PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications 2019

Understanding the PA Schedule UE

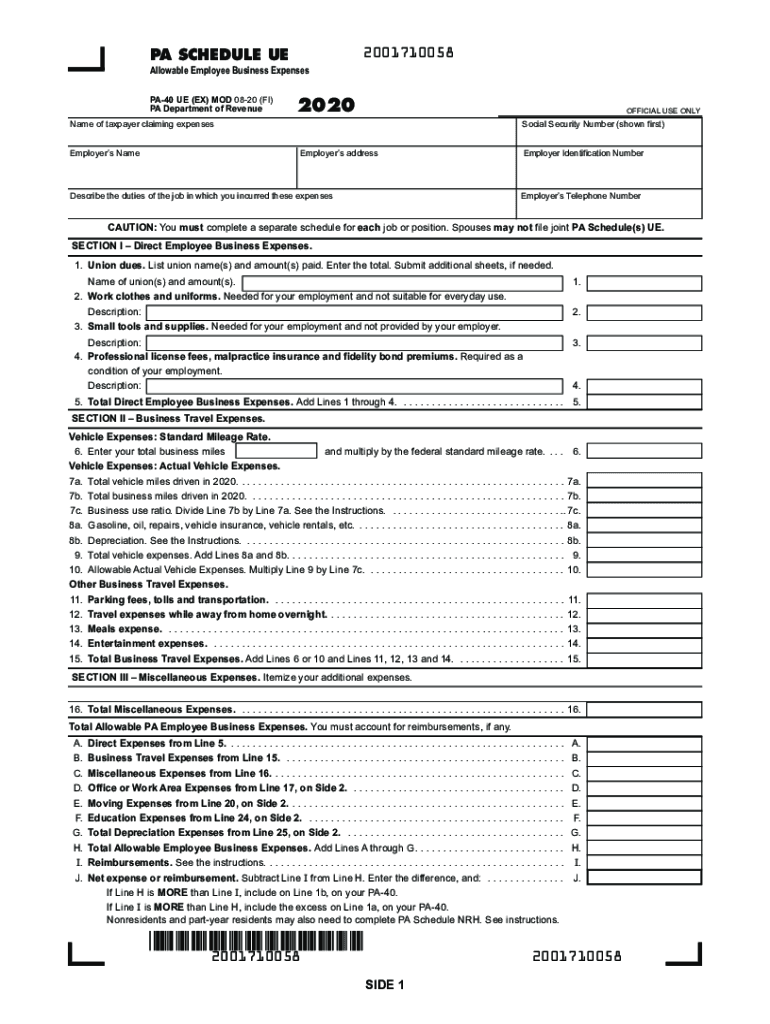

The PA Schedule UE is a crucial form for employees in Pennsylvania who wish to report their allowable business expenses. This form allows taxpayers to claim deductions for unreimbursed employee expenses incurred while performing job-related duties. It is essential for individuals to familiarize themselves with the specific expenses that qualify under Pennsylvania tax law.

Common allowable expenses include:

- Travel expenses, such as mileage and lodging

- Tools and equipment necessary for job functions

- Uniforms and work-related clothing

- Continuing education and training costs

Understanding these categories can help employees maximize their deductions and ensure compliance with state regulations.

Steps to Complete the PA Schedule UE

Completing the PA Schedule UE requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps to follow:

- Gather all relevant receipts and documentation for your business expenses.

- Fill out the personal information section, including your name, address, and Social Security number.

- List each allowable expense in the appropriate section of the form, ensuring to categorize them correctly.

- Calculate the total amount of allowable expenses and enter this figure on the designated line.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that your PA Schedule UE is completed correctly and submitted on time.

Key Elements of the PA Schedule UE

When filling out the PA Schedule UE, several key elements must be understood to ensure compliance with Pennsylvania tax regulations:

- Expense Categories: Familiarize yourself with the different categories of expenses that can be claimed.

- Documentation: Keep thorough records of all expenses, including receipts and invoices, as these may be required in case of an audit.

- Filing Requirements: Understand the filing requirements and deadlines to avoid penalties.

- Signature: Ensure that the form is signed and dated before submission.

These elements are vital for a successful filing and can help in maximizing potential deductions.

Legal Use of the PA Schedule UE

The PA Schedule UE is legally recognized for reporting employee business expenses in Pennsylvania. To ensure that your use of this form is compliant with state laws, consider the following:

- All reported expenses must be necessary and ordinary for your job.

- Expenses must not be reimbursed by your employer.

- Maintain accurate records and documentation to substantiate your claims.

Understanding the legal framework surrounding the PA Schedule UE can help protect you from potential audits and penalties.

Filing Deadlines for the PA Schedule UE

Timely filing of the PA Schedule UE is essential to avoid penalties. The deadline for submitting this form typically aligns with the Pennsylvania personal income tax return deadline, which is usually April 15. However, it is advisable to check for any changes or extensions that may apply in a given tax year.

Late submissions may result in penalties, so it is crucial to be aware of these deadlines and plan accordingly.

Examples of Using the PA Schedule UE

Understanding how to apply the PA Schedule UE in real-life scenarios can provide clarity on its use. Here are a few examples:

- An employee who travels for work and incurs expenses for lodging and meals can report these on the PA Schedule UE.

- A teacher who purchases classroom supplies out of pocket can claim these expenses as allowable deductions.

- A remote worker who sets up a home office may also report expenses related to office furniture and equipment.

These examples illustrate the diverse situations in which the PA Schedule UE can be beneficial for employees seeking to claim their business expenses.

Quick guide on how to complete 2020 pa schedule ue allowable employee business expenses pa 40 ue formspublications

Complete PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications seamlessly

- Locate PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your liking. Modify and eSign PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 pa schedule ue allowable employee business expenses pa 40 ue formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2020 pa schedule ue allowable employee business expenses pa 40 ue formspublications

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What features does airSlate SignNow offer for managing Pennsylvania expenses?

airSlate SignNow provides a range of features specifically designed to help businesses manage Pennsylvania expenses efficiently. You can create, send, and eSign documents related to expenses seamlessly. The platform also allows for tracking and reporting, ensuring all Pennsylvania expenses are organized and easily accessible.

-

How does airSlate SignNow streamline the approval process for Pennsylvania expenses?

With airSlate SignNow, the approval process for Pennsylvania expenses is simplified through electronic signatures and automated workflows. Users can initiate approvals through customizable templates that expedite the review of expense reports. This leads to faster processing times and improved compliance with company policies.

-

What is the pricing structure for airSlate SignNow when managing Pennsylvania expenses?

The pricing for airSlate SignNow is designed to be budget-friendly, especially for managing Pennsylvania expenses. Multiple tiers are available to cater to different business sizes, ensuring that everyone can benefit from the capabilities of the platform. You can choose a plan that best suits your expense management needs and budget.

-

Can I integrate airSlate SignNow with other tools for Pennsylvania expenses tracking?

Yes, airSlate SignNow offers integration capabilities with various accounting and expense management tools. This allows for a seamless workflow when managing Pennsylvania expenses. You can connect with popular applications like QuickBooks and Xero to enhance your financial tracking processes.

-

What benefits does airSlate SignNow provide when handling Pennsylvania expenses?

airSlate SignNow offers several benefits for handling Pennsylvania expenses, including increased efficiency and reduced paper waste. Administrative tasks are automated, ensuring that your team spends less time on clerical work and more time on revenue-generating activities. Additionally, the electronic signature feature provides security and accountability.

-

Is airSlate SignNow compliant with Pennsylvania laws regarding expenses?

Yes, airSlate SignNow is designed to be compliant with Pennsylvania laws concerning expenses, ensuring that electronic signatures and documentation are legally valid. This compliance helps businesses feel secure as they manage their Pennsylvania expenses digitally. Regular updates are made to align with changes in legislation.

-

How can I get support for using airSlate SignNow for Pennsylvania expenses?

airSlate SignNow offers robust customer support options for users managing Pennsylvania expenses. You can access a comprehensive help center, live chat, and email support. This ensures that any issues related to paperwork or expenses are resolved promptly, keeping your operations running smoothly.

Get more for PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications

- City of plano termination torque forms building

- Ohio dnr form

- Mahindra 4530 owners manual form

- Extended leave form nsw school

- Laboratory skills assessment answer key form

- Speed amp agility training for high school athletes st teamunify form

- Davie dog house form

- Helen holt mollohan scholarship application mollohanfoundation form

Find out other PA Schedule UE Allowable Employee Business Expenses PA 40 UE FormsPublications

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast