California FTB Releases Income Tax Form 592 V, Payment 2024

Understanding the California FTB Releases Income Tax Form 592 V

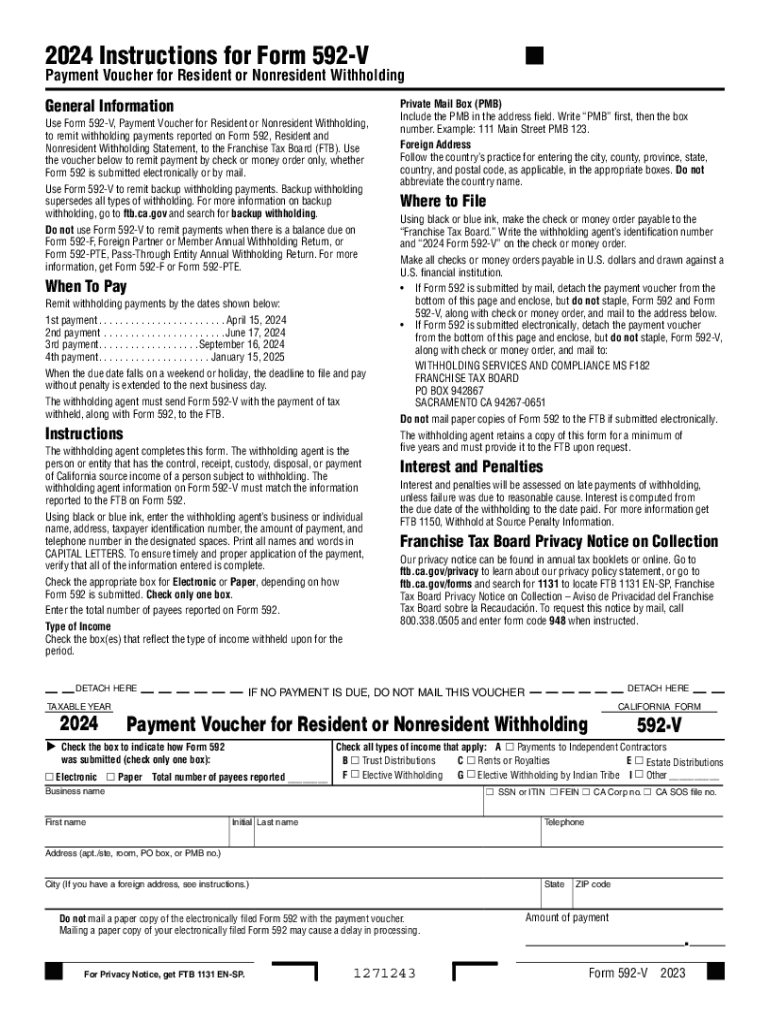

The California Franchise Tax Board (FTB) releases Income Tax Form 592 V, which is used for making payments related to withholding tax on income earned by non-residents. This form is essential for businesses and individuals who need to report and remit taxes withheld from payments made to non-resident individuals or entities. The form ensures compliance with California tax laws and helps facilitate the proper collection of taxes owed to the state.

Steps to Complete Income Tax Form 592 V

Completing Form 592 V requires careful attention to detail. Follow these steps to ensure accurate submission:

- Gather required information, including the payee's details and the amount withheld.

- Fill out the form with accurate data, ensuring all fields are completed as per the instructions.

- Double-check calculations to confirm the withholding amounts are correct.

- Sign and date the form where indicated.

- Submit the form along with your payment to the appropriate FTB address or through the designated online portal.

Obtaining Income Tax Form 592 V

Form 592 V can be obtained directly from the California FTB's official website. The form is available in a downloadable PDF format, which allows for easy printing and completion. Additionally, physical copies may be requested from the FTB if needed. Ensure you have the latest version of the form to comply with current tax regulations.

Key Elements of Income Tax Form 592 V

Form 592 V includes several key elements that must be accurately filled out to ensure proper processing:

- Payee Information: This section requires the name, address, and taxpayer identification number of the non-resident payee.

- Withholding Amount: Clearly indicate the total amount withheld from payments made to the non-resident.

- Payment Information: Include details regarding the payment method and any relevant transaction identifiers.

- Signature: The form must be signed by the person responsible for the withholding.

Filing Deadlines for Income Tax Form 592 V

It is crucial to be aware of the filing deadlines associated with Form 592 V to avoid penalties. Typically, the form must be submitted by the 15th day of the month following the payment to the non-resident. For example, if a payment was made in January, the form should be filed by February 15. Staying informed about these deadlines helps ensure compliance with California tax laws.

Penalties for Non-Compliance with Form 592 V

Failure to file Form 592 V or to remit the appropriate withholding tax can result in significant penalties. The California FTB may impose fines, interest on unpaid taxes, and other consequences for non-compliance. It is essential to submit the form accurately and on time to avoid these issues.

Create this form in 5 minutes or less

Find and fill out the correct california ftb releases income tax form 592 v payment

Create this form in 5 minutes!

How to create an eSignature for the california ftb releases income tax form 592 v payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 592 v 2024 in document signing?

The term 592 v 2024 refers to the latest updates in electronic signature regulations that enhance the security and legality of eSigning documents. Understanding these changes is crucial for businesses looking to comply with legal standards while using solutions like airSlate SignNow.

-

How does airSlate SignNow support the 592 v 2024 compliance?

airSlate SignNow is designed to meet the requirements set forth by the 592 v 2024 regulations, ensuring that all electronic signatures are legally binding and secure. Our platform incorporates advanced security features and audit trails to help businesses maintain compliance effortlessly.

-

What are the pricing options for airSlate SignNow in relation to 592 v 2024?

airSlate SignNow offers flexible pricing plans that cater to various business needs while ensuring compliance with 592 v 2024. Our competitive pricing structure allows businesses of all sizes to access essential eSigning features without breaking the bank.

-

What features does airSlate SignNow provide to enhance the eSigning experience under 592 v 2024?

Our platform includes features such as customizable templates, real-time tracking, and secure storage, all designed to streamline the eSigning process in line with 592 v 2024. These tools help businesses improve efficiency and ensure that all documents are signed promptly and securely.

-

Can airSlate SignNow integrate with other software to support 592 v 2024 compliance?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your workflow while adhering to 592 v 2024 standards. This integration capability allows businesses to maintain compliance across different platforms, ensuring a smooth eSigning experience.

-

What benefits does airSlate SignNow offer for businesses concerned about 592 v 2024?

By using airSlate SignNow, businesses can benefit from increased efficiency, reduced paper usage, and enhanced security, all while complying with 592 v 2024 regulations. Our solution empowers teams to focus on their core tasks without worrying about the complexities of document signing.

-

How does airSlate SignNow ensure the security of documents signed under 592 v 2024?

airSlate SignNow employs advanced encryption and security protocols to protect documents signed under 592 v 2024. Our commitment to security ensures that sensitive information remains confidential and that all signatures are verifiable and legally binding.

Get more for California FTB Releases Income Tax Form 592 V, Payment

Find out other California FTB Releases Income Tax Form 592 V, Payment

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter