Form 592 V 2021

What is the Form 592 V

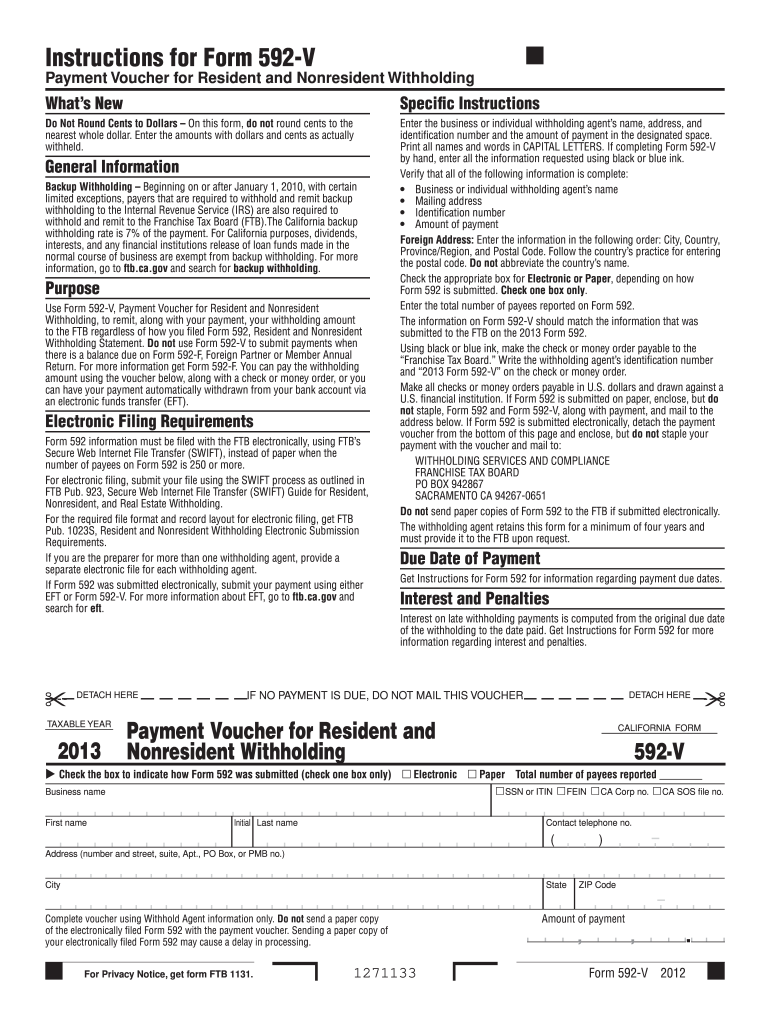

The Form 592 V is a tax form used in the United States for reporting and paying California withholding tax on certain payments made to non-residents. This form is particularly relevant for businesses and individuals who make payments to non-residents for services performed in California. It ensures compliance with state tax laws and helps facilitate the proper withholding and remittance of taxes owed to the state. Understanding this form is essential for accurate tax reporting and to avoid potential penalties.

How to use the Form 592 V

Using the Form 592 V involves several steps to ensure that all required information is accurately reported. First, gather necessary information about the payee, including their name, address, and taxpayer identification number. Next, determine the amount of payment made to the non-resident and calculate the appropriate withholding tax based on the applicable rates. Once the calculations are complete, fill out the form, ensuring all sections are completed accurately. Finally, submit the form along with the payment to the California Franchise Tax Board by the specified deadline.

Steps to complete the Form 592 V

Completing the Form 592 V requires careful attention to detail. Follow these steps:

- Gather all necessary information about the payee, including their identification and payment details.

- Calculate the withholding tax amount based on the payment made and the applicable rate.

- Fill out the form, ensuring that all sections are completed correctly.

- Review the form for accuracy to prevent errors that could lead to penalties.

- Submit the completed form along with the payment to the California Franchise Tax Board.

Legal use of the Form 592 V

The legal use of the Form 592 V is governed by California tax laws, which require businesses to withhold taxes on payments made to non-residents. This form serves as a declaration of the amount withheld and ensures that the state receives the appropriate tax revenue. Failure to use this form correctly can result in penalties, including fines and interest on unpaid taxes. Therefore, it is crucial for businesses to understand their obligations under California law when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 V are critical to ensure compliance with California tax regulations. Generally, the form must be submitted by the last day of the month following the end of the quarter in which the payment was made. For example, if a payment is made in the first quarter, the form must be filed by April 30. It is important to keep track of these deadlines to avoid late fees and penalties.

Required Documents

When completing the Form 592 V, several documents may be required to support the information provided. These documents typically include:

- Payment records showing the amount paid to the non-resident.

- Identification documents for the payee, such as a Social Security number or Employer Identification Number.

- Any relevant contracts or agreements outlining the terms of the payment.

Having these documents readily available can facilitate the accurate completion of the form and ensure compliance with tax requirements.

Quick guide on how to complete form 592 v 2013

Complete Form 592 V effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form 592 V on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form 592 V with ease

- Locate Form 592 V and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign function, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Form 592 V and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 592 v 2013

Create this form in 5 minutes!

How to create an eSignature for the form 592 v 2013

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is Form 592 V and why is it important?

Form 592 V is a tax form used to report California source income paid to nonresidents. It's important for ensuring compliance with California tax laws and avoiding penalties. Properly filing this form helps businesses manage their withholding obligations efficiently.

-

How does airSlate SignNow simplify the process of filling out Form 592 V?

airSlate SignNow simplifies the process of filling out Form 592 V by offering customizable templates and an intuitive interface. This allows users to quickly input necessary information, reducing the chances of errors and streamlining the completion of the form. Enhanced workflow features also help facilitate collaboration among team members.

-

What are the pricing options for using airSlate SignNow in relation to Form 592 V?

airSlate SignNow offers competitive pricing plans tailored to various business needs, including features for managing Form 592 V. Subscriptions typically include options for teams and enterprises, ensuring that users get the necessary tools without overspending. Check our website for detailed pricing information and available plans.

-

Can I integrate airSlate SignNow with other software for Form 592 V management?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to streamline Form 592 V management. This capability enhances document workflow by allowing users to connect with tools they are already using, such as CRM and accounting software. Integrations help reduce manual data entry and improve operational efficiency.

-

What features does airSlate SignNow offer for electronic signatures on Form 592 V?

airSlate SignNow provides legally binding electronic signatures, ensuring that Form 592 V can be signed quickly and securely. Users benefit from features like signature tracking, templates, and reminders, making the entire signing process smoother. This not only saves time but also enhances the safety and confidentiality of sensitive tax information.

-

How can airSlate SignNow improve my team's efficiency in handling Form 592 V?

By using airSlate SignNow, your team can improve efficiency when handling Form 592 V through automation and collaboration features. The platform allows multiple users to work on documents simultaneously, track changes, and streamline approvals. This reduces the back-and-forth often associated with traditional paperwork, helping your team stay organized and focused.

-

Is there customer support available for assistance with Form 592 V on airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support for users navigating Form 592 V. Our team is accessible through various channels, including live chat, email, and phone, providing timely assistance. Whether you need help with technical issues or questions about form management, support is always available to help you.

Get more for Form 592 V

Find out other Form 592 V

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word