Ca Form 592 V Fill Out & Sign Online DocHub 2023

Understanding the 2024 Form 592 V

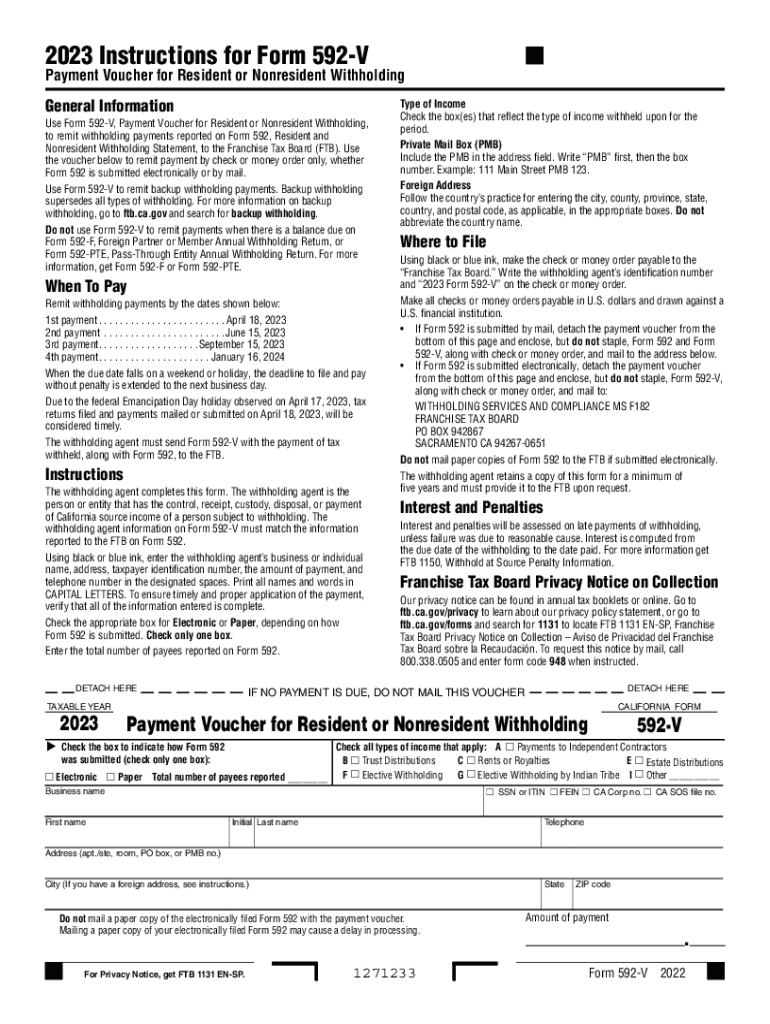

The 2024 Form 592 V is a critical document used for reporting California source income paid to non-residents. This form is essential for ensuring compliance with California tax laws. It is primarily utilized by businesses and individuals who make payments to non-residents, allowing them to report and remit withholding taxes appropriately. Understanding the requirements and proper usage of this form can help avoid penalties and ensure smooth processing with the California Franchise Tax Board.

Steps to Complete the 2024 Form 592 V

Completing the 2024 Form 592 V involves several key steps:

- Gather Information: Collect all necessary information about the payee, including their name, address, and taxpayer identification number.

- Report Payments: Enter the total amount of payments made to the non-resident during the tax year.

- Calculate Withholding: Determine the appropriate withholding amount based on the payment type and applicable tax rates.

- Complete the Form: Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Review and Sign: Double-check the information for accuracy and sign the form before submission.

Filing Deadlines for the 2024 Form 592 V

Timely filing of the 2024 Form 592 V is crucial to avoid penalties. The form must be submitted by the due date of the tax return for the year in which the payments were made. Typically, this means the form is due on or before the fifteenth day of the month following the end of the tax year. It is advisable to check the California Franchise Tax Board's website for any updates or changes to deadlines.

Legal Use of the 2024 Form 592 V

The 2024 Form 592 V is legally binding when completed correctly and submitted on time. It serves as evidence of the withholding tax obligations met by the payer. To ensure its legal validity, it is essential to comply with all relevant tax regulations and maintain accurate records of all transactions reported on the form. Failure to adhere to these regulations may result in penalties or audits.

