Form 3805V Net Operating Loss NOL Computation and NOL and Disaster Loss LimitationsIndividuals, Estates, and Trusts 2019

What is the Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts

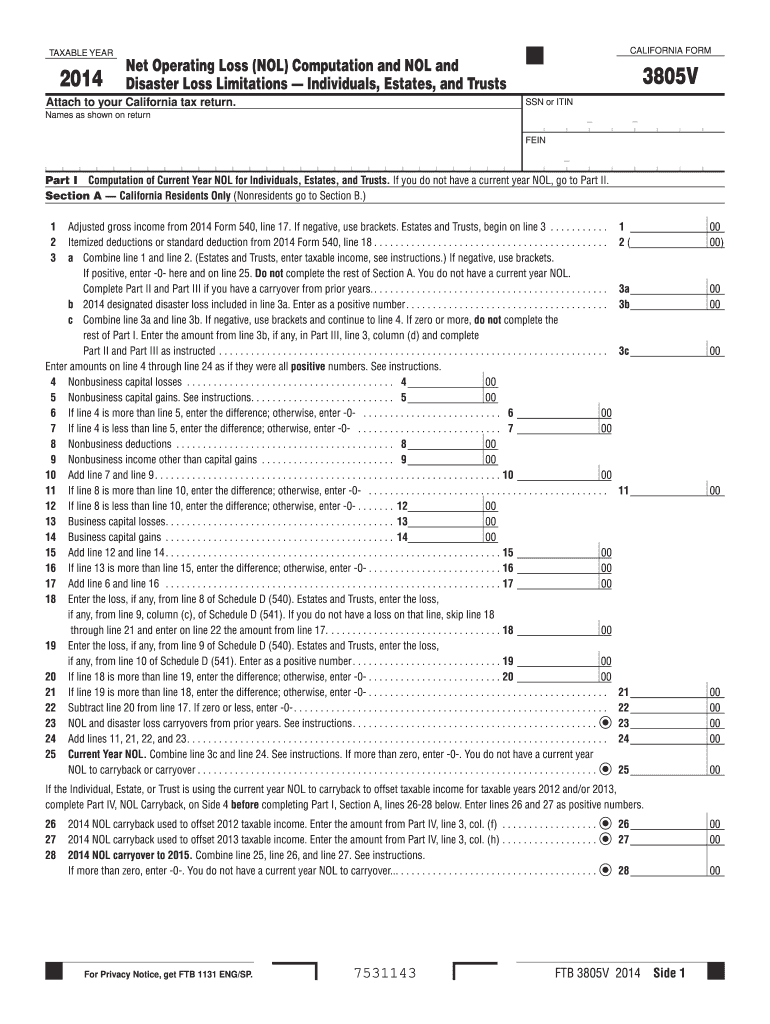

The Form 3805V is a tax form used by individuals, estates, and trusts to compute net operating losses (NOL) and to apply any limitations related to disaster losses. This form is essential for taxpayers who have incurred losses that can offset taxable income in other years. It allows for the calculation of the NOL amount and provides guidelines on how to apply these losses in accordance with IRS regulations.

How to use the Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts

To use Form 3805V effectively, taxpayers must first gather all relevant financial documents that detail their income and losses. The form guides users through the process of calculating their NOL by providing specific lines for entering loss amounts, income, and any applicable adjustments. It is important to follow the instructions carefully to ensure accurate reporting and compliance with IRS requirements.

Steps to complete the Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts

Completing Form 3805V involves several key steps:

- Gather all financial records related to income and losses.

- Fill out the identification section with your name, taxpayer identification number, and other required information.

- Calculate your NOL by entering your total losses and any adjustments on the appropriate lines.

- Complete the sections related to disaster loss limitations if applicable.

- Review the form for accuracy and ensure all necessary information is included.

Legal use of the Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts

The legal use of Form 3805V is governed by IRS regulations, which stipulate how NOLs can be calculated and applied. This form must be completed accurately to ensure that the losses claimed are legitimate and comply with tax laws. Failing to adhere to these regulations can result in penalties or disallowance of the claimed losses.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 3805V. Generally, the form should be submitted along with your tax return for the year in which the NOL occurred. It is crucial to check the IRS guidelines for specific deadlines, as they may vary based on individual circumstances and any extensions that may apply.

Eligibility Criteria

Eligibility to use Form 3805V is primarily determined by the nature of the losses incurred. Individuals, estates, and trusts that have experienced net operating losses or disaster-related losses may qualify. It is important to review IRS guidelines to confirm eligibility and understand any specific conditions that must be met to utilize the form.

Quick guide on how to complete 2014 form 3805v net operating loss nol computation and nol and disaster loss limitationsindividuals estates and trusts

Complete Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsIndividuals, Estates, And Trusts effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsIndividuals, Estates, And Trusts on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsIndividuals, Estates, And Trusts with ease

- Find Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsIndividuals, Estates, And Trusts and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that require printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsIndividuals, Estates, And Trusts and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 3805v net operating loss nol computation and nol and disaster loss limitationsindividuals estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 3805v net operating loss nol computation and nol and disaster loss limitationsindividuals estates and trusts

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 3805V Net Operating Loss NOL Computation and NOL and Disaster Loss Limitations for Individuals, Estates, and Trusts?

Form 3805V is used to compute the Net Operating Loss (NOL) for individuals, estates, and trusts, allowing taxpayers to claim losses that may reduce taxable income. This form is crucial for determining if any disaster loss limitations apply, thereby ensuring accurate tax filings.

-

How can airSlate SignNow help me with Form 3805V Net Operating Loss NOL Computation?

airSlate SignNow offers a user-friendly platform that simplifies the process of eSigning and sending documents related to Form 3805V Net Operating Loss NOL Computation. With our cost-effective solution, you can easily manage your tax documents and ensure they are securely signed and delivered.

-

What features does airSlate SignNow offer for managing Form 3805V related documents?

Our platform includes features like document templates, real-time collaboration, and detailed tracking of document status, all tailored for managing Form 3805V and other tax-related documents. This streamlines the process and enhances productivity for users needing Form 3805V Net Operating Loss NOL Computation.

-

Is there a cost associated with using airSlate SignNow for Form 3805V document management?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, ensuring you get the best value for managing Form 3805V Net Operating Loss NOL Computation and related documents. We provide a cost-effective solution with features that cater to individuals, estates, and trusts.

-

Can I integrate airSlate SignNow with other software for processing Form 3805V?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax preparation software, allowing for easy management of Form 3805V Net Operating Loss NOL Computation and its associated tasks. This ensures a smooth workflow between your documents and your existing tools.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form 3805V?

Using airSlate SignNow for tax-related documents, including Form 3805V, provides efficiency, security, and easy accessibility. Our platform guarantees that your documents are securely eSigned, enhancing your workflow and compliance during tax season.

-

How secure is airSlate SignNow for submitting sensitive tax documents like Form 3805V?

airSlate SignNow employs industry-leading security measures to protect your sensitive documents, including Form 3805V Net Operating Loss NOL Computation. With encrypted communications and secure storage, you can trust that your information is safe.

Get more for Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsIndividuals, Estates, And Trusts

- High risk pregnancy letter from doctor form

- Annexure xii form

- Braden scale 101220187 form

- Vista previa imagenes inces form

- Reg 481 form

- Energieovernamedocument 64884522 form

- Kalpesh chotalia font download form

- Www uslegalforms comform library464507 newnew zealand darts council transfer form fill and sign

Find out other Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsIndividuals, Estates, And Trusts

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself