Individuals West Virginia State Tax Department WV Gov 2020

Steps to complete the WV IT 140 for 2019 tax

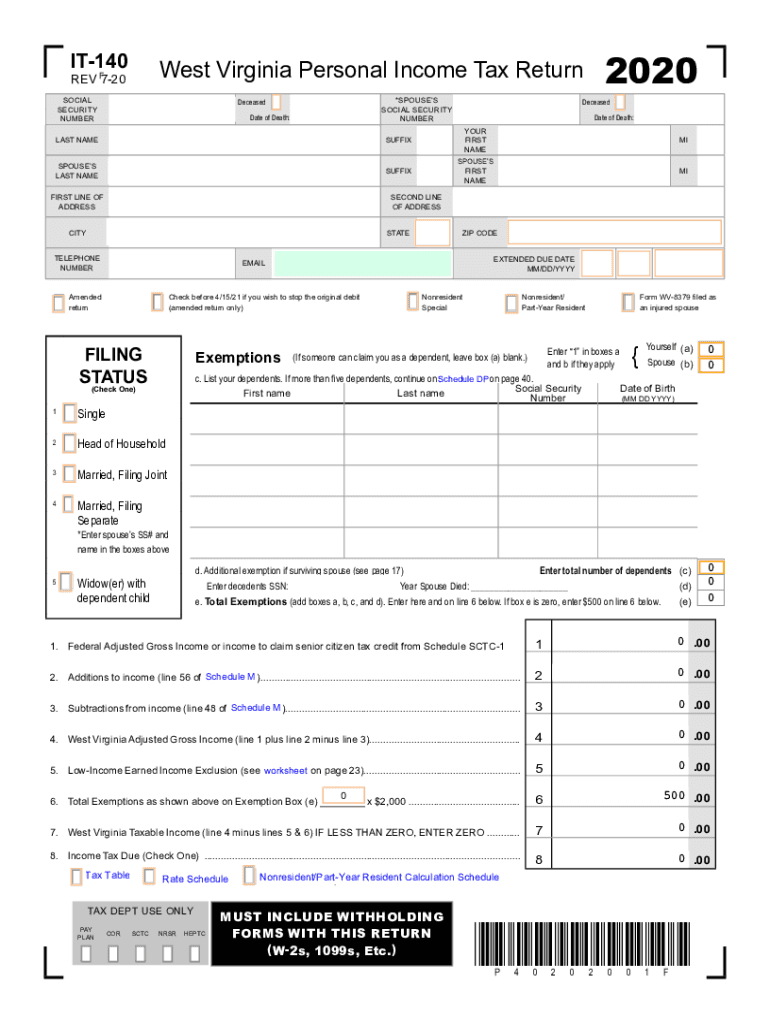

Filling out the WV IT 140 form for the 2019 tax year involves several essential steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, download the fillable WV IT 140 form from the West Virginia State Tax Department's official website or use a reliable electronic signing platform.

Once you have the form, carefully enter your personal information, including your name, address, and Social Security number. Follow the instructions for reporting your income, deductions, and credits. Be sure to double-check all entries for accuracy, as errors can lead to delays or penalties.

After completing the form, review it thoroughly. You may want to consult with a tax professional if you have questions about specific entries or deductions. Finally, submit the form electronically through a secure platform, or print and mail it to the appropriate address listed on the form.

Required Documents for the WV IT 140

To successfully fill in the WV IT 140 for the 2019 tax year, you will need several key documents. These include:

- W-2 forms from all employers showing your total earnings

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or interest

- Documentation for any tax deductions you plan to claim, such as mortgage interest or student loan interest

- Any relevant tax credits that apply to your situation

Having these documents on hand will streamline the process and help ensure that your form is completed accurately.

Legal use of the WV IT 140

The WV IT 140 form is a legally binding document that must be filled out accurately and submitted in compliance with state tax laws. When completing this form electronically, it is crucial to use a trusted eSignature solution that meets the legal requirements set forth by the ESIGN Act and UETA. This ensures that your electronic signature is recognized as valid and enforceable.

