Revenue Form K 4 2020

What is the Revenue Form K-4

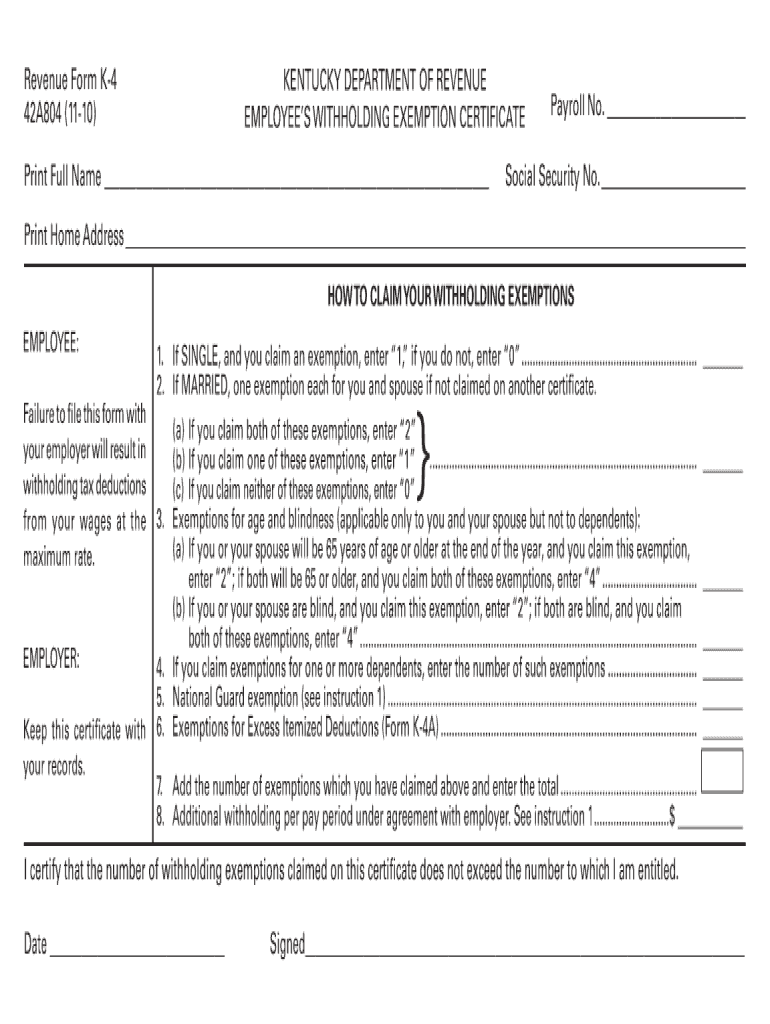

The Revenue Form K-4 is a tax document used in the United States, primarily for withholding tax purposes. This form is essential for employers who need to calculate the correct amount of state income tax to withhold from employees' paychecks. The K-4 form collects information about the employee's filing status, exemptions, and additional withholding preferences. By accurately completing this form, employees can ensure that the correct amount of taxes is withheld, which can help avoid underpayment or overpayment of taxes throughout the year.

How to use the Revenue Form K-4

Using the Revenue Form K-4 involves several straightforward steps. First, employees should obtain the form from their employer or the relevant state tax authority. Next, they need to fill out personal information, including their name, address, and Social Security number. Employees must also indicate their filing status and any additional withholding amounts they wish to request. Once completed, the form should be submitted to the employer, who will use the information to adjust the withholding on the employee's paycheck.

Steps to complete the Revenue Form K-4

Completing the Revenue Form K-4 requires careful attention to detail. Follow these steps:

- Obtain the form from your employer or state tax website.

- Fill in your personal information, including name, address, and Social Security number.

- Select your filing status, such as single, married, or head of household.

- Indicate the number of exemptions you are claiming.

- Specify any additional amount you wish to withhold from each paycheck.

- Review the completed form for accuracy.

- Submit the form to your employer for processing.

Legal use of the Revenue Form K-4

The Revenue Form K-4 is legally binding when completed and submitted correctly. It complies with state tax regulations, ensuring that employers withhold the appropriate amount of state income tax from employees' wages. To maintain its legal validity, it is crucial that employees provide accurate information and update the form whenever their personal or financial circumstances change, such as marriage, divorce, or changes in dependents.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Revenue Form K-4 is essential for compliance. Generally, employees should submit their K-4 form to their employer at the start of the tax year or whenever they experience a change in their tax situation. Employers are responsible for ensuring that the correct withholdings are made throughout the year, so timely submission of the K-4 is crucial. Additionally, employees should be aware of state tax filing deadlines to avoid penalties.

Who Issues the Form

The Revenue Form K-4 is typically issued by state tax authorities. Employers may also provide the form to their employees as part of the onboarding process or during annual tax preparations. It is important for employees to ensure they are using the most current version of the form, as tax regulations and requirements may change from year to year.

Quick guide on how to complete revenue form k 4

Effortlessly Complete Revenue Form K 4 on Any Device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to generate, edit, and electronically sign your documents promptly without any hold-ups. Handle Revenue Form K 4 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Alter and Electronically Sign Revenue Form K 4 with Ease

- Obtain Revenue Form K 4 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive details using tools that airSlate SignNow specifically offers.

- Create your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Amend and electronically sign Revenue Form K 4 to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenue form k 4

Create this form in 5 minutes!

How to create an eSignature for the revenue form k 4

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Revenue Form K 4?

The Revenue Form K 4 is a crucial document used in various tax-related processes, and airSlate SignNow allows users to efficiently handle these forms. With our platform, businesses can easily prepare, send, and eSign the Revenue Form K 4, streamlining compliance and record-keeping.

-

How can airSlate SignNow help with the management of Revenue Form K 4?

airSlate SignNow provides tools to help manage the Revenue Form K 4 by offering customizable templates and secure eSignature options. This reduces the time spent on paperwork and minimizes errors, ensuring that your forms are completed accurately and swiftly.

-

What are the pricing options available for using airSlate SignNow with Revenue Form K 4?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes to manage essential documents like the Revenue Form K 4. These plans provide flexibility in terms of features and user access, ensuring you only pay for what you need.

-

Are there any integrations available for managing Revenue Form K 4?

Yes, airSlate SignNow integrates seamlessly with various platforms that are crucial for managing the Revenue Form K 4. These integrations enhance workflows, allowing users to connect with tools they already use, such as CRM systems and cloud storage services.

-

What features does airSlate SignNow offer for the Revenue Form K 4?

airSlate SignNow features include customizable templates, automated workflows, and secure eSigning, all designed to simplify the handling of the Revenue Form K 4. These features enhance productivity and ensure your documents are processed efficiently.

-

Can I track the status of my Revenue Form K 4 with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their Revenue Form K 4 in real-time. This feature provides visibility into the signing process, ensuring that you are always informed about the progress of your documents.

-

Is airSlate SignNow secure for handling sensitive Revenue Form K 4 information?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive information, including the Revenue Form K 4. Our platform employs advanced encryption and secure storage to protect your documents and ensure peace of mind.

Get more for Revenue Form K 4

- Dd form 2866 instructions

- Sce owner authorization agreement form

- Achievers focusing system form

- Pennsylvania form dl 9105

- Preliminary change of ownership form los angeles county

- Noven enrollment form secuado

- Custody statutes are included after the complaint form

- Petition for modification of legal decision making andor parenting form

Find out other Revenue Form K 4

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement