Form 104pn 2020

What is the Form 104pn

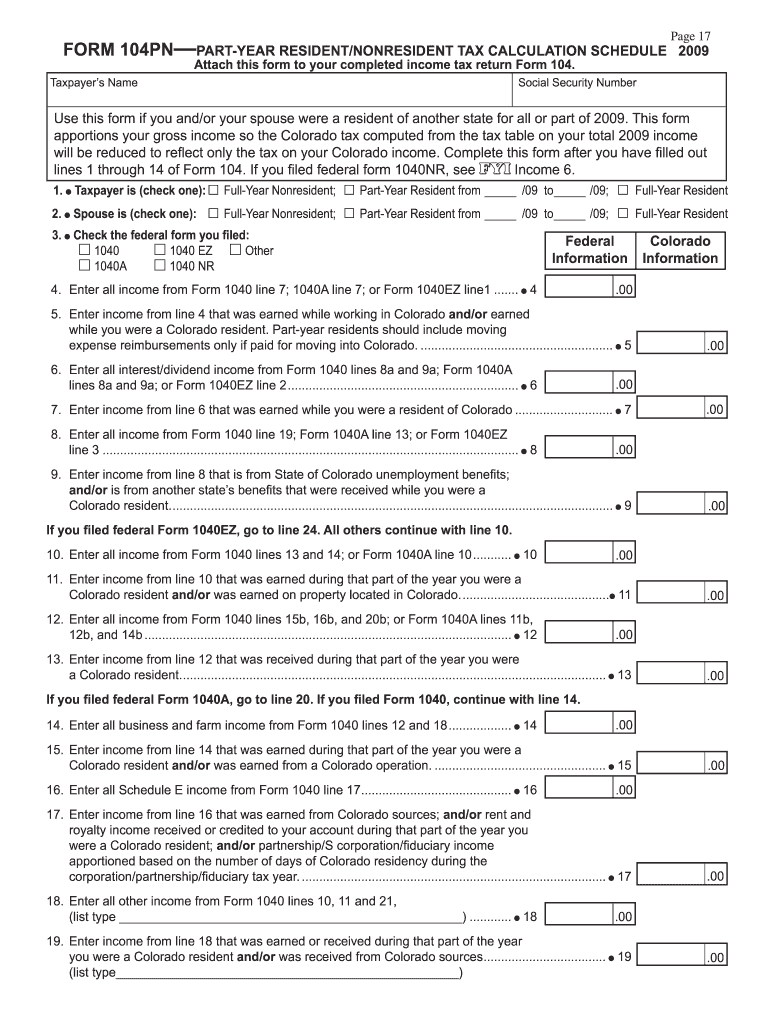

The Form 104pn is a specific tax form used by individuals in the United States to report income and calculate their tax liability. This form is particularly relevant for residents of certain states that require additional information for state tax purposes. It is essential for taxpayers to understand the purpose of this form and how it fits into their overall tax filing process.

How to use the Form 104pn

Using the Form 104pn involves several steps to ensure accurate reporting of income and deductions. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the required information is collected, individuals can begin filling out the form, ensuring that they follow the specific instructions provided for each section. After completing the form, it should be reviewed for accuracy before submission.

Steps to complete the Form 104pn

Completing the Form 104pn involves a systematic approach:

- Gather all necessary financial documents, including income statements and deduction records.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income as indicated on the form.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 104pn

The Form 104pn is legally recognized for tax reporting purposes in the United States. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Internal Revenue Service (IRS) and any applicable state tax authorities. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these regulations can result in penalties or legal issues.

Filing Deadlines / Important Dates

Timely filing of the Form 104pn is crucial to avoid penalties. The standard deadline for submitting this form is typically April 15 of each year. However, taxpayers should be aware of any extensions or changes to deadlines that may occur. It is advisable to check the IRS website or consult a tax professional for the most current information regarding filing deadlines.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 104pn. The form can be filed electronically through approved e-filing software, which often provides a streamlined process for submission. Alternatively, individuals may choose to print the completed form and mail it to the appropriate tax authority. In some cases, in-person submission may be available at designated tax offices. Each method has its own benefits, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete 2009 2014 form 104pn

Effortlessly Prepare Form 104pn on Any Gadget

Digital document management has gained traction among businesses and individuals. It offers a perfect sustainable alternative to traditional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 104pn on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Form 104pn with Ease

- Obtain Form 104pn and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Adjust and eSign Form 104pn and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 2014 form 104pn

Create this form in 5 minutes!

How to create an eSignature for the 2009 2014 form 104pn

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 104pn?

Form 104pn is a tax form used for reporting income and deductions for certain nonresidents. It is essential for businesses and individuals who need to file taxes accurately. Utilizing airSlate SignNow can streamline the signing and submission of Form 104pn.

-

How does airSlate SignNow help with Form 104pn?

airSlate SignNow offers a user-friendly platform for electronically signing and managing Form 104pn. This service simplifies the process, making it easier to collect signatures and maintain compliance. With advanced tracking features, you can monitor the status of your Form 104pn submissions.

-

What are the pricing options for using airSlate SignNow to manage Form 104pn?

airSlate SignNow offers flexible pricing plans to fit various business needs. You can choose between different tiers based on the number of users and features required for handling Form 104pn. This ensures you get the best value while managing your tax forms effectively.

-

Can I integrate airSlate SignNow with other software for Form 104pn processing?

Yes, airSlate SignNow easily integrates with various software applications, enhancing your workflow for processing Form 104pn. Whether you use accounting software or other document management systems, you can seamlessly connect and streamline your operations.

-

What features does airSlate SignNow offer for Form 104pn?

airSlate SignNow includes features like eSigning, document templates, and automated workflows specifically designed for Form 104pn. These tools help enhance productivity by reducing paperwork and increasing efficiency, allowing you to focus on more critical tasks.

-

Is airSlate SignNow secure for handling sensitive Form 104pn information?

Absolutely. airSlate SignNow employs industry-standard security measures to protect your sensitive Form 104pn data. With encryption, secure cloud storage, and compliance with regulations, your documents are safe from unauthorized access.

-

How can airSlate SignNow improve the turnaround time for Form 104pn?

By utilizing airSlate SignNow’s electronic signing capabilities, businesses can signNowly reduce the turnaround time for Form 104pn submissions. With instant notifications and document sharing, you can collect signatures quickly, ensuring timely filings and compliance.

Get more for Form 104pn

Find out other Form 104pn

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word