Form 588 California Franchise Tax Board 2020

What is the Form 588 California Franchise Tax Board

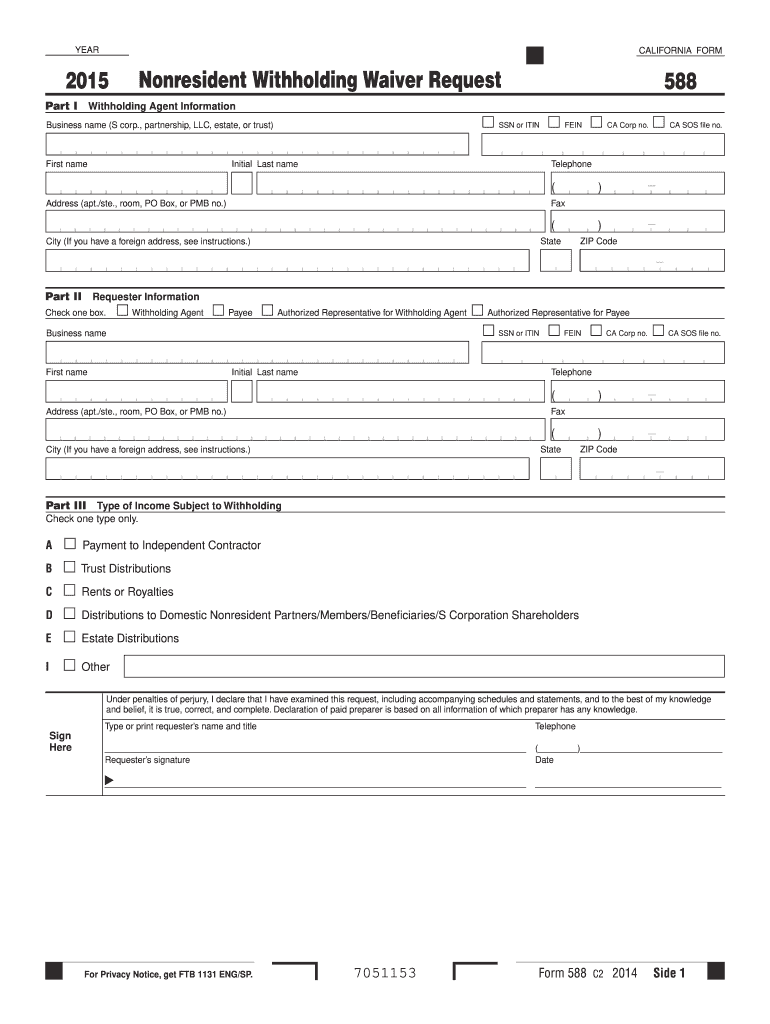

The Form 588 is a document used by the California Franchise Tax Board (FTB) to report and claim a withholding exemption for certain non-resident individuals and entities. This form is essential for those who earn income in California but are not residents of the state. It helps determine the appropriate amount of state tax withholding on income received from California sources, ensuring compliance with California tax laws.

How to use the Form 588 California Franchise Tax Board

To use the Form 588 effectively, individuals and businesses must complete the form accurately to claim the withholding exemption. This involves providing necessary information such as the taxpayer's identification, the type of income being reported, and the reason for the exemption. Once completed, the form should be submitted to the payer of the income to ensure that the correct withholding amount is applied. It is crucial to keep a copy of the submitted form for personal records and future reference.

Steps to complete the Form 588 California Franchise Tax Board

Completing the Form 588 involves several key steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Identify the type of income you are receiving from California sources.

- Determine your eligibility for the withholding exemption based on California tax laws.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the income payer to adjust withholding accordingly.

Legal use of the Form 588 California Franchise Tax Board

The legal use of Form 588 ensures that non-residents comply with California tax regulations while claiming appropriate exemptions. Proper completion and submission of this form can prevent unnecessary tax withholding and potential penalties. It is essential to provide truthful and accurate information, as any discrepancies may lead to legal implications or audits by the California Franchise Tax Board.

Key elements of the Form 588 California Franchise Tax Board

Key elements of the Form 588 include:

- Taxpayer Information: Name, address, and identification number.

- Income Type: Description of the income being received from California sources.

- Exemption Reason: Justification for claiming a withholding exemption.

- Signature: Required signature to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 588 vary based on the type of income and the payer's payment schedule. Generally, it is advisable to submit the form before the first payment is made to ensure proper withholding. Keeping track of important dates helps avoid penalties and ensures compliance with California tax obligations.

Quick guide on how to complete form 588 california franchise tax board

Effortlessly Prepare Form 588 California Franchise Tax Board on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and easily. Manage Form 588 California Franchise Tax Board on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven processes today.

The Easiest Way to Alter and eSign Form 588 California Franchise Tax Board Without Breaking a Sweat

- Locate Form 588 California Franchise Tax Board and click on Get Form to initiate the process.

- Make use of the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Form 588 California Franchise Tax Board to ensure outstanding communication throughout every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 588 california franchise tax board

Create this form in 5 minutes!

How to create an eSignature for the form 588 california franchise tax board

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is Form 588 California Franchise Tax Board used for?

Form 588 California Franchise Tax Board is utilized by partnerships to notify the state of income that is being allocated to non-resident partners. This form is essential for ensuring compliance with California tax regulations. By using this form, you can efficiently report your partnership's income and avoid potential penalties.

-

How can airSlate SignNow help with Form 588 California Franchise Tax Board?

airSlate SignNow simplifies the process of completing and eSigning Form 588 California Franchise Tax Board. Our platform allows users to fill out, sign, and securely send this form digitally, which streamlines document management. This enhances efficiency, saving time for both businesses and their partners.

-

Is there a cost associated with using airSlate SignNow for Form 588 California Franchise Tax Board?

Yes, airSlate SignNow offers affordable pricing plans based on your business needs. You can choose from various subscription options that provide access to tools for managing Form 588 California Franchise Tax Board and other documents. Check our pricing page for details on different plans and features.

-

What features does airSlate SignNow provide for managing Form 588 California Franchise Tax Board?

Our platform includes key features such as document templates, eSignature capabilities, and real-time collaboration tools, all tailored for Form 588 California Franchise Tax Board. You can easily customize your forms and track their status throughout the signing process. This increases overall efficiency and ensures compliance.

-

Can I integrate airSlate SignNow with other software for Form 588 California Franchise Tax Board?

Absolutely! airSlate SignNow offers integration with various applications, making it easy to manage Form 588 California Franchise Tax Board alongside your existing workflows. You can connect with CRM systems, cloud storage services, and more to streamline your document management process.

-

What benefits will I gain from using airSlate SignNow for handling Form 588 California Franchise Tax Board?

Using airSlate SignNow for Form 588 California Franchise Tax Board can signNowly reduce processing time and minimize errors. The platform's user-friendly interface ensures that documents are completed accurately and quickly. Additionally, eSigning enhances security, ensuring that sensitive information is protected.

-

Is eSigning on airSlate SignNow legally binding for Form 588 California Franchise Tax Board?

Yes, eSignatures created through airSlate SignNow are legally binding and comply with U.S. regulations. When you eSign Form 588 California Franchise Tax Board using our platform, you can be assured that it meets all legal requirements for electronic signatures. This reinforces the validity and security of your submissions.

Get more for Form 588 California Franchise Tax Board

Find out other Form 588 California Franchise Tax Board

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document