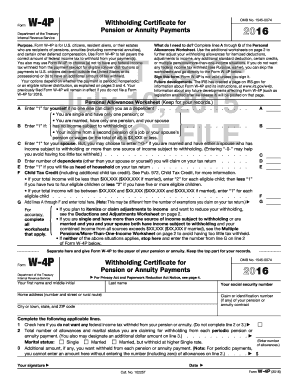

W4p Form

What is the W4P Form

The W4P form, officially known as the Withholding Certificate for Pension or Annuity Payments, is a crucial document used by retirees and beneficiaries in the United States. This form allows individuals to indicate their tax withholding preferences for pension or annuity payments. By completing the W4P form, recipients can ensure that the correct amount of federal income tax is withheld from their payments, helping to avoid underpayment penalties or unexpected tax bills at the end of the year.

How to Use the W4P Form

To effectively use the W4P form, individuals should first gather their personal information, including Social Security numbers and details about their pension or annuity plans. The form requires users to specify their filing status, exemptions, and any additional withholding amounts they wish to request. Once completed, the form should be submitted to the payer of the pension or annuity, ensuring that the withholding preferences are updated accordingly. It is advisable to review the form periodically, especially after significant life changes, to ensure that withholding remains accurate.

Steps to Complete the W4P Form

Completing the W4P form involves several clear steps:

- Gather necessary information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Decide on the number of allowances you wish to claim, which can affect the amount withheld.

- If applicable, specify any additional amount you want withheld from each payment.

- Sign and date the form to validate your information.

- Submit the completed form to your pension or annuity payer.

Legal Use of the W4P Form

The W4P form is legally binding when completed accurately and submitted to the appropriate entity. It complies with IRS regulations, ensuring that the withholding preferences are recognized for tax purposes. It is essential for individuals to understand that any inaccuracies or omissions on the form could lead to incorrect withholding, resulting in potential tax liabilities or penalties. Therefore, using a reliable method to complete and submit the W4P form is crucial for maintaining compliance with tax laws.

Key Elements of the W4P Form

Several key elements are essential to understand when filling out the W4P form:

- Personal Information: This includes your full name, address, and Social Security number.

- Filing Status: You must select your appropriate filing status to determine your withholding rate.

- Allowances: The number of allowances claimed can significantly impact your tax withholding.

- Additional Withholding: If desired, you can specify an additional amount to be withheld from each payment.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W4P form. These guidelines outline how to complete the form accurately, the importance of providing correct information, and the implications of withholding choices. It is recommended that individuals consult the IRS website or a tax professional for the most current information regarding tax withholding and the use of the W4P form to ensure compliance with federal tax laws.

Quick guide on how to complete w4p form 78644500

Complete W4p Form effortlessly on any device

Web-based document management has become prevalent among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage W4p Form on any platform using airSlate SignNow's Android or iOS apps and streamline your document-centric processes today.

How to edit and electronically sign W4p Form with ease

- Find W4p Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or errors necessitating the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign W4p Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4p form 78644500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4P form and how is it used?

The W4P form is a document used for tax withholding purposes by employers in the United States. It helps employees designate their tax withholding preferences, ensuring that the correct amount is withheld from their paychecks. By using airSlate SignNow, businesses can efficiently manage the W4P form process electronically, saving time and reducing paperwork.

-

How can airSlate SignNow streamline my W4P form management?

airSlate SignNow simplifies the management of the W4P form by allowing users to send, sign, and store documents electronically. This solution reduces the hassle of traditional paper processes, enabling quick access and improved organization. With airSlate SignNow, businesses can ensure that all W4P forms are completed and stored securely.

-

What are the pricing options for using airSlate SignNow for W4P form processing?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, making it cost-effective for managing W4P form processes. Each plan includes features that enhance document management and eSignature capabilities. You can choose a plan that suits your organization’s size and document volume.

-

Does airSlate SignNow integrate with other software for W4P form handling?

Yes, airSlate SignNow offers integrations with various business tools and applications to enhance the handling of W4P forms. This allows users to connect seamlessly with platforms like CRMs, accounting software, and more, ensuring a cohesive workflow. Integrations can help streamline processes and further reduce administrative burdens.

-

What are the benefits of using airSlate SignNow for W4P forms?

Using airSlate SignNow for W4P forms provides numerous benefits, including improved efficiency and reduced turnaround time. The electronic signature feature ensures that forms are signed quickly and stored securely, while easy tracking keeps you informed about document status. Overall, it enhances the user experience for both employers and employees.

-

Is it secure to manage W4P forms with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect all W4P forms and sensitive data. With encryption, secure storage, and compliance with regulations, you can trust that your documents are safeguarded against unauthorized access. Your information's confidentiality and security are a top priority.

-

Can I customize the W4P form template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the W4P form template to fit your specific business needs. You can add your company logo, modify fields, and adjust settings to ensure a personalized experience for users. Customization helps align the form with your brand and makes it more user-friendly.

Get more for W4p Form

- Aiiavcom form

- Statement of finacial condition for ky rev dept form

- 14144adoc dshs wa form

- Form 33ha utah department of workforce services utahgov jobs utah

- Download form ut1 ftc from the tribunals tribunalsgovuk

- Conditional waiver and release upon final payment jt wimsatt form

- Nyc uxs nycgov nyc form

- Ngb 4100 1b r e formpdffillercom

Find out other W4p Form

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement