Schedule Ca 540 Form 2019

What is the Schedule Ca 540 Form

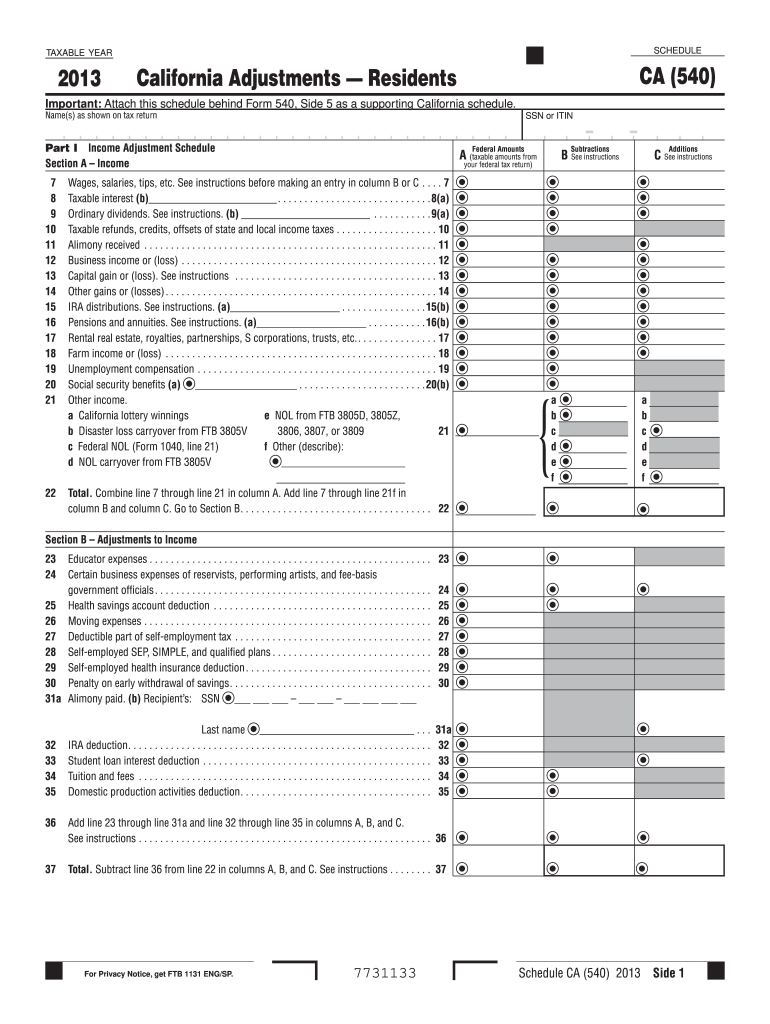

The Schedule Ca 540 Form is a tax document used by residents of California to report adjustments to their income when filing their state income tax returns. This form is specifically designed for individuals who are filing a California Form 540, which is the standard state income tax return. The Schedule Ca 540 allows taxpayers to make necessary modifications to their federal adjusted gross income, ensuring compliance with California tax laws.

How to use the Schedule Ca 540 Form

To effectively use the Schedule Ca 540 Form, taxpayers should first gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Once you have these documents, you can begin filling out the form. The Schedule Ca 540 requires you to report your federal adjusted gross income and then make specific adjustments based on California tax regulations. It is important to follow the instructions carefully to ensure accurate reporting and compliance with state requirements.

Steps to complete the Schedule Ca 540 Form

Completing the Schedule Ca 540 Form involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Start by entering your federal adjusted gross income from your federal tax return.

- Make any applicable adjustments based on California tax laws, such as deductions or credits.

- Review your entries for accuracy, ensuring that all calculations are correct.

- Sign and date the form before submission.

Legal use of the Schedule Ca 540 Form

The Schedule Ca 540 Form is legally binding when completed accurately and submitted in compliance with California tax regulations. It serves as an official document that reflects your income and any adjustments made for state tax purposes. To ensure its legal validity, taxpayers must provide truthful information and maintain compliance with all relevant tax laws. Failure to do so may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the Schedule Ca 540 Form. Typically, the filing deadline coincides with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates regarding filing extensions or changes in deadlines to avoid late penalties.

Required Documents

When completing the Schedule Ca 540 Form, certain documents are essential for accurate reporting. These include:

- W-2 forms from employers

- 1099 forms for additional income

- Documentation for any deductions or credits claimed

- Previous year's tax return for reference

Form Submission Methods

Taxpayers have several options for submitting the Schedule Ca 540 Form. The form can be filed electronically through approved e-filing services, which often provide a streamlined process. Alternatively, taxpayers can print the completed form and mail it to the appropriate California tax office. In-person submissions may also be accepted at designated tax offices, but it is advisable to check for specific requirements or restrictions before visiting.

Quick guide on how to complete 2013 schedule ca 540 form

Complete Schedule Ca 540 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly and without interruptions. Handle Schedule Ca 540 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Schedule Ca 540 Form with ease

- Find Schedule Ca 540 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Alter and eSign Schedule Ca 540 Form to ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 schedule ca 540 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule ca 540 form

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Schedule Ca 540 Form and why do I need it?

The Schedule Ca 540 Form is a California-specific tax form that individuals use to report their income and calculate their tax liabilities. It is crucial for taxpayers to accurately complete this form to ensure compliance with state tax laws and optimize their refunds or taxes owed.

-

How can airSlate SignNow help me complete the Schedule Ca 540 Form?

airSlate SignNow provides an intuitive platform for businesses to prepare and eSign the Schedule Ca 540 Form efficiently. With our easy-to-use tools, you can fill out the form electronically, ensuring accuracy and saving time in the process.

-

Is there a cost associated with using airSlate SignNow for the Schedule Ca 540 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. Depending on the features and number of users required, you can choose the plan that best suits your budget while ensuring you can seamlessly manage your Schedule Ca 540 Form.

-

Can I integrate airSlate SignNow with other tools for managing my Schedule Ca 540 Form?

Absolutely! airSlate SignNow integrates with various applications, such as cloud storage services and accounting software, making it easy to manage your Schedule Ca 540 Form alongside your other financial documents. This ensures a streamlined workflow and easy access to all necessary files.

-

What features does airSlate SignNow offer for signing the Schedule Ca 540 Form?

airSlate SignNow offers innovative features like templates, automated workflows, and secure eSignature capabilities. These features simplify the signing process for the Schedule Ca 540 Form, allowing you to collect signatures quickly and securely.

-

Is it safe to eSign the Schedule Ca 540 Form with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and compliance, providing a safe platform for eSigning the Schedule Ca 540 Form. Your information is encrypted and stored securely, ensuring that your sensitive data remains protected against unauthorized access.

-

How do I get started with airSlate SignNow for the Schedule Ca 540 Form?

To get started with airSlate SignNow for the Schedule Ca 540 Form, simply sign up for an account on our website. Once you have an account, you can access all the features needed to prepare and eSign your Schedule Ca 540 Form effortlessly.

Get more for Schedule Ca 540 Form

Find out other Schedule Ca 540 Form

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile