2021 Form 592 V, Payment Voucher for Resident and Nonresident Withholding 2021

What is the 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding

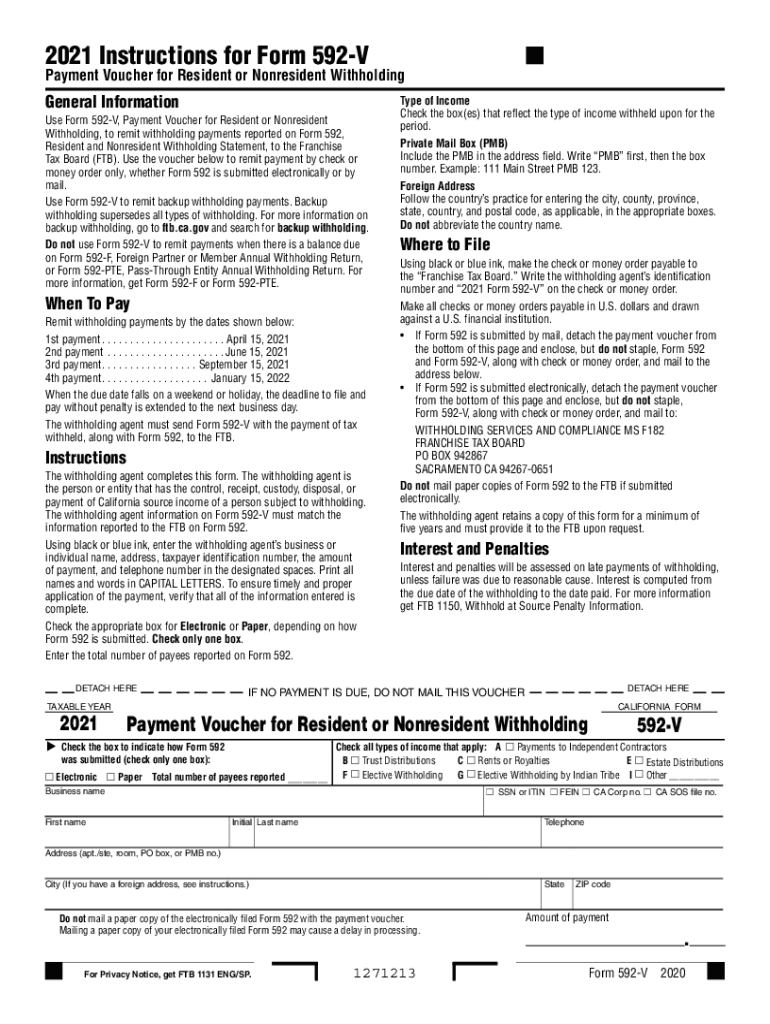

The 2021 Form 592 V serves as a payment voucher for both resident and nonresident withholding in the state of California. This form is essential for individuals and entities that need to report and remit withholding taxes on payments made to nonresidents. It ensures compliance with California tax laws by providing a structured method to submit these payments. The form is particularly relevant for businesses and individuals who engage in transactions that require withholding, such as rental income, royalties, and certain types of compensation.

Steps to complete the 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding

Completing the 2021 Form 592 V involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the payment being made, including the recipient's details and the amount withheld. Next, accurately fill in the payer's information, including name, address, and taxpayer identification number. Then, enter the total amount of the payment and the amount withheld. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority.

Legal use of the 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding

The legal use of the 2021 Form 592 V is crucial for ensuring that withholding taxes are reported and paid correctly. This form must be submitted in accordance with California tax regulations to avoid penalties. It serves as a formal declaration of payment and withholding, which can be referenced in case of audits or disputes. Proper use of this form helps maintain compliance with state laws governing taxation and protects both the payer and the payee from potential legal issues related to tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 2021 Form 592 V are critical for compliance. Typically, the form must be filed by the 15th day of the month following the end of the quarter in which the payment was made. For example, payments made in the first quarter should be reported by April 15. It is essential to stay informed about any changes in deadlines, as late submissions may incur penalties and interest. Marking these dates on a calendar can help ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The 2021 Form 592 V can be submitted through various methods to accommodate different preferences. Taxpayers can submit the form online through the California Franchise Tax Board's website, which offers a convenient and efficient option. Alternatively, the form can be mailed to the appropriate address provided in the instructions. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own processing times and requirements, so it's advisable to choose the one that best fits the situation.

Examples of using the 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding

Examples of using the 2021 Form 592 V include various scenarios where withholding is necessary. For instance, a business that pays royalties to a nonresident author must withhold a portion of the payment and remit it using this form. Similarly, if a property owner rents out a property to a nonresident, they are required to withhold taxes on the rental income. These examples illustrate the practical applications of the form in real-world situations, emphasizing its importance in maintaining compliance with tax regulations.

Quick guide on how to complete 2021 form 592 v payment voucher for resident and nonresident withholding

Complete 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily identify the correct form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to alter and eSign 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding with ease

- Find 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 592 v payment voucher for resident and nonresident withholding

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 592 v payment voucher for resident and nonresident withholding

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow, and how does it work?

airSlate SignNow is a powerful e-signature solution designed to empower businesses with easy document signing capabilities. It allows users to send, sign, and manage documents electronically, streamlining processes and enhancing productivity. With its user-friendly interface, airSlate SignNow simplifies document workflows, making it accessible for all team members.

-

How does the pricing for airSlate SignNow work?

The pricing for airSlate SignNow is designed to be cost-effective, catering to various business needs. Plans start at competitive rates, allowing businesses to choose a package that aligns with their requirements. With the flexibility in pricing, you can find a plan that best fits your budget while still enjoying the benefits of the 592 services.

-

What features does airSlate SignNow offer?

airSlate SignNow offers an array of features, including customizable templates, real-time tracking, and secure e-signature options. These functionalities help users manage their documents efficiently and ensure compliance with legal standards. With features tailored to enhance user experience, airSlate SignNow positions itself as a leader in the 592 market.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing its utility for businesses. By connecting with tools like Salesforce, Google Drive, and more, users can streamline their workflows and improve document management. This interoperability is crucial for businesses looking to optimize their 592 processes.

-

What benefits does airSlate SignNow provide for businesses?

The primary benefits of airSlate SignNow include reduced turnaround time for document signing and enhanced security for sensitive information. By automating tedious processes, businesses can focus on their core activities, driving efficiency and growth. Ultimately, airSlate SignNow delivers signNow advantages for organizations aiming to excel in the 592 landscape.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow is built with top-level security measures to protect sensitive documents. With features like data encryption and secure user authentication, it ensures that your information remains confidential and protected from unauthorized access. This commitment to security positions airSlate SignNow as a trustworthy option in the 592 e-signature market.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is straightforward and user-friendly. Simply sign up for a free trial on the website, explore the platform's features, and see how it fits your requirements. You'll quickly discover the numerous ways it can streamline your document signing process, catering to your 592 needs.

Get more for 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding

- Washington deed form

- Temporary lease agreement to prospective buyer of residence prior to closing washington form

- Washington deed form 497429670

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497429671 form

- Letter from landlord to tenant returning security deposit less deductions washington form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return washington form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return washington form

- Letter from tenant to landlord containing request for permission to sublease washington form

Find out other 2021 Form 592 V, Payment Voucher For Resident And Nonresident Withholding

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF