Form 592 V, Payment Voucher for Resident and Nonresident Withholding 2025-2026

Understanding Form 592 V: Payment Voucher for Resident and Nonresident Withholding

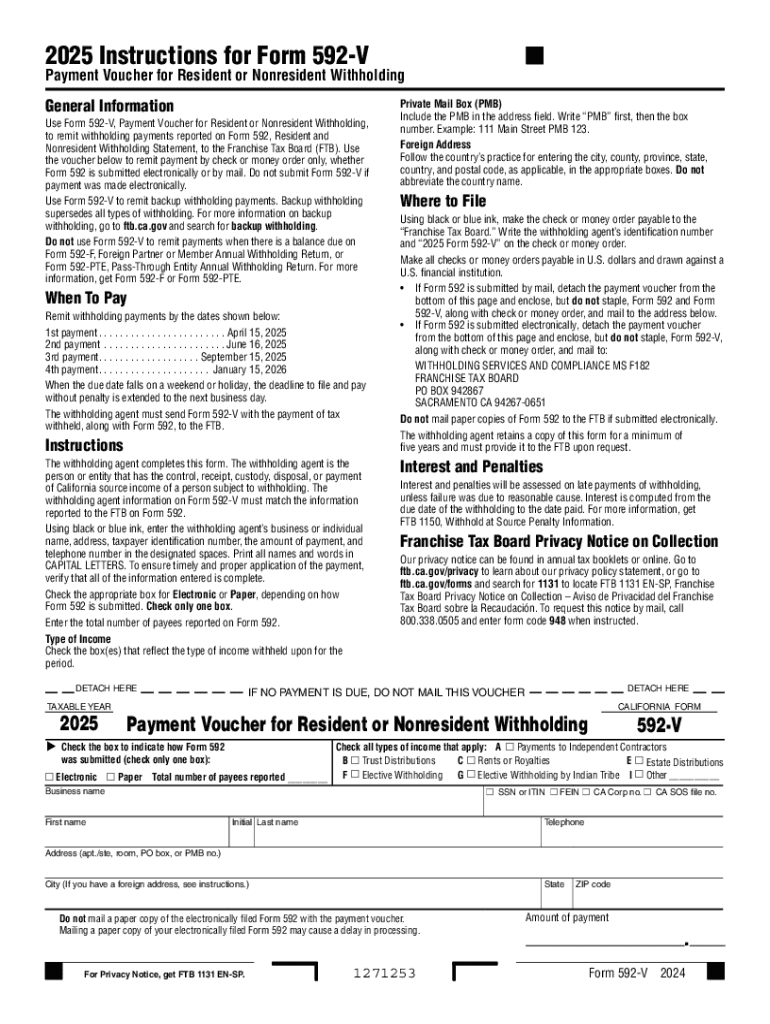

The Form 592 V serves as a payment voucher for withholding taxes applicable to both resident and nonresident individuals in the United States. This form is primarily used by businesses and individuals who are required to withhold state taxes from payments made to nonresidents. It ensures that the appropriate taxes are collected and submitted to the state, helping to maintain compliance with tax regulations.

Steps to Complete Form 592 V

Completing the Form 592 V involves several key steps:

- Gather Necessary Information: Collect details about the payee, including their name, address, and taxpayer identification number.

- Calculate Withholding Amount: Determine the amount to be withheld based on the payment type and applicable tax rates.

- Fill Out the Form: Enter the required information accurately, ensuring all fields are completed.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to penalties.

- Submit the Form: Follow the appropriate submission methods, whether online or via mail.

How to Obtain Form 592 V

Form 592 V can be obtained through various channels. It is available for download from the official state tax authority website. Additionally, physical copies can often be requested directly from tax offices or obtained through tax professionals. Ensuring you have the correct and most current version of the form is crucial for compliance.

Key Elements of Form 592 V

The key elements of Form 592 V include:

- Payee Information: Name, address, and taxpayer identification number of the individual receiving payment.

- Withholding Amount: The total amount withheld for state taxes.

- Payment Details: Type of payment and date of payment.

- Signature: The form must be signed by the payer to validate the information provided.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with Form 592 V. Typically, the form must be submitted by the due date of the payment being reported. Additionally, specific deadlines may vary based on the type of payment or the taxpayer’s filing schedule. Keeping track of these dates helps avoid penalties and ensures timely compliance.

Legal Use of Form 592 V

The legal use of Form 592 V is governed by state tax regulations. It is essential for businesses and individuals to understand the legal implications of withholding taxes and submitting this form. Proper use ensures compliance with state laws and helps avoid potential legal issues related to tax withholding and reporting.

Create this form in 5 minutes or less

Find and fill out the correct form 592 v payment voucher for resident and nonresident withholding

Create this form in 5 minutes!

How to create an eSignature for the form 592 v payment voucher for resident and nonresident withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 592 form 2025 and why is it important?

The 592 form 2025 is a crucial document for reporting California source income for non-residents. It helps ensure compliance with state tax regulations and is essential for accurate tax reporting. Understanding its requirements can save businesses from potential penalties.

-

How can airSlate SignNow assist with the 592 form 2025?

airSlate SignNow streamlines the process of sending and eSigning the 592 form 2025. Our platform allows users to easily upload, fill out, and send the form securely, ensuring that all necessary signatures are obtained promptly. This simplifies compliance and enhances efficiency.

-

What are the pricing options for using airSlate SignNow for the 592 form 2025?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Whether you are a small business or a large enterprise, our plans provide cost-effective solutions for managing documents like the 592 form 2025. Visit our pricing page for detailed information.

-

Are there any integrations available for the 592 form 2025 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage the 592 form 2025 efficiently. This integration helps streamline document management and storage.

-

What features does airSlate SignNow offer for managing the 592 form 2025?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for the 592 form 2025. These tools help ensure that your documents are organized and accessible, making the signing process faster and more efficient.

-

Can I use airSlate SignNow on mobile devices for the 592 form 2025?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage the 592 form 2025 on the go. Whether you are using a smartphone or tablet, you can easily send, sign, and track documents from anywhere.

-

What are the benefits of using airSlate SignNow for the 592 form 2025?

Using airSlate SignNow for the 592 form 2025 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are handled securely while simplifying the signing process, which can lead to improved compliance.

Get more for Form 592 V, Payment Voucher For Resident And Nonresident Withholding

- Teacher lesson reflection form

- Printable ppd form

- Ideal protein product list form

- Investment declaration form

- Jefferson parish occupational license form

- West haven pistol permit application form

- Www smartpractice comshopcategoryt r u e test ready to use patch test panels smartpractice form

- Weblink ocdsb caweblink0workplace violence reporting form form 733 appendix a to pr

Find out other Form 592 V, Payment Voucher For Resident And Nonresident Withholding

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement