Ga Dept of Revenue Form G 1003 2020

What is the Ga Dept Of Revenue Form G 1003

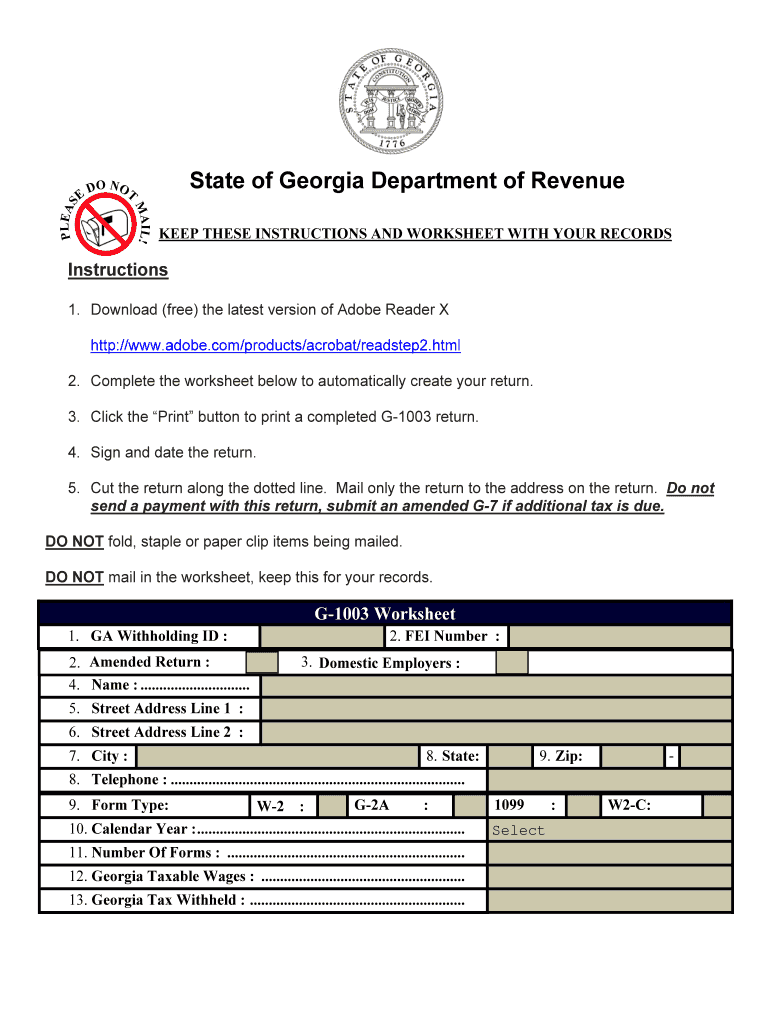

The Ga Dept Of Revenue Form G 1003 is a specific document utilized for tax purposes within the state of Georgia. This form is primarily used by taxpayers to report certain types of income or deductions that may not be included on standard tax forms. Understanding the purpose of Form G 1003 is essential for ensuring compliance with state tax regulations and for accurately reporting financial information to the Georgia Department of Revenue.

How to use the Ga Dept Of Revenue Form G 1003

Using the Ga Dept Of Revenue Form G 1003 involves several key steps. First, you need to gather all relevant financial documents, such as income statements and receipts for deductions. Once you have the necessary information, you can fill out the form by providing accurate details regarding your income and any applicable deductions. It is important to follow the instructions provided with the form carefully to ensure that all information is reported correctly. After completing the form, it can be submitted electronically or via traditional mail, depending on your preference and the requirements set by the Georgia Department of Revenue.

Steps to complete the Ga Dept Of Revenue Form G 1003

Completing the Ga Dept Of Revenue Form G 1003 requires a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather all necessary documents, including previous tax returns, income statements, and receipts for deductions.

- Download the Form G 1003 from the Georgia Department of Revenue website or obtain a physical copy.

- Carefully read the instructions included with the form to understand the requirements.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the Georgia Department of Revenue's e-filing system or mail it to the appropriate address.

Legal use of the Ga Dept Of Revenue Form G 1003

The legal use of the Ga Dept Of Revenue Form G 1003 is governed by state tax laws and regulations. This form must be completed accurately and submitted within the designated filing deadlines to be considered valid. Failure to comply with these regulations may result in penalties or legal repercussions. It is essential to ensure that all information provided on the form is truthful and complete, as discrepancies can lead to audits or other legal issues.

Form Submission Methods

The Ga Dept Of Revenue Form G 1003 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online Submission: Taxpayers can file the form electronically using the Georgia Department of Revenue's e-filing system, which is a convenient and efficient option.

- Mail Submission: Alternatively, the completed form can be printed and mailed to the appropriate address specified by the Georgia Department of Revenue.

- In-Person Submission: Some taxpayers may choose to submit the form in person at a local Department of Revenue office, where assistance may also be available.

Required Documents

To complete the Ga Dept Of Revenue Form G 1003, certain documents are required to support the information reported. These documents typically include:

- Income statements, such as W-2s or 1099s, that detail earnings.

- Receipts or records of deductible expenses that may be claimed.

- Previous tax returns for reference and consistency.

- Any additional documentation requested by the Georgia Department of Revenue.

Quick guide on how to complete ga dept of revenue form g 1003

Effortlessly Prepare Ga Dept Of Revenue Form G 1003 on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without any delays. Manage Ga Dept Of Revenue Form G 1003 on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign Ga Dept Of Revenue Form G 1003 with Ease

- Obtain Ga Dept Of Revenue Form G 1003 and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive details using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Ga Dept Of Revenue Form G 1003 and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ga dept of revenue form g 1003

Create this form in 5 minutes!

How to create an eSignature for the ga dept of revenue form g 1003

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the Ga Dept Of Revenue Form G 1003?

The Ga Dept Of Revenue Form G 1003 is a specific document used for tax reporting in Georgia. It is essential for businesses to complete this form accurately to meet state requirements. airSlate SignNow simplifies the process of signing and sending this important document electronically.

-

How can airSlate SignNow help me with the Ga Dept Of Revenue Form G 1003?

airSlate SignNow provides a user-friendly platform that enables you to eSign and send the Ga Dept Of Revenue Form G 1003 effortlessly. With our tool, you can reduce the time spent on paperwork and ensure that your form complies with all necessary regulations. This eases the filing process and enhances efficiency.

-

Is airSlate SignNow cost-effective for managing the Ga Dept Of Revenue Form G 1003?

Yes, airSlate SignNow offers a cost-effective solution for businesses handling the Ga Dept Of Revenue Form G 1003. Our pricing plans are designed to fit various budgets, ensuring that all users can access the necessary features for effective document management. This makes it an ideal choice for small and large businesses alike.

-

What features does airSlate SignNow offer for the Ga Dept Of Revenue Form G 1003?

airSlate SignNow includes features such as electronic signing, document tracking, and customizable templates specifically for the Ga Dept Of Revenue Form G 1003. You can easily integrate your workflows with our solution, making it convenient to manage all your tax-related documents in one place.

-

Can I integrate airSlate SignNow with other tools for processing the Ga Dept Of Revenue Form G 1003?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to streamline the processing of the Ga Dept Of Revenue Form G 1003 alongside your existing tools. This flexibility enhances productivity and allows for a more organized approach to document management.

-

What are the benefits of using airSlate SignNow for the Ga Dept Of Revenue Form G 1003?

Using airSlate SignNow for the Ga Dept Of Revenue Form G 1003 offers several benefits, including higher efficiency, reduced paper usage, and enhanced security for your documents. The platform allows you to complete and share forms quickly, ensuring compliance with Georgia's tax regulations without the hassle of paper forms.

-

How secure is airSlate SignNow when handling the Ga Dept Of Revenue Form G 1003?

airSlate SignNow prioritizes the security of your documents, including the Ga Dept Of Revenue Form G 1003. We employ robust encryption and security measures to protect your sensitive information during the signing and transmission process, giving you peace of mind when handling important tax forms.

Get more for Ga Dept Of Revenue Form G 1003

Find out other Ga Dept Of Revenue Form G 1003

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document