Required Documents for Completing the 2024 Form 592 V

To complete the 2024 Form 592 V, you will need several documents:

- Payee Information: Taxpayer identification number and contact details of the non-resident.

- Payment Records: Documentation of all payments made to the non-resident during the tax year.

- Tax Withholding Rates: Reference materials for applicable withholding rates based on the type of payment.

Penalties for Non-Compliance with the 2024 Form 592 V

Non-compliance with the filing requirements of the 2024 Form 592 V can lead to significant penalties. These may include fines for late submission, failure to file, or inaccuracies in reporting. It is important to be aware of these consequences and ensure that all information is submitted accurately and on time to avoid financial repercussions.

Quick guide on how to complete ca form 592 v fill out ampamp sign online dochub

Effortlessly manage Ca Form 592 V Fill Out & Sign Online DocHub on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly and without interruptions. Handle Ca Form 592 V Fill Out & Sign Online DocHub on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Ca Form 592 V Fill Out & Sign Online DocHub with ease

- Locate Ca Form 592 V Fill Out & Sign Online DocHub and click Get Form to initiate the process.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Ca Form 592 V Fill Out & Sign Online DocHub to ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca form 592 v fill out ampamp sign online dochub

Create this form in 5 minutes!

How to create an eSignature for the ca form 592 v fill out ampamp sign online dochub

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 592 v 2024 and why is it important?

The form 592 v 2024 is a tax form required for reporting California source income for non-resident individuals and entities. It's important because it ensures compliance with California tax laws and minimizes the risk of penalties. Understanding how to correctly fill out this form can help streamline your tax reporting process.

-

How can airSlate SignNow simplify the completion of form 592 v 2024?

airSlate SignNow simplifies the completion of form 592 v 2024 by providing user-friendly templates and tools for electronic signatures. With our solution, you can easily collaborate with your team and clients, ensuring that all necessary signatures are obtained promptly. This streamlines the filing process, saving you time and effort.

-

What features does airSlate SignNow offer for managing form 592 v 2024?

airSlate SignNow offers features such as customizable templates, document tracking, and in-app notifications, all tailored to assist with managing the form 592 v 2024. These features enhance collaboration and make it easier to ensure that all necessary information has been completed correctly. Additionally, our platform supports secure signing, ensuring document integrity.

-

Is airSlate SignNow a cost-effective solution for form 592 v 2024 processing?

Yes, airSlate SignNow is a cost-effective solution for processing form 592 v 2024. With a range of pricing plans, we cater to businesses of all sizes, ensuring that you only pay for what you need. This affordability allows you to streamline your document management while staying within budget.

-

Can I integrate airSlate SignNow with other software for form 592 v 2024?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, enhancing your workflow when dealing with form 592 v 2024. Whether you're using CRM tools or accounting software, our integrations help centralize your documentation processes, making it easier to manage all related tasks from one place.

-

What benefits does airSlate SignNow provide for eSigning form 592 v 2024?

eSigning form 592 v 2024 with airSlate SignNow provides enhanced speed and convenience while ensuring legal compliance. Our platform allows for rapid turnaround times and eliminates the need for physical signatures, which means you can finalize your documents without delays. Plus, it's accessible from any device, making it flexible for your business needs.

-

How secure is airSlate SignNow when handling form 592 v 2024?

airSlate SignNow prioritizes security when handling form 592 v 2024. We implement advanced security measures including encryption, secure cloud storage, and access controls to protect your sensitive information. This ensures that your documents are safe from unauthorized access while maintaining compliance with regulations.

Get more for Ca Form 592 V Fill Out & Sign Online DocHub

- Bojangles employee handbook form

- Guarantor form for car hire purchase

- Da 4856 fillable form

- Presbyterian association of musicians salary guidelines form

- Citibank nigeria account opening form

- Aditya birla mutual fund empanelment form

- Classification of newborns mead johnson nutrition form

- Futa were form

Find out other Ca Form 592 V Fill Out & Sign Online DocHub

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template