Ct3m4m Form 2020

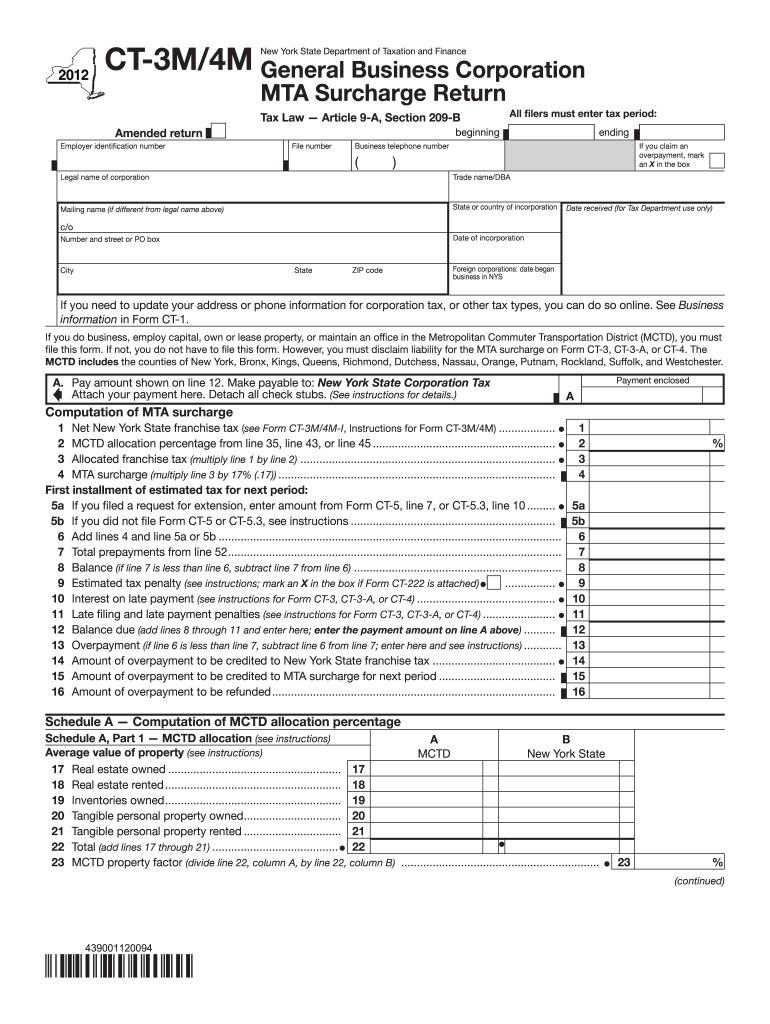

What is the Ct3m4m Form

The Ct3m4m Form is a specific tax form used by businesses in the United States to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations. It is typically utilized by corporations to summarize their financial activities for a given tax year, providing a comprehensive overview of their fiscal performance.

How to use the Ct3m4m Form

Using the Ct3m4m Form involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, accurately fill out the form, ensuring that all income, deductions, and credits are reported correctly. It is important to follow the IRS guidelines closely to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the business.

Steps to complete the Ct3m4m Form

Completing the Ct3m4m Form requires careful attention to detail. Here are the steps to follow:

- Gather financial records, including income and expenses.

- Fill out the identification section with your business information.

- Report total income, including all sources of revenue.

- Detail any deductions applicable to your business operations.

- Calculate the total tax liability based on the provided information.

- Review the form for accuracy before submission.

Legal use of the Ct3m4m Form

The Ct3m4m Form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and maintaining accurate records of all financial transactions reported on the form. Failure to comply with these regulations can result in penalties or audits by the IRS. It is crucial for businesses to understand their obligations regarding this form to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Ct3m4m Form are critical for compliance. Generally, the form must be filed by the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this typically falls on April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Businesses should mark these dates on their calendars to ensure timely submission.

Who Issues the Form

The Ct3m4m Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that businesses have the necessary information to comply with tax laws. It is essential for businesses to refer to the official IRS website or publications for the most current version of the form and any updates to filing procedures.

Quick guide on how to complete ct3m4m 2012 form

Complete Ct3m4m Form effortlessly on any device

Digital document management has become highly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents swiftly without delays. Manage Ct3m4m Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ct3m4m Form with ease

- Find Ct3m4m Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information carefully and then click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, the annoyance of searching for forms, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Ct3m4m Form and guarantee effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct3m4m 2012 form

Create this form in 5 minutes!

How to create an eSignature for the ct3m4m 2012 form

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the Ct3m4m Form and how does it work?

The Ct3m4m Form is a customized document template designed for efficient eSigning and workflow management. With airSlate SignNow, users can fill out, sign, and send this form seamlessly within minutes, ensuring a smooth experience for both senders and recipients.

-

How can I create a Ct3m4m Form for my business?

Creating a Ct3m4m Form is simple with airSlate SignNow. You can start by selecting the template option, customizing the fields according to your needs, and then easily sharing it with your clients or team members for eSigning.

-

What are the pricing options for using the Ct3m4m Form?

airSlate SignNow offers various pricing plans to accommodate different business sizes and requirements. The costs vary depending on the features you need, and you can easily create and manage your Ct3m4m Form with any of these plans at an affordable rate.

-

What features are included with the Ct3m4m Form?

The Ct3m4m Form comes with a range of features including customizable fields, automated reminders, and secure eSignature options. These features enhance document management efficiency and improve user experience, making it easier to get documents signed quickly.

-

What are the benefits of using the Ct3m4m Form over traditional paper forms?

Using the Ct3m4m Form replaces cumbersome paper processes, reducing errors and speeding up the signing process. Additionally, it provides better tracking and management capabilities, ensuring all documents are stored securely and can be accessed easily.

-

Are there integrations available for the Ct3m4m Form?

Yes, the Ct3m4m Form can be integrated with various applications including CRM systems and cloud storage solutions. This allows businesses to streamline their workflows and synchronize data across platforms for improved efficiency.

-

Is the Ct3m4m Form legally binding?

Absolutely, the Ct3m4m Form has the same legal standing as traditional signatures under U.S. law. Using airSlate SignNow ensures that your eSignatures are secure and compliant with legal standards, providing peace of mind for all parties involved.

Get more for Ct3m4m Form

- Mo 1040 es form

- Vaccine lodger forms

- Earths interior worksheet answers form

- Maritime declaration of health form

- Mbon license lookup form

- Where do i update address information in raymond james

- Www parks vic gov au mediaovernight hiking trip intention form grampians national park

- Unique solutions application form march tad

Find out other Ct3m4m Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF