590 Form 2020

What is the 590 Form

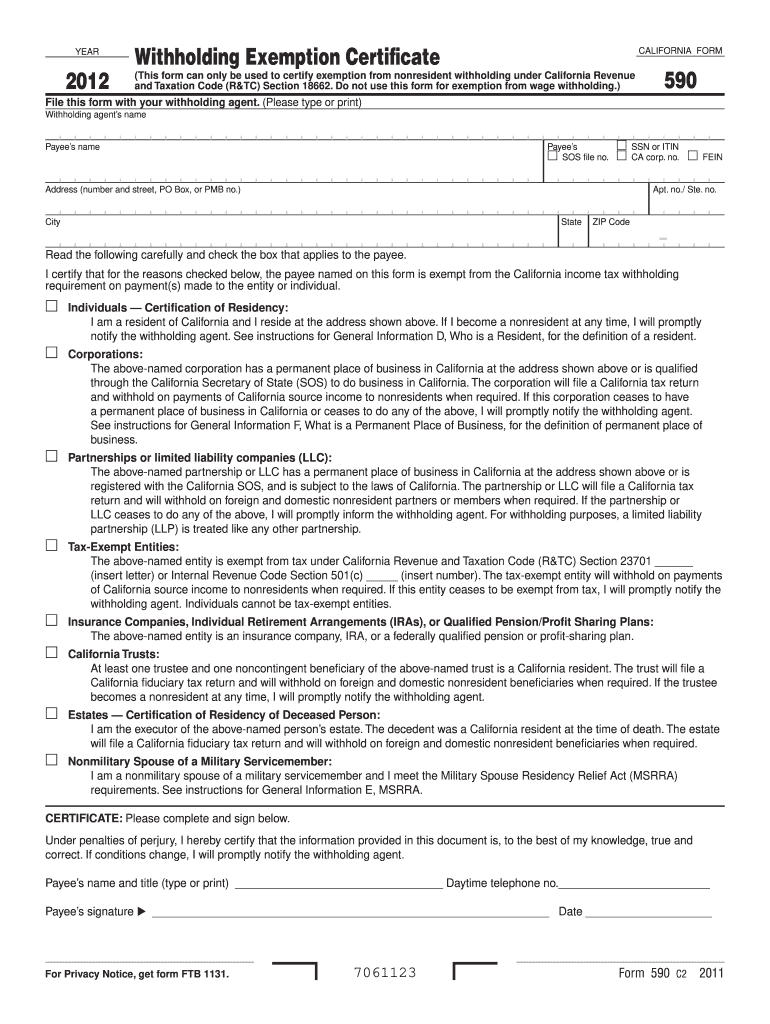

The 590 Form is a tax document used by individuals and businesses in the United States to report certain types of income and claim exemptions. It is primarily associated with California’s Franchise Tax Board and is important for taxpayers who wish to declare their eligibility for specific tax benefits. Understanding the purpose of the 590 Form is crucial for ensuring compliance with state tax regulations.

How to use the 590 Form

Using the 590 Form involves several key steps to ensure accurate completion. First, gather all necessary information, including your identification details and relevant financial data. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. It is important to follow the instructions provided with the form to avoid any complications.

Steps to complete the 590 Form

Completing the 590 Form requires a systematic approach:

- Obtain the latest version of the 590 Form from the appropriate source.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income and any exemptions you are claiming.

- Review the form for accuracy, ensuring all entries are correct.

- Sign and date the form before submission.

Legal use of the 590 Form

The legal use of the 590 Form is governed by specific regulations set forth by the California Franchise Tax Board. It is essential to ensure that the form is used in accordance with these guidelines to maintain its validity. Submitting the form improperly can result in penalties or delays in processing. Therefore, understanding the legal implications of the 590 Form is vital for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the 590 Form are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline for the year in which the income was earned. It is advisable to keep track of any changes in deadlines announced by the California Franchise Tax Board to ensure timely submission. Missing the deadline may result in additional fees or complications in processing your tax return.

Required Documents

Before completing the 590 Form, it is important to gather all required documents. This may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, including Social Security numbers.

- Any previous tax forms that may be relevant to your current filing.

Having these documents ready will facilitate a smoother completion process for the 590 Form.

Quick guide on how to complete 590 2012 form

Complete 590 Form effortlessly on any gadget

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage 590 Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to revise and eSign 590 Form with ease

- Locate 590 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any gadget of your choice. Revise and eSign 590 Form to ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 590 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 590 2012 form

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is a 590 Form?

The 590 Form is a document used for California tax withholding exemption purposes. It allows qualifying individuals or entities to claim exemption from California state withholding. This form is essential for ensuring compliance when conducting business in or with the state of California.

-

How can I fill out a 590 Form using airSlate SignNow?

airSlate SignNow offers a user-friendly interface that simplifies the process of filling out the 590 Form. Users can easily upload the form, fill in the required fields, and add eSignatures. The seamless workflow ensures a quick turnaround, reducing the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for the 590 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing documents like the 590 Form. You can choose a plan based on your organization's size and requirements. Pricing is competitive, ensuring businesses of all sizes can access its features.

-

What features does airSlate SignNow provide for the 590 Form?

airSlate SignNow provides features such as document templates, real-time collaboration, and automated workflows to streamline the completion of the 590 Form. Additionally, you can track the status of your documents and receive notifications for any actions taken. These features enhance efficiency and transparency in the signing process.

-

Can I integrate airSlate SignNow with other software when handling the 590 Form?

Absolutely! airSlate SignNow allows seamless integration with popular business software like Google Workspace, Salesforce, and QuickBooks. This means you can easily manage your documents and workflows related to the 590 Form within the tools your business already uses, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the 590 Form?

Using airSlate SignNow for the 590 Form offers numerous benefits, including faster processing times and improved accuracy. The electronic signature capability helps ensure that your documents are legally binding and securely stored. Furthermore, it reduces the environmental impact by minimizing paper use.

-

How secure is the information submitted with the 590 Form through airSlate SignNow?

Security is a top priority at airSlate SignNow. All documents, including the 590 Form, are encrypted and stored securely in compliance with industry standards. Additionally, features like user authentication and audit trails help protect sensitive information and maintain compliance.

Get more for 590 Form

- Rotzler winch parts form

- Hemophilia pedigree royal family worksheet form

- Dodd provider documentation form

- Bank of america deposit slip form

- Standard industrial commercial multi tenant lease gross form

- Supplement to petition for appointment of probate conservator form

- Gv 620 response to request to terminate gun violence restraining order form

- Cfb halifax officers mess cfmws form

Find out other 590 Form

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online