Additionally, retaining a copy of the completed form and any supporting documents is essential for your records. In the event of an audit or inquiry from the West Virginia State Tax Department, having this documentation readily available can help resolve any issues that may arise.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing the WV IT 140 form is typically April 15 of the following year. However, it is important to verify any changes or extensions that may apply. Mark your calendar for this date to avoid late filing penalties. If you need additional time, consider filing for an extension, which can provide an extra six months to submit your tax return.

Be aware of any specific deadlines for making payments if you owe taxes. Late payments can incur interest and penalties, so it is advisable to pay any owed amounts by the original due date to avoid additional charges.

Form Submission Methods

The WV IT 140 form can be submitted in various ways to accommodate different preferences. You may choose to file electronically using a secure eSignature platform, which allows for quick processing and confirmation of receipt. Alternatively, you can print the completed form and mail it to the designated address provided by the West Virginia State Tax Department.

If you prefer to file in person, check if local tax offices offer this option. Regardless of the method chosen, ensure that you keep a copy of the submitted form and any confirmation for your records.

Penalties for Non-Compliance

Failure to file the WV IT 140 form by the deadline can result in significant penalties. The West Virginia State Tax Department may impose late filing fees, which can accumulate over time. Additionally, if you owe taxes and do not pay them by the due date, interest will accrue on the unpaid balance.

It is crucial to file on time and ensure that all information is accurate to avoid these penalties. If you encounter difficulties meeting the deadline, consider reaching out to a tax professional for guidance on your options.

Quick guide on how to complete individuals west virginia state tax department wvgov

Complete Individuals West Virginia State Tax Department WV gov effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Individuals West Virginia State Tax Department WV gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Individuals West Virginia State Tax Department WV gov effortlessly

- Obtain Individuals West Virginia State Tax Department WV gov and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign Individuals West Virginia State Tax Department WV gov and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individuals west virginia state tax department wvgov

Create this form in 5 minutes!

How to create an eSignature for the individuals west virginia state tax department wvgov

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the process to fill in it 140 for 2019 tax using airSlate SignNow?

To fill in it 140 for 2019 tax using airSlate SignNow, simply upload your tax form to our platform. You can then fill out the form electronically, ensuring all necessary fields are completed accurately. Once you're done, you can eSign and send it directly to the relevant tax authorities.

-

Is airSlate SignNow suitable for filling all types of tax forms?

Yes, airSlate SignNow is designed to handle various tax forms efficiently, including how to fill in it 140 for 2019 tax. Our platform supports the upload and electronic signing of all common tax documents, enhancing your tax preparation process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to suit different business needs. Each plan includes features that facilitate tasks like filling in it 140 for 2019 tax and other essential document management needs. You can select a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with various applications, providing enhanced functionality. You can easily connect it with CRM and accounting software, making it simpler to fill in it 140 for 2019 tax and manage related documents.

-

What benefits does airSlate SignNow provide over traditional methods?

Using airSlate SignNow to fill in it 140 for 2019 tax streamlines the entire process compared to traditional paper methods. It reduces paperwork, minimizes the risk of errors, and speeds up submission times, letting you focus more on your business needs.

-

Is it secure to use airSlate SignNow for sensitive documents?

Yes, airSlate SignNow prioritizes the security of your sensitive documents. Our platform uses advanced encryption and authentication methods, ensuring that your data remains protected while you fill in it 140 for 2019 tax or sign other important documents.

-

How can I get support if I have questions while filling in it 140 for 2019 tax?

airSlate SignNow provides dedicated customer support to assist you with any questions while filling in it 140 for 2019 tax. You can access our help center, chat with representatives, or consult our extensive FAQ section for prompt assistance.

Get more for Individuals West Virginia State Tax Department WV gov

Find out other Individuals West Virginia State Tax Department WV gov

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy