small business or a larger enterprise, our affordable plans can accommodate your requirements without compromising on features. You can choose the one that best suits your document signing volumes and functionalities.

-

Can I integrate airSlate SignNow with other software for managing Tax Forms H&e?

Absolutely! airSlate SignNow seamlessly integrates with numerous software applications, enhancing your ability to manage Tax Forms H&e. Whether you use accounting software or CRM systems, our integrations provide a cohesive experience that simplifies your workflow and ensures the easy transfer of data between platforms.

-

What security measures are in place for Tax Forms H&e within airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Tax Forms H&e. Our platform employs robust security measures, including encryption and secure access controls, to safeguard your information. You can rest assured that your tax documents are protected from unauthorized access.

-

How can airSlate SignNow improve collaboration on Tax Forms H&e?

AirSlate SignNow enhances collaboration on Tax Forms H&e by allowing multiple users to access, edit, and eSign documents simultaneously. This feature promotes teamwork and ensures that all stakeholders have the latest version of the tax forms. By facilitating real-time collaboration, our platform streamlines the completion of these essential documents.

Get more for Tax Forms H&e

Find out other Tax Forms H&e

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy