Irs K 1 565 Form Printable 2019

What is the IRS K-1 565 Form Printable

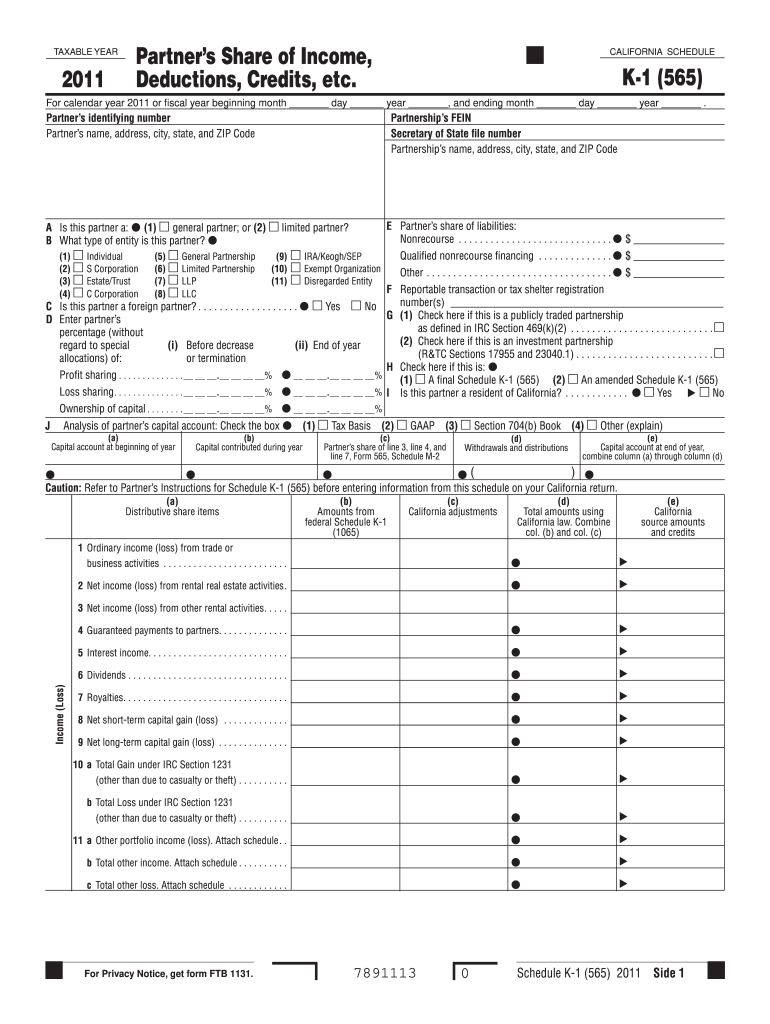

The IRS K-1 565 Form is a tax document used to report income, deductions, and credits from partnerships and S corporations. This form is essential for partners in a partnership or shareholders in an S corporation to accurately report their share of the entity's income on their individual tax returns. The K-1 565 form provides detailed information regarding the income allocation, ensuring that all partners and shareholders are aware of their tax responsibilities. Understanding this form is crucial for compliance with IRS regulations and for accurate tax filing.

How to Use the IRS K-1 565 Form Printable

Using the IRS K-1 565 Form involves several steps to ensure accurate reporting of income. First, partners or shareholders should receive the completed form from the partnership or S corporation. It is important to review the information for accuracy, including the reported income, deductions, and credits. Once verified, the data should be entered into the appropriate sections of the individual tax return, typically on Form 1040. If there are discrepancies or questions regarding the information, it is advisable to consult with a tax professional for clarification and guidance.

Steps to Complete the IRS K-1 565 Form Printable

Completing the IRS K-1 565 Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial records, including income statements and previous tax returns.

- Fill out the entity information, including the name, address, and Employer Identification Number (EIN).

- Report the partner's or shareholder's share of income, deductions, and credits in the designated sections.

- Ensure all calculations are accurate and reflect the partnership's or S corporation's financial activities.

- Review the completed form for any errors before submitting it to the IRS and providing copies to partners or shareholders.

Legal Use of the IRS K-1 565 Form Printable

The IRS K-1 565 Form is legally binding when filled out correctly and submitted in compliance with IRS regulations. It serves as an official record of income distribution among partners and shareholders, which is essential for tax reporting purposes. To ensure legal validity, the form must be signed by an authorized representative of the partnership or S corporation. Additionally, both the entity and the partners or shareholders must retain copies of the form for their records, as it may be necessary for future audits or inquiries by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS K-1 565 Form are critical to avoid penalties. Generally, partnerships and S corporations must issue K-1 forms to their partners and shareholders by March 15 of the following tax year. Recipients should then use the information to complete their individual tax returns, which are typically due on April 15. It is essential to keep track of these dates to ensure timely filing and compliance with IRS regulations.

Who Issues the Form

The IRS K-1 565 Form is issued by partnerships and S corporations to their partners and shareholders. It is the responsibility of the entity to prepare and distribute the form, ensuring that all relevant income and deduction information is accurately reported. Each partner or shareholder receives their own K-1, reflecting their specific share of the entity's financial activities. This process is crucial for maintaining transparency and compliance with tax obligations.

Quick guide on how to complete irs k 1 565 form printable 2011

Complete Irs K 1 565 Form Printable effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Irs K 1 565 Form Printable on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to modify and electronically sign Irs K 1 565 Form Printable with ease

- Find Irs K 1 565 Form Printable and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal force as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs K 1 565 Form Printable to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs k 1 565 form printable 2011

Create this form in 5 minutes!

How to create an eSignature for the irs k 1 565 form printable 2011

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the IRS K 1 565 Form Printable?

The IRS K 1 565 Form Printable is a tax document used to report income, deductions, and credits from partnerships. This form allows partners to report their share of the partnership's income on their tax returns. Utilizing the IRS K 1 565 Form Printable ensures accurate tax reporting and compliance.

-

How can I access the IRS K 1 565 Form Printable?

You can easily access the IRS K 1 565 Form Printable by visiting the official IRS website or through platforms like airSlate SignNow that offer document management services. Simply download the form, fill it out, and then eSign your document to streamline the submission process.

-

Is the IRS K 1 565 Form Printable free to use?

Yes, the IRS K 1 565 Form Printable can be downloaded for free from the IRS website. However, when using services like airSlate SignNow for e-signing and document management, there are cost-effective pricing options available that provide added features and convenience.

-

What features does airSlate SignNow offer for the IRS K 1 565 Form Printable?

airSlate SignNow provides a comprehensive set of features for managing the IRS K 1 565 Form Printable, including easy document editing, e-signature capabilities, and seamless sharing options. Users can collaborate in real-time and securely track changes to ensure compliance and accuracy.

-

How can I integrate the IRS K 1 565 Form Printable with my existing tools?

airSlate SignNow offers robust integration options with popular tools and applications, allowing seamless use of the IRS K 1 565 Form Printable within your existing workflow. This integration helps streamline processes and enhances productivity from within the tools you already use.

-

What are the benefits of using airSlate SignNow for the IRS K 1 565 Form Printable?

Using airSlate SignNow for the IRS K 1 565 Form Printable maximizes efficiency through its user-friendly interface and fast e-signature process. You can save time and reduce paperwork hassles, allowing you to focus on your core business activities while ensuring all documents are securely completed.

-

Can I track the status of my IRS K 1 565 Form Printable with airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily track the status of your IRS K 1 565 Form Printable in real-time. You’ll receive notifications when your document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Irs K 1 565 Form Printable

- Example of a nyda job filled form

- Public forum debate ballot form

- Dhs 5223 eng form

- Form of faith mrcp

- Student handbook northside christian academy northsidechristianacademy form

- Felony conviction notice form austin isd archive austinisd

- Our annual field day grades 1 8 will be held on school stmax form

- 24 printable affidavit of domicile wells fargo forms and

Find out other Irs K 1 565 Form Printable

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe