590 Form 2020

What is the 590 Form

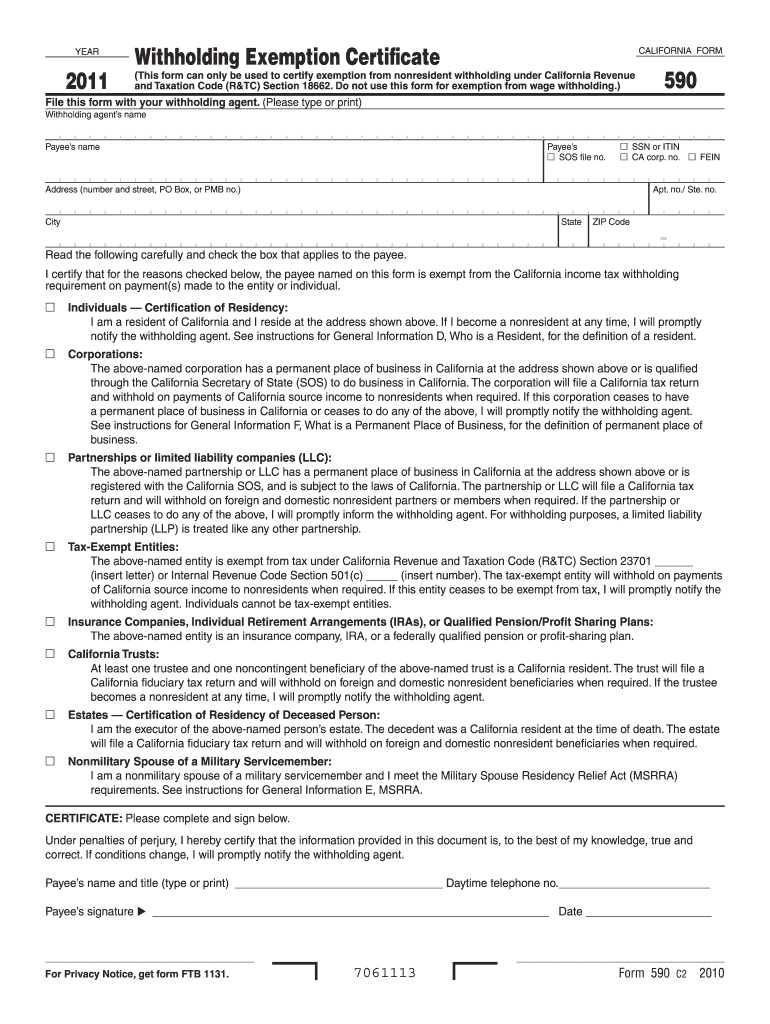

The 590 Form is a tax document used in the United States primarily by individuals and businesses to report certain types of income and tax exemptions. This form is essential for those who need to declare their eligibility for specific tax benefits or exemptions, particularly in relation to withholding tax on payments made to them. Understanding the purpose and implications of the 590 Form is crucial for ensuring compliance with IRS regulations.

How to use the 590 Form

Using the 590 Form involves several steps to ensure accurate reporting and compliance. First, individuals must determine their eligibility for the exemptions or benefits outlined in the form. Next, they should gather all necessary documentation and information required to complete the form accurately. Once the form is filled out, it must be submitted to the appropriate tax authority, ensuring that all deadlines are met to avoid penalties.

Steps to complete the 590 Form

Completing the 590 Form requires careful attention to detail. Here are the key steps:

- Review the form's instructions to understand the requirements.

- Gather necessary personal and financial information, including Social Security numbers and income details.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check for any errors or omissions before submission.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the 590 Form

The legal use of the 590 Form is governed by IRS guidelines and regulations. It is crucial to ensure that the information provided is truthful and complete, as inaccuracies can lead to legal repercussions. The form serves as a declaration of eligibility for tax exemptions, and improper use may result in penalties or audits. Therefore, understanding the legal implications of the information reported on the 590 Form is essential for compliance.

Key elements of the 590 Form

The 590 Form includes several key elements that are vital for accurate completion. These elements typically include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Types of income being reported and relevant amounts.

- Exemption Claims: Specific exemptions being requested based on eligibility.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the 590 Form are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, especially during tax season, to ensure timely submission.

Quick guide on how to complete 590 2011 form

Complete 590 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 590 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign 590 Form without hassle

- Locate 590 Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign 590 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 590 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 590 2011 form

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is a 590 Form and why do I need it?

The 590 Form is used to claim exemptions from California withholding on certain types of income. Businesses and individuals often need this form to ensure compliance with tax regulations and to avoid unnecessary withholding. Properly filing the 590 Form can help streamline your tax processes and save you money.

-

How does airSlate SignNow facilitate the signing of the 590 Form?

airSlate SignNow simplifies the signing process for the 590 Form by providing a user-friendly platform where documents can be uploaded, signed, and securely shared. Our eSignature solution ensures that your 590 Form is signed in compliance with legal standards, making it both efficient and reliable for your business needs.

-

Is there a cost associated with using airSlate SignNow for the 590 Form?

Yes, while airSlate SignNow offers several pricing plans, you can select one that suits your business's needs and budget for processing the 590 Form. Our plans are designed to be cost-effective, providing excellent value for the features and security we offer. You can explore various options to find the best fit for your organization.

-

What are the key features of airSlate SignNow for managing the 590 Form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and mobile accessibility, all of which are beneficial for managing the 590 Form. Our platform allows for easy tracking of document status and facilitates quick retrieval of signed forms. This efficiency can save your team time and enhance productivity.

-

Can I integrate airSlate SignNow with other software while processing the 590 Form?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, allowing you to manage the 590 Form and other documents effortlessly. Whether you're using CRM systems or project management tools, our integrations help streamline your workflow and ensure that eSignatures are collected quickly and efficiently.

-

What benefits does using airSlate SignNow provide for the 590 Form?

Using airSlate SignNow for the 590 Form offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our electronic signature solution is legally binding and ensures that your documents are handled with the utmost care. Additionally, it helps maintain compliance with IRS standards, making tax filing easier and less stressful.

-

Is my information safe when signing the 590 Form with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your information. We implement industry-standard encryption and strict access controls to protect your documents, including the 590 Form. You can trust that your data is secure, allowing you to focus on your business without worrying about potential security bsignNowes.

Get more for 590 Form

- Sgb functionality tool form

- Sso meal count form

- 1921 canada census blank form

- Emergency lighting test sheet pdf form

- Dubai employment visa sample pdf form

- N8 form download

- Bhav uni form

- University of turbat kech public library photo 1x1 library membership form i hereby apply for the membership and permission to

Find out other 590 Form

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement