California Form Credit 2019

What is the California Form Credit

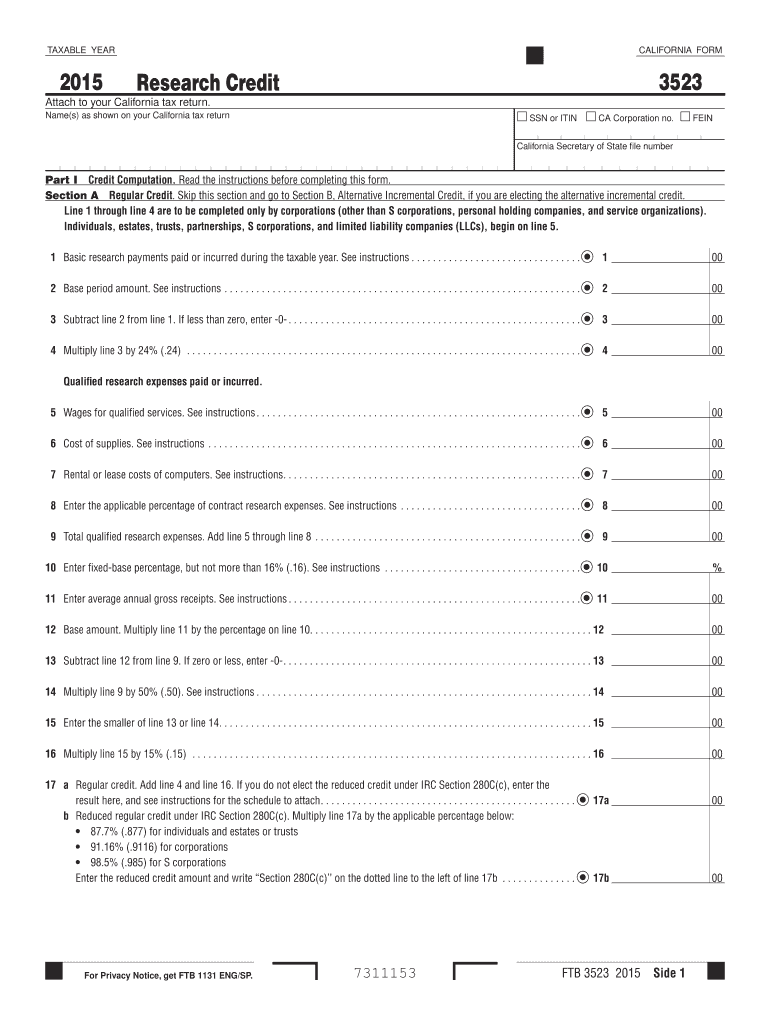

The California Form Credit is a tax form utilized by residents and businesses in California to claim various tax credits. These credits can reduce the overall tax liability for individuals or entities, providing financial relief and encouraging specific economic activities. The form is essential for ensuring that taxpayers receive the benefits they are entitled to under California tax law.

How to use the California Form Credit

Using the California Form Credit involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility for the credits available on the form. Once eligibility is established, the form should be filled out with the necessary personal and financial information. It's crucial to follow the instructions carefully to avoid errors that could delay processing or result in denial of the credits.

Steps to complete the California Form Credit

Completing the California Form Credit requires attention to detail. Here are the key steps:

- Gather all necessary documentation, including income statements and previous tax returns.

- Review the specific credits available on the form to determine which ones apply to your situation.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your entries for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the California Form Credit

The legal use of the California Form Credit is governed by state tax laws. To ensure compliance, taxpayers must adhere to the guidelines set forth by the California Franchise Tax Board. This includes accurately reporting income, claiming only eligible credits, and maintaining proper documentation to support claims. Non-compliance can lead to penalties or audits.

Eligibility Criteria

Eligibility for the California Form Credit varies depending on the specific credits being claimed. Generally, taxpayers must meet certain income thresholds, residency requirements, and other conditions outlined in the instructions for the form. It is important to review these criteria carefully to ensure that all qualifications are met before submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the California Form Credit typically align with the state income tax return deadlines. Taxpayers should be aware of the annual deadlines to ensure timely submission. Important dates include the original filing date, any extensions, and specific deadlines for claiming certain credits. Keeping track of these dates is essential to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The California Form Credit can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically through approved software or the California Franchise Tax Board’s website.

- Mail: Taxpayers can print the completed form and send it via postal mail to the appropriate address specified in the form instructions.

- In-Person: Some individuals may opt to submit their forms in person at local tax offices, although this method is less common.

Quick guide on how to complete california form credit 2015

Complete California Form Credit effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage California Form Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and eSign California Form Credit with ease

- Locate California Form Credit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require reprinting document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign California Form Credit and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form credit 2015

Create this form in 5 minutes!

How to create an eSignature for the california form credit 2015

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is California Form Credit and how can airSlate SignNow help?

California Form Credit refers to specific documentation required for credit-related transactions in California. airSlate SignNow simplifies the process by providing a platform where you can easily eSign and manage these forms digitally, ensuring that your business remains compliant and efficient.

-

How much does airSlate SignNow cost for using California Form Credit?

Our pricing plans for airSlate SignNow are designed to be cost-effective, especially for handling California Form Credit. You can choose from various subscription tiers that suit your business needs, and each plan offers features that enhance document management and eSigning capabilities.

-

What features does airSlate SignNow offer for managing California Form Credit?

airSlate SignNow offers a suite of features tailored for managing California Form Credit, including customizable templates, real-time tracking, and secure storage options. Our platform also allows for easy collaboration among team members, ensuring that all parties can efficiently review and sign the necessary documents.

-

Can I integrate airSlate SignNow with other tools for handling California Form Credit?

Yes, airSlate SignNow offers seamless integrations with various tools and applications relevant to managing California Form Credit. Whether you use CRM software or other document management systems, our platform can work in conjunction to streamline your workflow.

-

Is airSlate SignNow compliant with California laws for Form Credit?

Absolutely! airSlate SignNow is designed to comply with Californian regulations regarding Form Credit and eSignature validity. We ensure that all eSigning processes align with legal standards, giving you peace of mind when handling sensitive documents.

-

What are the benefits of using airSlate SignNow for California Form Credit?

One of the primary benefits of using airSlate SignNow for California Form Credit is the time saved in document processing. With features like automated reminders and a user-friendly interface, you can finalize agreements faster while reducing errors commonly associated with manual processes.

-

How can I get started with airSlate SignNow for California Form Credit?

Getting started with airSlate SignNow for California Form Credit is simple. You can sign up for a free trial on our website, where you'll have access to all features for evaluating how airSlate SignNow can suit your document signing needs.

Get more for California Form Credit

Find out other California Form Credit

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template